TENNESSEE DEPARTMENT of REVENUE LETTER TN Gov 2019

Understanding the Tennessee Franchise and Excise Tax Return

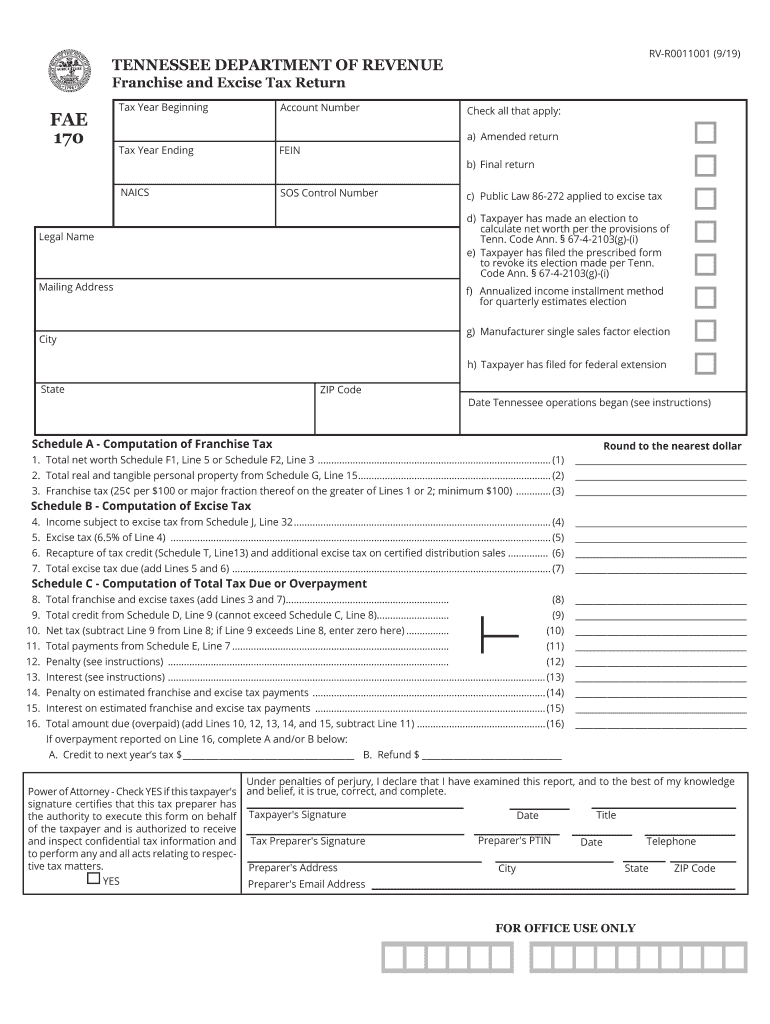

The Tennessee Franchise and Excise Tax Return, commonly referred to as the TN FAE 170, is a critical document for businesses operating in Tennessee. This form is used to report and pay the franchise and excise taxes imposed by the state. The franchise tax is based on the net worth of the business, while the excise tax is calculated on the net earnings. Understanding the purpose and requirements of this form is essential for compliance and accurate reporting.

Steps to Complete the TN FAE 170 Fillable Form

Completing the TN FAE 170 fillable form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, enter your business information, including the legal name, address, and entity type. Then, calculate your franchise and excise taxes based on the provided instructions. Finally, review the form for accuracy before submitting it electronically or by mail.

Filing Deadlines for the TN FAE 170

Timely filing of the TN FAE 170 is crucial to avoid penalties and interest. The due date for filing the form is typically the 15th day of the fourth month following the end of your fiscal year. For most businesses operating on a calendar year, this means the form is due on April 15. It is important to mark your calendar and ensure that all required information is submitted on time to maintain compliance with state regulations.

Required Documents for Filing

When preparing to file the TN FAE 170, certain documents are necessary to support your tax return. These documents typically include:

- Income statements detailing revenue and expenses

- Balance sheets showing assets, liabilities, and equity

- Prior year tax returns for reference

- Any additional schedules or forms required by the Tennessee Department of Revenue

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in your tax reporting.

Penalties for Non-Compliance

Failure to file the TN FAE 170 on time or inaccuracies in the form can lead to significant penalties. The state of Tennessee imposes late filing fees and interest on unpaid taxes. Additionally, businesses may face further scrutiny from the Department of Revenue, which can result in audits or additional assessments. It is essential to understand these potential consequences and take steps to file accurately and on time.

Form Submission Methods

The TN FAE 170 can be submitted through various methods, ensuring flexibility for businesses. Options include:

- Electronic filing through the Tennessee Department of Revenue's online portal

- Mailing a paper copy of the form to the appropriate address

- In-person submission at designated Department of Revenue offices

Choosing the right submission method can depend on your business's needs and preferences, as well as the urgency of your filing.

Quick guide on how to complete tennessee department of revenue letter tngov

Manage TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov effortlessly on any device

Online document handling has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools needed to create, amend, and eSign your documents quickly without delays. Handle TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov on any device using airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov effortlessly

- Locate TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Completed button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from the device of your choice. Modify and eSign TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee department of revenue letter tngov

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue letter tngov

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the tn fae 170 fillable form?

The tn fae 170 fillable form is a document used for tax-related purposes, particularly in Tennessee. It allows individuals and businesses to report and pay taxes efficiently. With airSlate SignNow, you can easily fill out and sign this form online.

-

How can I access the tn fae 170 fillable form using airSlate SignNow?

To access the tn fae 170 fillable form with airSlate SignNow, simply log into your account and use the form search feature. You can then fill out the form online and save or send it for eSignature. This process simplifies the management of tax documentation.

-

Is there a cost associated with using the tn fae 170 fillable form through airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to the tn fae 170 fillable form. Depending on your chosen plan, you can benefit from unlimited eSignatures and document management at an affordable rate. It's best to explore our pricing page for more details.

-

What features does airSlate SignNow provide for the tn fae 170 fillable form?

With airSlate SignNow, you can utilize various features for the tn fae 170 fillable form, including electronic signatures, document templates, and real-time collaboration. These features enhance efficiency and ensure that your tax documents are processed smoothly and securely.

-

Can I integrate the tn fae 170 fillable form with other applications?

Yes, airSlate SignNow supports integration with a variety of applications, allowing you to streamline your workflow involving the tn fae 170 fillable form. Popular integrations include Google Drive, Dropbox, and more, making it easy to manage your documents across platforms.

-

What are the benefits of using the tn fae 170 fillable form with airSlate SignNow?

Using the tn fae 170 fillable form with airSlate SignNow brings several benefits, such as time savings and enhanced accuracy in document submission. Additionally, eSigning capabilities reduce the need for physical paperwork, leading to a more environmentally-friendly approach.

-

How secure is the tn fae 170 fillable form on airSlate SignNow?

Security is a top priority at airSlate SignNow. The tn fae 170 fillable form is protected with advanced encryption protocols, ensuring your data is safe during transmission and storage. Our compliance with industry standards helps safeguard your sensitive information.

Get more for TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov

Find out other TENNESSEE DEPARTMENT OF REVENUE LETTER TN gov

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF