Connecticuts New Pass through Entity TaxWelcome to the Connecticut Department of Revenue Services Connecticut Department of Reve 2020

Understanding Connecticut's New Pass-Through Entity Tax

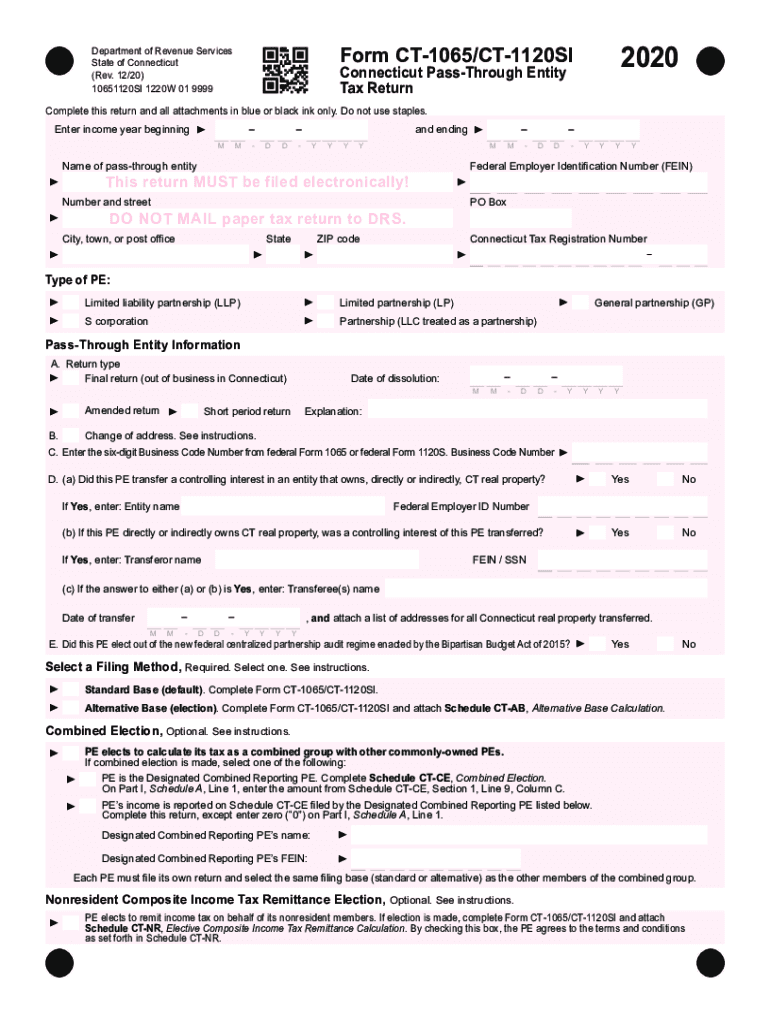

The Connecticut Pass-Through Entity Tax is designed to impose a tax on certain business entities, such as partnerships and S corporations, that pass their income through to their owners. This tax allows these entities to pay state income tax at the entity level rather than at the individual level. This approach can provide benefits, including potential federal tax deductions for owners. Understanding the nuances of this tax is essential for compliance and effective tax planning.

Steps to Complete the Connecticut CT 1065 Form

Filling out the Connecticut CT 1065 form involves several critical steps. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately report the income, deductions, and credits applicable to the business. Ensure that each partner's share of income and deductions is clearly outlined. After completing the form, review it for accuracy before submitting it to the Connecticut Department of Revenue Services. Utilizing a digital platform can streamline this process, making it easier to manage signatures and ensure compliance.

Filing Deadlines and Important Dates

Awareness of key filing deadlines is crucial for avoiding penalties. The Connecticut CT 1065 form is typically due on the fifteenth day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Staying informed about these dates helps ensure timely submission and compliance with state regulations.

Required Documents for Form CT 1065

To complete the Connecticut CT 1065 form, specific documents are necessary. These include financial statements detailing income and expenses, a list of partners or shareholders, and any applicable tax credits or deductions. Additionally, supporting documentation for each partner’s share of income and deductions should be included. Having these documents readily available will facilitate a smoother filing process and help ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Connecticut CT 1065 can result in significant penalties. These may include fines for late submissions, interest on unpaid taxes, and potential audits. Understanding these consequences emphasizes the importance of timely and accurate filing. Entities should take proactive measures to ensure compliance and avoid the financial repercussions of non-compliance.

Digital vs. Paper Version of the CT 1065 Form

Choosing between the digital and paper versions of the Connecticut CT 1065 form can impact the filing experience. The digital version offers advantages such as ease of use, faster processing times, and enhanced security features. Electronic submissions can also simplify the signing process, ensuring that all necessary parties can sign the document without delays. In contrast, paper submissions may involve longer processing times and increased risk of errors. Opting for a digital solution can enhance efficiency and compliance.

Quick guide on how to complete connecticuts new pass through entity taxwelcome to the connecticut department of revenue services connecticut department of

Complete Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve on any platform using airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

The easiest way to modify and eSign Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve with ease

- Access Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact confidential information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticuts new pass through entity taxwelcome to the connecticut department of revenue services connecticut department of

Create this form in 5 minutes!

How to create an eSignature for the connecticuts new pass through entity taxwelcome to the connecticut department of revenue services connecticut department of

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Connecticut CT 1065 form, and why is it important?

The Connecticut CT 1065 form is a partnership income tax return that needs to be filed by partnerships doing business in Connecticut. It is crucial as it ensures compliance with state tax laws and helps partnerships accurately report income, deductions, and credits. Filing this form correctly can help avoid penalties and streamline tax obligations for businesses.

-

How can airSlate SignNow assist in filing the Connecticut CT 1065?

airSlate SignNow simplifies the process of preparing and submitting the Connecticut CT 1065 by allowing users to sign, send, and manage documents electronically. With its intuitive interface, you can easily fill out tax forms and obtain necessary signatures quickly, ensuring that your submissions are accurate and timely. This streamlining of paperwork saves valuable time for businesses.

-

What are the pricing options for airSlate SignNow for managing Connecticut CT 1065 filings?

airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes, ensuring cost-effectiveness when managing documents like the Connecticut CT 1065. Users can choose from various subscription tiers to find an option that best fits their budget and filing needs. Free trials are also available to assess the platform's capabilities before commitment.

-

What features do airSlate SignNow provide for Connecticut CT 1065 filings?

airSlate SignNow boasts several features that enhance the filing of the Connecticut CT 1065, including customizable templates, automated reminders, and secure document storage. Additionally, its mobile-friendly design allows users to manage documents from anywhere, making it easy to access and revise your CT 1065 form on the go. This ensures a smooth workflow for all parties involved.

-

Can airSlate SignNow integrate with other software I use for Connecticut CT 1065 preparation?

Yes, airSlate SignNow can seamlessly integrate with various accounting and financial software, enhancing the process for filing your Connecticut CT 1065. These integrations allow users to import data directly, reducing manual entry errors and streamlining the overall documentation process. This capability ensures accuracy and efficiency in preparing tax returns.

-

Are there any benefits to using airSlate SignNow for Connecticut CT 1065 compared to traditional methods?

Using airSlate SignNow for your Connecticut CT 1065 offers numerous benefits over traditional paper methods, such as increased efficiency and reduced turnaround times. The platform allows for real-time collaboration, making it easier for teams to work together on filings. Furthermore, the electronic signature capability eliminates the hassle and delays associated with printing, signing, and scanning documents.

-

How secure is airSlate SignNow when handling Connecticut CT 1065 documents?

airSlate SignNow prioritizes security in handling sensitive documents, including the Connecticut CT 1065. The platform uses advanced encryption protocols and secure cloud storage to ensure that your information is protected. Additionally, audit trails and user authentication features provide a comprehensive security architecture that safeguards your data.

Get more for Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve

- Assignment of lease package alaska form

- Alaska purchase form

- Satisfaction cancellation or release of mortgage package alaska form

- Premarital agreements package alaska form

- Painting contractor package alaska form

- Framing contractor package alaska form

- Foundation contractor package alaska form

- Plumbing contractor package alaska form

Find out other Connecticuts New Pass Through Entity TaxWelcome To The Connecticut Department Of Revenue Services Connecticut Department Of Reve

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer