Withholding Certificate for Pension or Annuity Payments EDD Form

What is the withholding certificate for pension or annuity payments EDD?

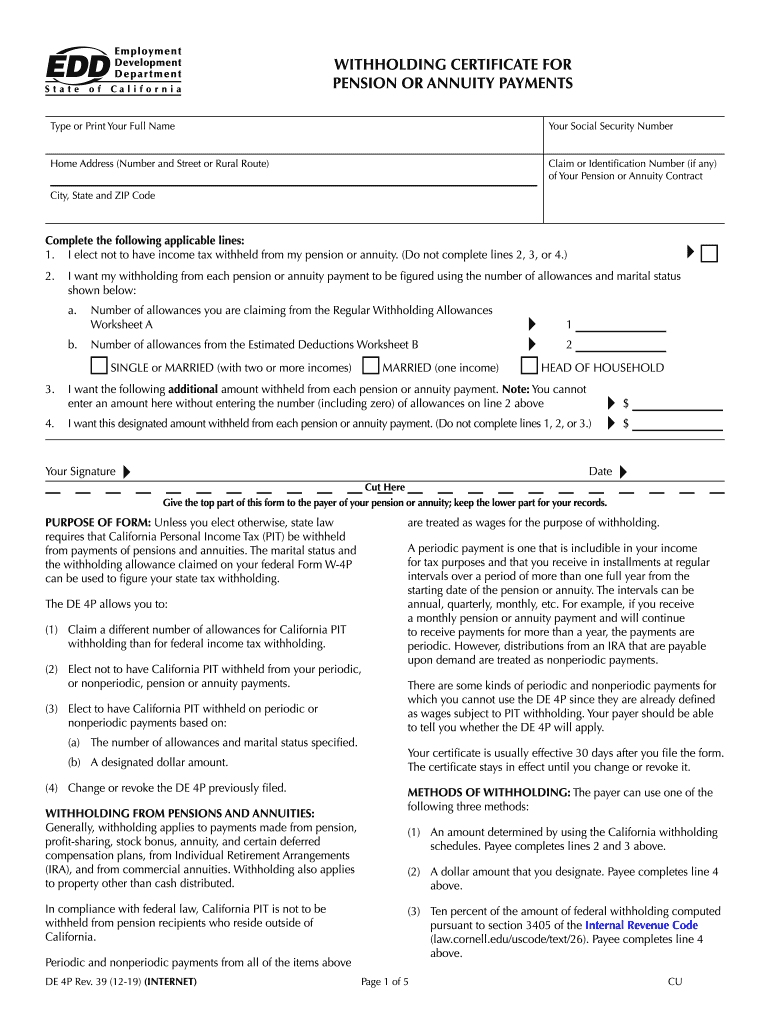

The withholding certificate for pension or annuity payments, commonly referred to as the California DE 4P form, is a crucial document used by individuals receiving pension or annuity payments in California. This form allows recipients to specify the amount of state income tax to be withheld from their payments. By completing this form, individuals can manage their tax obligations more effectively, ensuring that the correct amount is withheld based on their financial situation and preferences.

How to use the withholding certificate for pension or annuity payments EDD

Using the California DE 4P form involves a straightforward process. Recipients should first obtain the form, which can typically be downloaded from the California Employment Development Department (EDD) website. After filling out the required information, including personal details and the desired withholding amount, individuals should submit the completed form to their pension or annuity provider. This ensures that the provider adjusts the withholding accordingly, aligning with the recipient's tax preferences.

Steps to complete the withholding certificate for pension or annuity payments EDD

Completing the California DE 4P form requires careful attention to detail. Follow these steps for accurate completion:

- Download the California DE 4P form from the EDD website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you wish to have withheld from your pension or annuity payments.

- Review the form for accuracy and completeness.

- Submit the completed form to your pension or annuity provider.

Key elements of the withholding certificate for pension or annuity payments EDD

The California DE 4P form contains several key elements that are essential for proper tax withholding. These include:

- Personal Information: Name, address, and Social Security number of the recipient.

- Withholding Amount: The specific amount or percentage to be withheld from payments.

- Signature: The recipient's signature, confirming the accuracy of the information provided.

Legal use of the withholding certificate for pension or annuity payments EDD

The California DE 4P form is legally recognized for managing state income tax withholding on pension and annuity payments. By submitting this form, individuals ensure compliance with California tax laws, which require accurate reporting and withholding of state income taxes. Proper use of this form helps avoid potential penalties and ensures that individuals meet their tax obligations effectively.

Eligibility criteria for the withholding certificate for pension or annuity payments EDD

Eligibility to use the California DE 4P form primarily applies to individuals receiving pension or annuity payments within California. Recipients must be residents of California and should have a valid Social Security number. Additionally, individuals should assess their financial situation to determine the appropriate withholding amount, ensuring it aligns with their tax liabilities.

Quick guide on how to complete withholding certificate for pension or annuity payments edd

Complete Withholding Certificate For Pension Or Annuity Payments EDD seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily find the correct form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without delays. Handle Withholding Certificate For Pension Or Annuity Payments EDD on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign Withholding Certificate For Pension Or Annuity Payments EDD without any hassle

- Obtain Withholding Certificate For Pension Or Annuity Payments EDD and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Withholding Certificate For Pension Or Annuity Payments EDD and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding certificate for pension or annuity payments edd

The best way to generate an e-signature for a PDF document online

The best way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

The way to create an e-signature for a PDF file on Android OS

People also ask

-

What is a California de form and how does airSlate SignNow help?

A California de form is a legal document used in various processes across California. airSlate SignNow simplifies the process by allowing you to send and eSign California de forms electronically, ensuring that your documents are processed quickly and efficiently.

-

How much does it cost to use airSlate SignNow for California de forms?

airSlate SignNow offers several pricing plans to accommodate different business needs. You can choose a plan based on the number of users and features required, making it an affordable choice for managing California de forms and other documents.

-

Can I integrate airSlate SignNow with other software for managing California de forms?

Yes, airSlate SignNow supports seamless integrations with various applications, including CRM and project management tools. This allows you to easily manage your California de forms and streamline your workflows across different platforms.

-

What are the key features of airSlate SignNow for handling California de forms?

Key features of airSlate SignNow include customizable templates, secure eSigning, and document tracking. These features ensure that dealing with California de forms is efficient, secure, and user-friendly.

-

Is airSlate SignNow suitable for small businesses needing California de forms?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. Its cost-effective solution allows small firms to efficiently manage and eSign California de forms without breaking the bank.

-

How secure is the airSlate SignNow platform for California de forms?

The airSlate SignNow platform prioritizes security with advanced encryption and compliance with industry standards. This ensures that your California de forms and sensitive information are protected throughout the entire signing process.

-

Can airSlate SignNow help with multiple users working on California de forms?

Yes, airSlate SignNow allows for multiple users to collaborate on California de forms. You can invite team members to review, sign, and manage documents collectively, improving productivity and team communication.

Get more for Withholding Certificate For Pension Or Annuity Payments EDD

- Financial corporation of santa barbara form

- Form of amended and restated bylaws sec

- Form of indemnity agreement entered into between the company

- Division of corporate ampamp consumer services nonstock form

- Antero resources midstream management llc form s 1a

- This indemnification agreement is made this form

- This agreement made and entered into as of the form

- Trust agreement made this day of 1989 form

Find out other Withholding Certificate For Pension Or Annuity Payments EDD

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself