Tdameritrade Distribution Form PDF 2006-2026

Understanding the Tdameritrade Distribution Form PDF

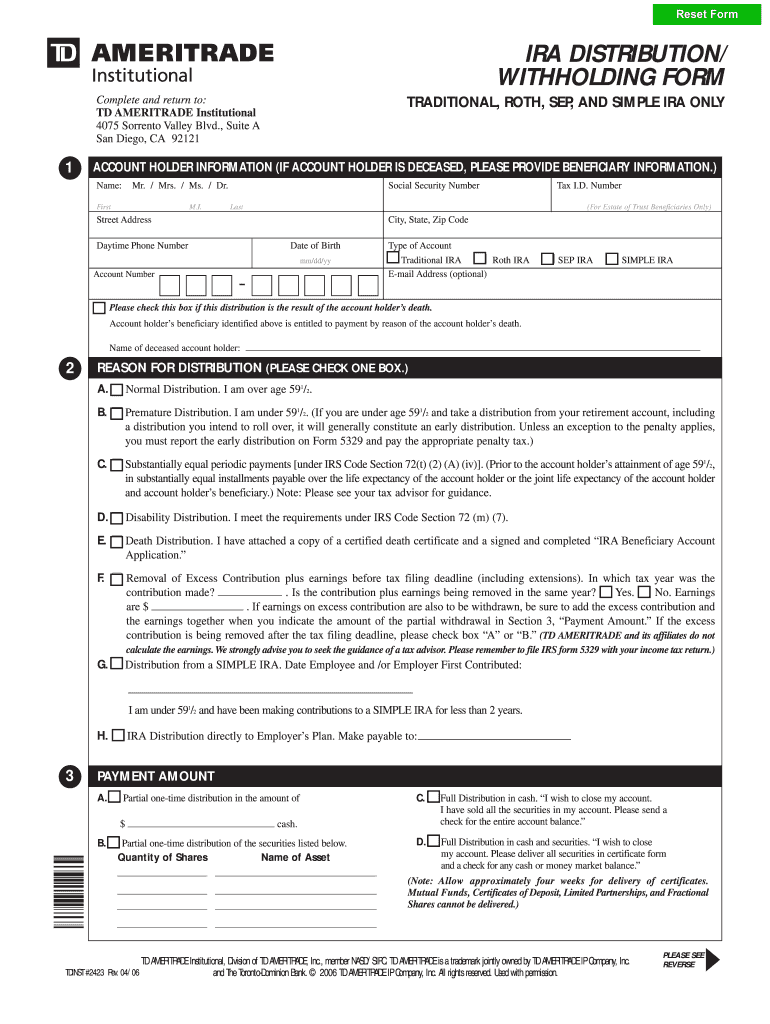

The Tdameritrade distribution form PDF is a crucial document for individuals looking to manage their retirement funds effectively. This form is specifically designed for clients who wish to initiate a distribution from their Tdameritrade IRA. Understanding its components is essential for ensuring compliance with IRS regulations and for making informed decisions regarding retirement savings.

Steps to Complete the Tdameritrade Distribution Form PDF

Completing the Tdameritrade distribution form PDF involves several key steps:

- Download the form from the official Tdameritrade website or request it through customer service.

- Fill in your personal information, including your name, address, and account number.

- Specify the type of distribution you are requesting, whether it is a full withdrawal, partial withdrawal, or a rollover to another account.

- Provide any necessary tax withholding instructions, as this will affect your overall tax liability.

- Review the completed form for accuracy before signing and dating it.

How to Obtain the Tdameritrade Distribution Form PDF

Obtaining the Tdameritrade distribution form PDF can be done through various methods:

- Visit the Tdameritrade website and navigate to the forms section to download the PDF directly.

- Contact Tdameritrade customer service for assistance in acquiring the form.

- Check your account dashboard, as forms may be available for download directly from your account.

Legal Use of the Tdameritrade Distribution Form PDF

The legal use of the Tdameritrade distribution form PDF ensures that all transactions comply with IRS regulations. It is important to fill out the form accurately and submit it within the required timeframes to avoid penalties. This form serves as an official request for distributions and must be handled with care to maintain compliance with federal tax laws.

Key Elements of the Tdameritrade Distribution Form PDF

Several key elements are essential when filling out the Tdameritrade distribution form PDF:

- Personal identification details, including Social Security number and account information.

- Type of distribution requested, such as direct deposit or check issuance.

- Tax withholding preferences, which can significantly impact your tax obligations.

- Signature and date, confirming your request and understanding of the terms.

Form Submission Methods

Once the Tdameritrade distribution form PDF is completed, you can submit it through various methods:

- Online submission via the Tdameritrade client portal, ensuring a faster processing time.

- Mailing the form to the designated Tdameritrade address, which is specified on the form itself.

- In-person submission at a local Tdameritrade branch, if available, for immediate assistance.

Quick guide on how to complete td ameritrade ira distribution form

The simplest method to obtain and endorse Tdameritrade Distribution Form Pdf

Across the entirety of a business, ineffective procedures regarding document approval can use up a signNow amount of working time. Endorsing documents like Tdameritrade Distribution Form Pdf is an inherent aspect of operations in any sector, which is why the efficiency of each agreement’s lifecycle has a substantial impact on the company's overall productivity. With airSlate SignNow, endorsing your Tdameritrade Distribution Form Pdf is as straightforward and quick as possible. This platform provides you with the most recent version of nearly any form. Even better, you can endorse it on-site without needing to install external software on your computer or print out any physical copies.

How to acquire and endorse your Tdameritrade Distribution Form Pdf

- Browse our collection by category or utilize the search bar to find the document you require.

- View the form preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Tdameritrade Distribution Form Pdf.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete the editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything necessary to manage your documentation effectively. You can locate, fill out, modify, and even send your Tdameritrade Distribution Form Pdf in one tab with ease. Enhance your workflows by using a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

What are the benefits from transferring an IRA account from TD Ameritrade to Charles Schwab?

Two dollars a trade on stocks and etfs. ($7 vs. $5)However, in an IRA, you’re probably buying mutual funds, and both have no transaction fee (NTF) mutual fund selections.Schwab has an excellent checking account you can open (refunds ATM fees!), which may make moving money easier when you retire.I have accounts with Schwab and have never been disappointed with their service. I haven’t used TD Ameritrade, so I can’t speak of their service quality.Honestly, if you haven’t had any problems with TD, there may not be strong reasons to switch.

-

Is it possible to convert a Roth IRA held at TD Ameritrade to a standard trading account?

I'd advise you to contact TD Ameritrade's award winning customer support. Your Roth-IRA can be traded like standard account their and if you have other accounts with TDA, you can setup account linking so you can manage all of your accounts from one login/user profile. TD Ameritrade Review 2013 - StockBrokers.com

-

How is it possible to open an account in TD Ameritrade for non-US residents?

It is possible. I am a Bulgarian, and I managed to do that. Best thing is to just contact the support by dropping them an email, and they’ll write back with all the documents that are required for you to register with TD Ameritrade (few banks statements). The whole thing took like month and something, since in the end they send you a regular mail with your account number and PIN, but it is a lot faster to just contact the support and ask to activate your account.Here’s what the support answered to me:>>>> Thanks for your email and your interest in TDA. I can confirm that we are>> able to open accounts for residents of Bulgaria. To get started, please>> visit the following link:>>>> https://invest.tdameritrade.com/...>>>> You will need to print out and sign the application before faxing it to>> us. Please be sure to include a passport copy, a bank or brokerage>> statement (in English), and a W-8BEN. In order to transfer from IB to TDA,>> you will need to submit a Transfer Form.

-

Does TD Ameritrade require foreign investors to fax them the W-8BEN form?

W8ben form has to signed by you and sent by post to TDAmerirade office in Omaha. They would like to have original signed form. This is what I understood.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

Create this form in 5 minutes!

How to create an eSignature for the td ameritrade ira distribution form

How to make an eSignature for your Td Ameritrade Ira Distribution Form online

How to generate an eSignature for your Td Ameritrade Ira Distribution Form in Chrome

How to generate an eSignature for putting it on the Td Ameritrade Ira Distribution Form in Gmail

How to create an eSignature for the Td Ameritrade Ira Distribution Form from your mobile device

How to generate an eSignature for the Td Ameritrade Ira Distribution Form on iOS devices

How to generate an eSignature for the Td Ameritrade Ira Distribution Form on Android devices

People also ask

-

What is a TD Ameritrade rollover IRA?

A TD Ameritrade rollover IRA is an individual retirement account that allows you to transfer funds from your previous retirement accounts into a TD Ameritrade account. This can help you consolidate your retirement savings, potentially reduce fees, and take advantage of TD Ameritrade's investment options. It's a strategic way to manage your retirement savings efficiently.

-

What are the benefits of using a TD Ameritrade rollover IRA?

Using a TD Ameritrade rollover IRA can offer several benefits, including access to a wide range of investment options, professional guidance, and a user-friendly platform for managing your retirement funds. Additionally, you can potentially enjoy lower fees compared to other retirement accounts. This makes it easier to grow your savings over time.

-

Are there any fees associated with a TD Ameritrade rollover IRA?

While TD Ameritrade does not charge fees for the account itself, there may be standard trading commissions and other fees associated with specific investment products. It's essential to review the fee schedule to understand how they may impact your investments. This transparency helps you manage your rollover IRA effectively.

-

How do I initiate a TD Ameritrade rollover IRA?

To initiate a TD Ameritrade rollover IRA, you need to contact TD Ameritrade to start the process. This typically involves filling out a form and providing information about your current retirement account. They will guide you through the steps to ensure a smooth transfer, allowing you to focus on your investment strategy.

-

Can I transfer multiple accounts into a TD Ameritrade rollover IRA?

Yes, you can transfer multiple retirement accounts into a TD Ameritrade rollover IRA. This can help streamline your retirement savings and maximize your investment potential. You'll need to follow the proper procedures for each account, but TD Ameritrade offers support to make this process as efficient as possible.

-

What investment options are available with a TD Ameritrade rollover IRA?

A TD Ameritrade rollover IRA provides access to a wide variety of investment options, including stocks, bonds, mutual funds, ETFs, and options. This diverse range allows you to create a personalized investment strategy that aligns with your financial goals. Additionally, TD Ameritrade's resources can help you make informed decisions.

-

Is there a minimum balance requirement for a TD Ameritrade rollover IRA?

There is no minimum balance requirement to open a TD Ameritrade rollover IRA, making it accessible for many investors. This flexibility allows you to start saving for retirement without a signNow initial investment. However, maintaining a healthy balance can help you optimize your investment strategies over time.

Get more for Tdameritrade Distribution Form Pdf

Find out other Tdameritrade Distribution Form Pdf

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation