INC251 Application for Extension of Filing TimePrepayment of Individual Income Tax INC251 Application for Extension of Filing Ti Form

What is the INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax?

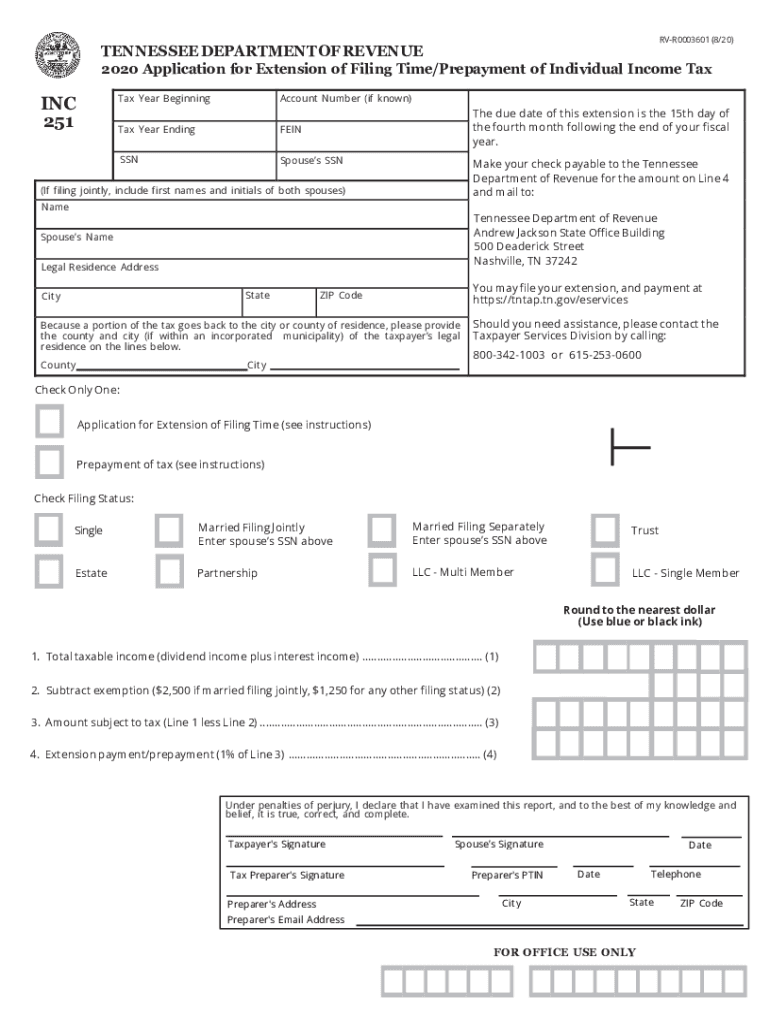

The INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax is a formal request submitted by taxpayers to the Internal Revenue Service (IRS) for an extension on the deadline to file their individual income tax returns. This form allows individuals to defer their filing date while ensuring they remain compliant with tax obligations. It is particularly useful for those who may need additional time to gather necessary documentation or complete their tax returns accurately. By submitting this application, taxpayers can avoid penalties associated with late filings, provided they meet the requirements set forth by the IRS.

Steps to Complete the INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax

Completing the INC251 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and income details. Next, accurately fill out the form, specifying the amount of tax you expect to owe and any payments made. Once completed, review the form for any errors or omissions. Finally, submit the INC251 either electronically or via mail, ensuring it is sent before the original filing deadline to avoid penalties. Keeping a copy of the submitted form for your records is also advisable.

Legal Use of the INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax

The INC251 form is legally recognized as a valid request for an extension of time to file individual income tax returns. To ensure its legal standing, the form must be completed accurately and submitted within the designated timeframe set by the IRS. Compliance with federal eSignature laws, such as the ESIGN Act and UETA, is essential when submitting the form electronically. These laws ensure that electronic signatures and documents are treated with the same legal weight as their paper counterparts, provided all necessary conditions are met.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the INC251 form is crucial for taxpayers. The application must be submitted by the original due date of the tax return, typically April 15 for most individuals. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should also be aware of any specific state deadlines that may apply, as these can vary. Timely submission of the INC251 form is essential to avoid penalties and ensure a smooth extension process.

Required Documents for the INC251 Application

When completing the INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax, certain documents may be required to support your application. These typically include your previous year’s tax return, any relevant income statements such as W-2s or 1099s, and documentation of any estimated tax payments made. Having these documents readily available can streamline the completion process and help ensure that all information provided is accurate and complete.

IRS Guidelines for the INC251 Application

The IRS provides specific guidelines for the use of the INC251 form, outlining eligibility criteria, submission methods, and compliance requirements. Taxpayers must ensure they meet the eligibility criteria, which generally include being an individual taxpayer with a valid Social Security number. The IRS also emphasizes the importance of submitting the form on time and accurately reporting any estimated tax payments. Familiarizing yourself with these guidelines can help avoid common pitfalls and ensure compliance with federal tax laws.

Eligibility Criteria for the INC251 Application

To qualify for using the INC251 Application for Extension of Filing Time Prepayment of Individual Income Tax, taxpayers must meet certain eligibility criteria. Primarily, the applicant must be an individual taxpayer who is required to file an income tax return. Additionally, the form is applicable to those who anticipate owing taxes and need an extension to file their return. It is important for applicants to review their specific circumstances and ensure they meet all requirements before submitting the form to avoid complications.

Quick guide on how to complete inc251 application for extension of filing timeprepayment of individual income tax inc251 application for extension of filing

Effortlessly prepare INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely save it online. airSlate SignNow supplies you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Manage INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti on any device using airSlate SignNow's Android or iOS applications and streamline any documentation process today.

The easiest way to modify and electronically sign INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti with ease

- Find INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your updates.

- Select your preferred method to send your form via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti and ensure outstanding communication throughout the document preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inc251 application for extension of filing timeprepayment of individual income tax inc251 application for extension of filing

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

How to make an e-signature for a PDF file on Android devices

People also ask

-

What is the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax?

The INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax is a document that provides taxpayers with an official request to extend the deadline for filing and prepayment of their individual income tax. This process helps manage tax obligations more flexibly, allowing individuals to avoid penalties for late filings.

-

How can airSlate SignNow assist with the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax?

airSlate SignNow simplifies the process of completing and submitting the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax. With our platform, users can easily fill out the necessary forms, sign digitally, and securely transmit their applications to the appropriate tax authorities.

-

What are the pricing plans available for using airSlate SignNow for the INC251 application?

airSlate SignNow offers flexible pricing plans that cater to different user needs for the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax. Our affordable packages provide access to essential features for individuals and businesses looking to streamline their document management at a budget-friendly rate.

-

What features does airSlate SignNow provide for the INC251 document handling?

airSlate SignNow comes with robust features like eSigning, document templates, and real-time collaboration specifically designed for managing the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax. These features increase efficiency and ensure compliance with tax requirements.

-

Are there any benefits to using airSlate SignNow for the INC251 process?

Yes, using airSlate SignNow for the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax offers numerous benefits, including streamlined processes, reduced paperwork, and improved accuracy. Our platform saves time and reduces stress during tax season.

-

Can airSlate SignNow integrate with other tools I use for tax management?

Absolutely, airSlate SignNow is designed to integrate seamlessly with various applications and tools commonly used for tax management, enhancing your ability to manage the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax alongside your existing systems.

-

Is the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax accepted electronically?

Yes, the INC251 Application For Extension Of Filing Time Prepayment Of Individual Income Tax can be submitted electronically through platforms like airSlate SignNow, which ensures that your application is processed quickly and securely.

Get more for INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti

- Connecticut affidavit of original contractor by individual form

- Connecticut assignment of mortgage by corporate mortgage holder form

- Connecticut notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Connecticut provisions form

- Ct assignment 481379322 form

- Connecticut rental form

- Creditors matrix form

- Connecticut closing form

Find out other INC251 Application For Extension Of Filing TimePrepayment Of Individual Income Tax INC251 Application For Extension Of Filing Ti

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney