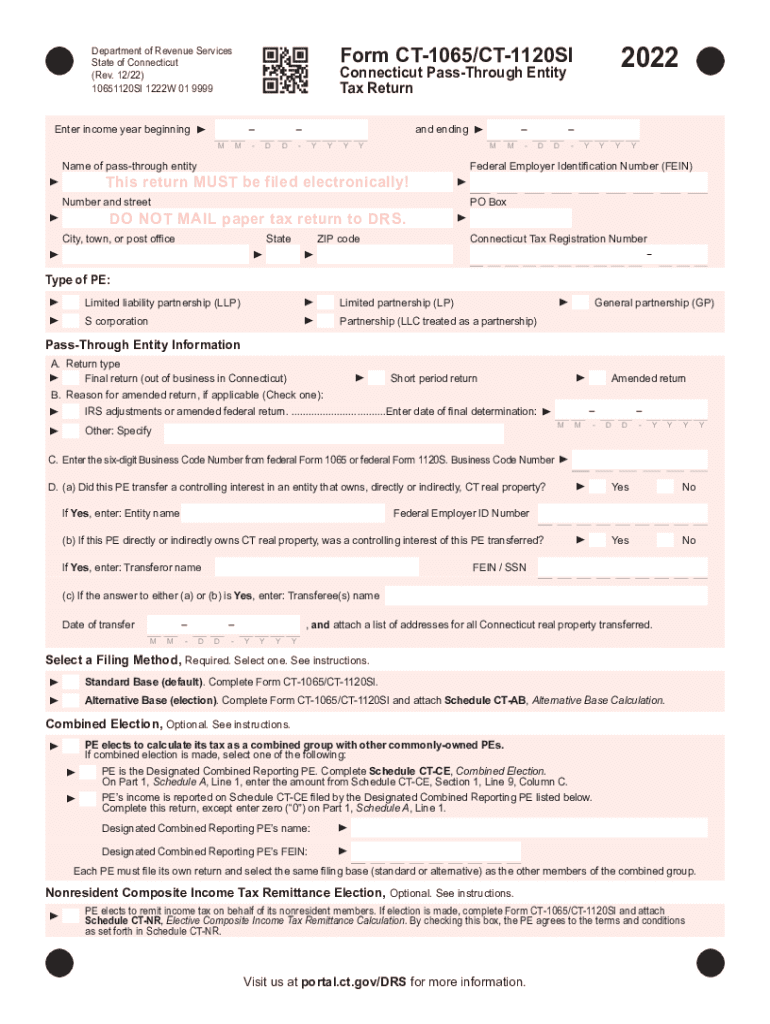

Enter Income Year Beginning 2022-2026

What is the Enter Income Year Beginning

The Enter Income Year Beginning refers to the specific year that marks the start of the income reporting period for the 2018 Form CT 1065. This form is utilized by partnerships operating in Connecticut to report income, deductions, and other relevant financial information to the state. Understanding the income year beginning is crucial as it establishes the timeframe for which the partnership's financial activities will be assessed for tax purposes.

Steps to complete the Enter Income Year Beginning

Completing the Enter Income Year Beginning section on the 2018 Form CT 1065 involves a few straightforward steps:

- Identify the correct income year that your partnership is reporting. This is typically the year in which the partnership's fiscal year starts.

- Enter the year in the designated field on the form. Ensure that the year is formatted correctly, using four digits.

- Double-check the entry for accuracy to avoid any potential issues with your tax filing.

Legal use of the Enter Income Year Beginning

The Enter Income Year Beginning is legally significant as it determines the reporting period for the partnership's income and expenses. Accurate reporting is essential to comply with state tax laws and regulations. Misreporting the income year can lead to complications, including penalties or audits by the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

For the 2018 Form CT 1065, it is important to be aware of the filing deadlines to ensure compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the partnership's income year. For partnerships operating on a calendar year, this means the due date is April 15 of the following year. Extensions may be available, but they must be requested appropriately.

Required Documents

When completing the 2018 Form CT 1065, certain documents may be necessary to ensure accurate reporting. These include:

- Financial statements for the reporting year, including income statements and balance sheets.

- Records of all income received and expenses incurred during the income year.

- Partnership agreements that outline the structure and ownership of the partnership.

Form Submission Methods (Online / Mail / In-Person)

The 2018 Form CT 1065 can be submitted through various methods. Partnerships have the option to file online, which is often the most efficient method. Alternatively, the form can be mailed to the Connecticut Department of Revenue Services or submitted in person at designated locations. It is important to choose the method that best suits your partnership's needs while ensuring compliance with filing requirements.

Penalties for Non-Compliance

Failure to accurately complete and submit the 2018 Form CT 1065 by the deadline can result in various penalties. These may include fines for late filing, interest on unpaid taxes, and potential audits. It is essential for partnerships to adhere to all filing requirements to avoid these consequences and maintain good standing with the state.

Quick guide on how to complete enter income year beginning

Complete Enter Income Year Beginning effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Enter Income Year Beginning on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-oriented process today.

The simplest way to edit and eSign Enter Income Year Beginning with ease

- Locate Enter Income Year Beginning and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional pen-and-ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Enter Income Year Beginning and ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enter income year beginning

Create this form in 5 minutes!

How to create an eSignature for the enter income year beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 Form CT 1065 and why is it important?

The 2018 Form CT 1065 is the Connecticut partnership income tax return form, which must be filed annually by partnerships in the state. It's important as it ensures compliance with state tax laws and helps partnerships report their income accurately.

-

How does airSlate SignNow simplify the process of filing the 2018 Form CT 1065?

airSlate SignNow allows businesses to seamlessly eSign and send documents, including the 2018 Form CT 1065, providing an efficient way to manage tax filings. Its user-friendly interface ensures that users can complete and sign forms with minimal hassle.

-

What features does airSlate SignNow offer for managing the 2018 Form CT 1065?

Key features of airSlate SignNow include document templates, eSignature capabilities, and real-time collaboration. These tools simplify the process of completing the 2018 Form CT 1065 and ensure all necessary parties can provide their input easily.

-

Is airSlate SignNow cost-effective for filing the 2018 Form CT 1065?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file the 2018 Form CT 1065. With competitive pricing plans, users can choose the option that best fits their needs without breaking the budget.

-

Can I integrate airSlate SignNow with other accounting software for the 2018 Form CT 1065?

Absolutely! airSlate SignNow integrates with several accounting software, making it easy to pull in data needed to complete the 2018 Form CT 1065. This integration streamlines the filing process and reduces the risk of errors in reporting.

-

What are the benefits of using airSlate SignNow for the 2018 Form CT 1065?

Using airSlate SignNow provides numerous benefits, such as enhanced security for sensitive tax documents and reduced printing costs. Additionally, the efficiency gained from electronic signatures accelerates the overall submission process for the 2018 Form CT 1065.

-

How does airSlate SignNow ensure the security of the 2018 Form CT 1065 documents?

airSlate SignNow implements advanced security protocols, including encryption and secure cloud storage, to protect all documents, including the 2018 Form CT 1065. This ensures that sensitive financial data remains safe during the eSigning and sharing process.

Get more for Enter Income Year Beginning

Find out other Enter Income Year Beginning

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online