Avats 2019

Filing Deadlines / Important Dates

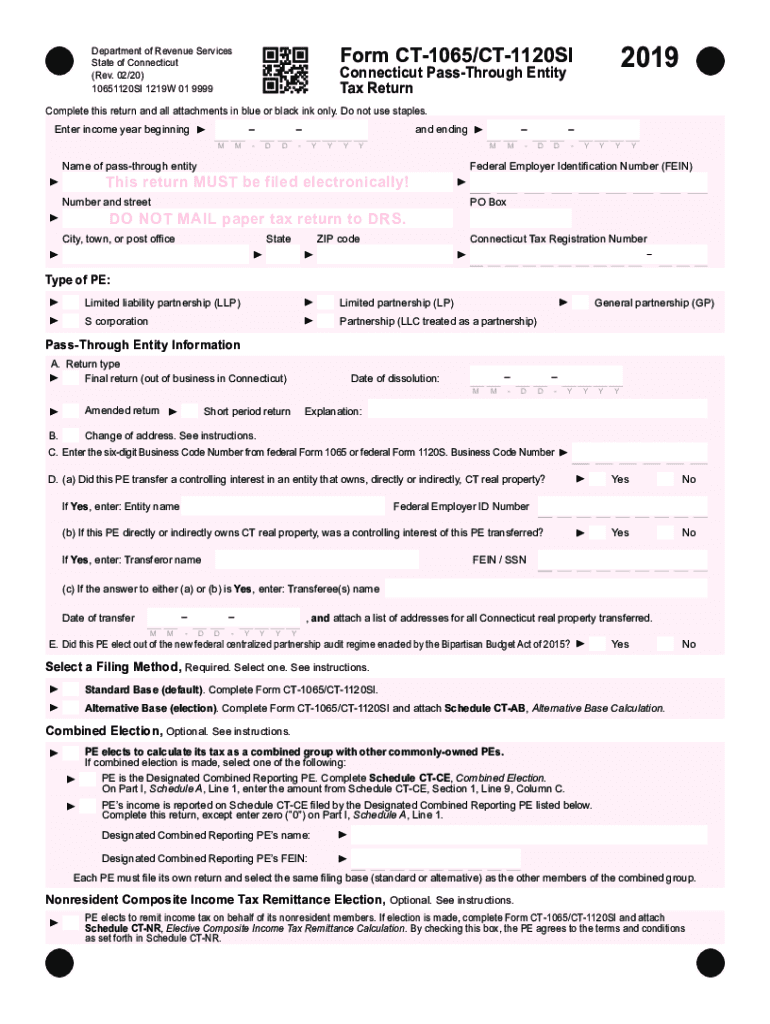

The due date for submitting Form 1065 in Connecticut is typically the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due on March 15. If the due date falls on a weekend or a holiday, the deadline is extended to the next business day. It is crucial for partnerships to be aware of these dates to avoid penalties and ensure compliance with state regulations.

Steps to Complete the Avats

Completing Form 1065 involves several key steps. First, gather all necessary financial documents, including income statements, expense reports, and prior year tax returns. Next, fill out the form accurately, ensuring that all income, deductions, and credits are reported correctly. Pay special attention to the partner’s information section, as it must reflect each partner's share of profits and losses. Once the form is completed, review it for accuracy before submitting it either electronically or by mail.

Legal Use of the Avats

Form 1065 serves as a legal declaration of a partnership's income, deductions, and credits. To ensure its legal validity, the form must be signed by an authorized partner. Additionally, using a reliable eSignature solution can enhance the legal standing of the document. Compliance with federal and state regulations is essential, as improper filing can lead to penalties or audits. Ensure that all signatures are obtained in accordance with the Electronic Signatures in Global and National Commerce Act (ESIGN) and other relevant laws.

Required Documents

When preparing to file Form 1065, certain documents are essential. These include financial statements, such as profit and loss statements, balance sheets, and any supporting documentation for deductions claimed. Additionally, partners should provide their Social Security numbers or Employer Identification Numbers (EINs). Gathering these documents in advance can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

Form 1065 can be submitted through various methods. Partnerships have the option to file electronically using approved software that supports eFiling. This method is often faster and allows for immediate confirmation of receipt. Alternatively, the form can be mailed to the appropriate address specified by the Connecticut Department of Revenue Services. In-person submission may also be possible, but it is advisable to check local guidelines and availability before proceeding.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1065. These guidelines include instructions on how to report income, deductions, and credits accurately. Additionally, the IRS outlines the requirements for partnerships, including the necessity of providing a Schedule K-1 to each partner. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors or audits.

Penalties for Non-Compliance

Failure to file Form 1065 by the due date can result in significant penalties. The IRS imposes a late filing penalty for each month the form is overdue, which can add up quickly. Additionally, partnerships may face penalties for inaccuracies or failure to provide required information. Understanding these potential penalties underscores the importance of timely and accurate filing to maintain compliance with tax regulations.

Quick guide on how to complete avats

Complete Avats seamlessly on any device

The management of online documents has become popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Avats on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign Avats effortlessly

- Locate Avats and click Get Form to get started.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Avats and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct avats

Create this form in 5 minutes!

How to create an eSignature for the avats

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the form 1065 ct due date for the current tax year?

The form 1065 ct due date typically falls on the 15th day of the third month after the end of the partnership's tax year. For most partnerships operating on a calendar year, this means the due date is March 15th. It's important to mark this date to avoid penalties and ensure timely compliance.

-

How can airSlate SignNow help with completing form 1065 ct?

airSlate SignNow streamlines the process of completing form 1065 ct by allowing users to easily fill out and eSign documents online. With our intuitive interface, businesses can quickly gather necessary information, ensuring that they meet the form 1065 ct due date without hassle. This efficiency saves time and reduces errors in filing.

-

Are there any penalties for missing the form 1065 ct due date?

Yes, there are penalties for not submitting form 1065 ct by its due date. The IRS imposes fines that can accumulate rapidly; therefore, it's crucial to adhere to the form 1065 ct due date. Utilizing airSlate SignNow can help prevent these costly mistakes by providing reminders and a reliable filing process.

-

Can airSlate SignNow integrate with other accounting software for form 1065 ct?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, enabling users to import and export data efficiently for form 1065 ct. This functionality allows businesses to streamline their accounting processes while ensuring they meet the form 1065 ct due date seamlessly.

-

What features does airSlate SignNow offer for form 1065 ct compliance?

airSlate SignNow offers features such as document templates, automated reminders, and secure eSigning. These tools are designed to make compliance with form 1065 ct more manageable. With our service, you’ll stay organized and on track to meet the form 1065 ct due date effortlessly.

-

Is there a cost associated with filing form 1065 ct through airSlate SignNow?

Yes, airSlate SignNow operates on a subscription-based pricing model, making it a cost-effective solution for businesses. The pricing depends on various factors such as features and user levels. Investing in airSlate SignNow simplifies the filing process, ensuring compliance with the form 1065 ct due date while offering excellent value.

-

What are the benefits of using airSlate SignNow for form 1065 ct?

Using airSlate SignNow for form 1065 ct offers numerous benefits, including increased efficiency, reduced manual errors, and enhanced security. Our platform simplifies the workflow, ensuring that users can complete their forms accurately and meet the due date with confidence. This peace of mind allows businesses to focus on growth instead of paperwork.

Get more for Avats

Find out other Avats

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template