Franchise & Excise Tax Forms Tennessee 2020-2026

What is the Franchise & Excise Tax Forms Tennessee

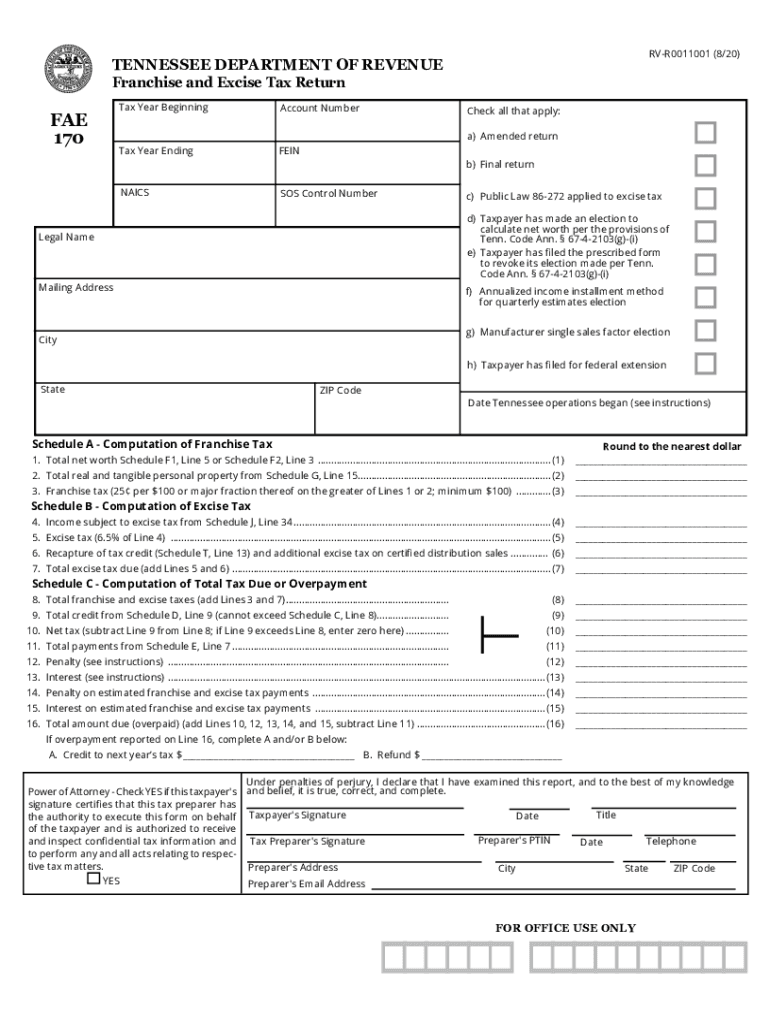

The Franchise and Excise Tax Forms in Tennessee are essential documents used by businesses operating within the state to report their tax obligations. These forms are designed to assess the franchise tax, which is based on the net worth of a business, and the excise tax, which is calculated on the income generated by the business. Understanding these forms is crucial for compliance with Tennessee tax laws and for ensuring that businesses fulfill their financial responsibilities accurately.

Steps to complete the Franchise & Excise Tax Forms Tennessee

Completing the Franchise and Excise Tax Forms involves several important steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements and balance sheets. Next, determine the appropriate form based on your business structure, whether it be a corporation, LLC, or partnership. Follow the instructions carefully to fill out the form, ensuring that all required fields are completed. After reviewing the form for any errors, submit it by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Franchise and Excise Tax Forms in Tennessee are typically set for the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the forms are due by April 15. It is important to be aware of these deadlines to avoid late fees and penalties. Additionally, businesses may need to make estimated tax payments throughout the year, which also have specific due dates.

Required Documents

When preparing to file the Franchise and Excise Tax Forms, businesses must gather various documents to support their tax calculations. Required documents typically include:

- Income statements for the tax year

- Balance sheets

- Records of any deductions or credits claimed

- Documentation supporting the business's net worth and income

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Legal use of the Franchise & Excise Tax Forms Tennessee

The legal use of the Franchise and Excise Tax Forms is governed by Tennessee state law. These forms must be filed accurately and on time to ensure compliance with tax regulations. Failure to file or inaccuracies in the forms can lead to penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand the legal implications of these forms and to seek assistance if needed to navigate the complexities of tax compliance.

Who Issues the Form

The Franchise and Excise Tax Forms are issued by the Tennessee Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating in Tennessee. The Department provides resources and guidance to help businesses understand their tax obligations and navigate the filing process effectively.

Quick guide on how to complete franchise ampampamp excise tax forms tennessee

Complete Franchise & Excise Tax Forms Tennessee effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents quickly without delays. Manage Franchise & Excise Tax Forms Tennessee on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Franchise & Excise Tax Forms Tennessee with minimal effort

- Obtain Franchise & Excise Tax Forms Tennessee and click on Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Adjust and eSign Franchise & Excise Tax Forms Tennessee and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct franchise ampampamp excise tax forms tennessee

Create this form in 5 minutes!

How to create an eSignature for the franchise ampampamp excise tax forms tennessee

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is the FAE 170 and how does it work with airSlate SignNow?

The FAE 170 is a powerful document management tool that integrates seamlessly with airSlate SignNow, enabling businesses to send and eSign documents efficiently. It simplifies the process by allowing users to manage documents from any device while ensuring secure electronic signatures.

-

What are the main features of the FAE 170 in airSlate SignNow?

The FAE 170 offers features such as customizable templates, real-time tracking of document status, and audit trails to ensure compliance. By utilizing these features in airSlate SignNow, users can streamline their document workflows and improve overall productivity.

-

How much does airSlate SignNow with FAE 170 integration cost?

Pricing for airSlate SignNow with FAE 170 integration varies based on the number of users and additional features needed. It is designed to be cost-effective, providing businesses with flexible pricing plans to meet their unique needs while maximizing value.

-

What are the benefits of using FAE 170 within airSlate SignNow?

Using the FAE 170 within airSlate SignNow provides businesses with enhanced efficiency, improved collaboration, and accelerated document turnaround times. This integration allows for a smooth user experience and reduces the likelihood of errors, ensuring effective document management.

-

Can FAE 170 integrate with other software and platforms?

Yes, FAE 170 is designed to integrate easily with a variety of software applications and platforms, enhancing its functionality within airSlate SignNow. This includes CRM tools, project management software, and other business applications, making it a versatile solution for any organization.

-

Is airSlate SignNow with FAE 170 secure for sensitive documents?

Absolutely! airSlate SignNow with FAE 170 employs industry-standard security protocols, including data encryption and secure access controls, to protect sensitive documents. This commitment to security ensures that your documents remain confidential and secure throughout the signing process.

-

How does the FAE 170 improve the user experience with airSlate SignNow?

The FAE 170 enhances the user experience in airSlate SignNow by providing an intuitive interface and easy navigation. This user-friendly design minimizes the learning curve, ensuring that teams can quickly start managing their documents and eSigning with minimal disruption.

Get more for Franchise & Excise Tax Forms Tennessee

- Connecticut motion to approve arbitration agreement in family cases form

- Connecticut affidavit consent to termination of parental rights form

- Connecticut order of notice petition termination parental rights form

- Connecticut small estate affidavit in lieu of administration form

- Connecticut certificate of devise descent or distribution form

- Connecticut schedule a proposed distribution final financial report of guardian or conservator form

- Connecticut agreement of fiduciaryies guardianship of minors estate form

- Connecticut application for change of name adult form

Find out other Franchise & Excise Tax Forms Tennessee

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement