Privileged Assets Form

What is the Privileged Assets?

The term "privileged assets" refers to specific financial instruments or assets that are afforded special legal protections. These assets often include certain types of annuities, retirement accounts, and insurance policies. In the context of a privileged assets annuity, these financial products are designed to provide security and potential tax advantages while safeguarding the owner's wealth from creditors. Understanding what constitutes privileged assets is essential for effective financial planning and asset protection strategies.

How to Use the Privileged Assets

Utilizing privileged assets effectively involves strategic planning and management. Individuals can incorporate these assets into their overall financial portfolio to maximize benefits such as tax deferral and protection from legal claims. For example, a privileged assets annuity can be used as a retirement income source, allowing for tax-free growth while providing a steady income stream during retirement. It is crucial to consult with a financial advisor to determine the best approach for integrating these assets into your financial strategy.

Steps to Complete the Privileged Assets

Completing the process related to privileged assets, such as a privileged assets annuity, typically involves several key steps:

- Assess your financial situation and determine your eligibility for the annuity.

- Gather necessary documentation, including personal identification and financial records.

- Consult with a financial advisor to understand the implications of the annuity.

- Complete the application form accurately, ensuring all information is correct.

- Submit the application through the designated method, whether online or via mail.

Following these steps carefully can help ensure a smooth process in managing your privileged assets.

Legal Use of the Privileged Assets

Privileged assets, including privileged assets annuities, must comply with specific legal regulations to ensure their validity. In the United States, these assets are often protected under state and federal laws, which can vary significantly. It is essential to understand the legal framework governing these assets, including laws related to bankruptcy protection and creditor claims. Consulting with a legal expert specializing in financial law can provide clarity on how to legally utilize these assets without jeopardizing their protected status.

Required Documents

When dealing with privileged assets annuities, certain documents are typically required to facilitate the process. These may include:

- Proof of identity, such as a driver's license or passport.

- Financial statements that demonstrate your current financial situation.

- Tax documents, including previous tax returns, to assess eligibility.

- Any existing contracts related to the annuity or other privileged assets.

Having these documents ready can streamline the application process and ensure compliance with legal requirements.

Eligibility Criteria

Eligibility for privileged assets, particularly privileged assets annuities, often hinges on several factors. These may include age, income level, and financial goals. Generally, individuals must meet specific criteria to qualify for these financial products, such as being of a certain age to access retirement benefits or having a minimum income to ensure the annuity's sustainability. Understanding these criteria is vital for anyone considering investing in privileged assets.

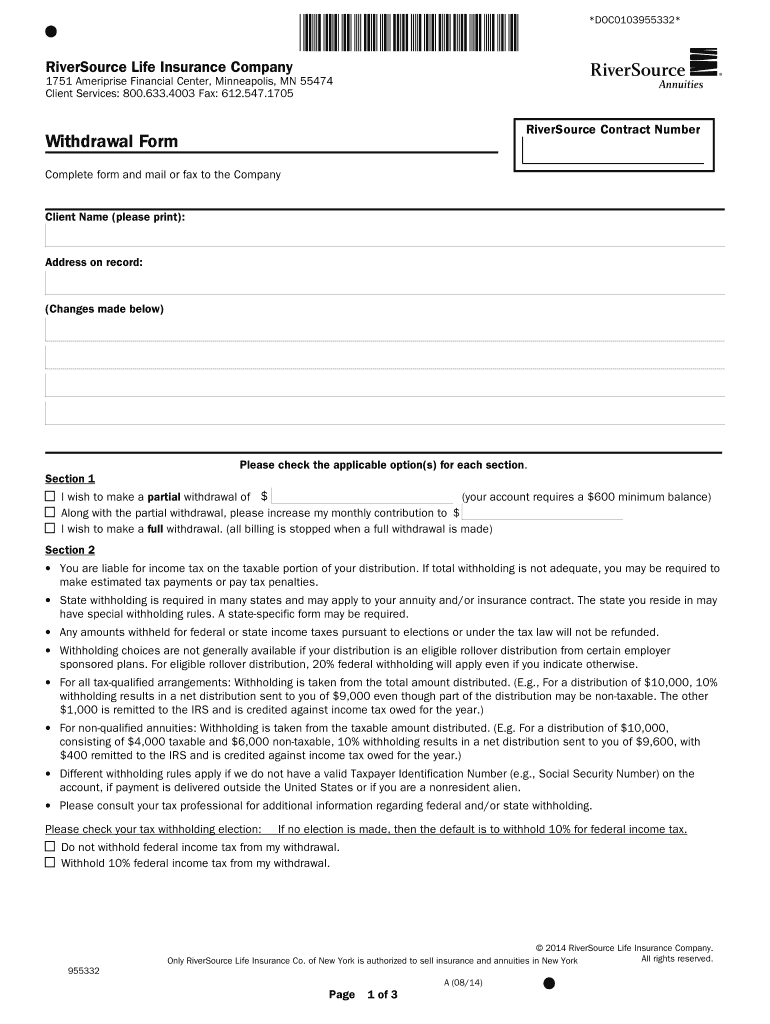

Quick guide on how to complete privileged asset annuity withdrawal request form ameriprise

Effortlessly complete Privileged Assets on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Privileged Assets on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign Privileged Assets with ease

- Find Privileged Assets and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign Privileged Assets and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

Startup I am no longer working with is requesting that I fill out a 2014 w9 form. Is this standard, could someone please provide any insight as to why a startup may be doing this and how would I go about handling it?

It appears that the company may be trying to reclassify you as an independent contractor rather than an employee.Based on the information provided, it appears that such reclassification (a) would be a violation of applicable law by the employer and (b) potentially could be disadvantageous for you (e.g., depriving you of unemployment compensation if you are fired without cause).The most prudent approach would be to retain a lawyer who represents employees in employment matters.In any event, it appears that you would be justified in refusing to complete and sign the W-9, telling the company that there is no business or legal reason for you to do so.Edit: After the foregoing answer was written, the OP added Q details concerning restricted stock repurchase being the reason for the W-9 request. As a result, the foregoing answer appears to be irrelevant. However, I will leave it, for now, in case Q details are changed yet again in a way that reestablishes the answer's relevance.

Create this form in 5 minutes!

How to create an eSignature for the privileged asset annuity withdrawal request form ameriprise

How to generate an electronic signature for the Privileged Asset Annuity Withdrawal Request Form Ameriprise in the online mode

How to create an eSignature for your Privileged Asset Annuity Withdrawal Request Form Ameriprise in Chrome

How to make an eSignature for putting it on the Privileged Asset Annuity Withdrawal Request Form Ameriprise in Gmail

How to make an eSignature for the Privileged Asset Annuity Withdrawal Request Form Ameriprise right from your smart phone

How to generate an electronic signature for the Privileged Asset Annuity Withdrawal Request Form Ameriprise on iOS devices

How to create an electronic signature for the Privileged Asset Annuity Withdrawal Request Form Ameriprise on Android

People also ask

-

What is a privileged assets annuity and how does it work?

A privileged assets annuity is a financial product designed to provide income while safeguarding your assets. This type of annuity is tailored for individuals who wish to ensure a stable income stream while leveraging their privileged assets. By investing in a privileged assets annuity, you can benefit from tax advantages and guaranteed returns.

-

What are the key benefits of a privileged assets annuity?

The primary benefits of a privileged assets annuity include tax-deferred growth, security of your principal investment, and the ability to convert your investment into a steady income stream. Additionally, privileged assets annuities can help in estate planning by providing beneficiaries with financial security. They are perfect for retirees looking for reliable income sources.

-

Are there different types of privileged assets annuities?

Yes, there are several types of privileged assets annuities, including fixed, variable, and indexed annuities. Each type offers different features and risks, allowing you to choose one that fits your financial goals. A fixed privileged assets annuity provides a guaranteed return, while a variable option offers potential for higher returns linked to market performance.

-

How much does a privileged assets annuity cost?

The cost of a privileged assets annuity can vary based on factors such as the type of annuity, the issuing company, and your investment amount. Typically, there may be upfront costs or ongoing fees associated with the management of the annuity. It's essential to review the specific terms and conditions to understand the total cost involved.

-

Can I withdraw funds from my privileged assets annuity?

Yes, you can withdraw funds from your privileged assets annuity, but be aware of any potential penalties or surrender charges that may apply. Withdrawals may also incur tax liabilities depending on your situation. It's advisable to consult with a financial advisor to understand the implications of withdrawing funds.

-

What features should I look for in a privileged assets annuity?

When evaluating a privileged assets annuity, consider features such as flexible payout options, investment choices, and the presence of a death benefit for your beneficiaries. Additionally, look for low fees and a reputable insurance company. These factors will help ensure that your annuity meets your financial needs.

-

Can privileged assets annuities be integrated with other financial products?

Yes, privileged assets annuities can often be integrated with other financial products such as retirement accounts and life insurance policies. This integration can provide a comprehensive financial strategy tailored to your needs. It's beneficial to discuss your options with a financial planner to maximize the effectiveness of your investments.

Get more for Privileged Assets

Find out other Privileged Assets

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form