Ct Form 1065 2018

What is the CT Form 1065?

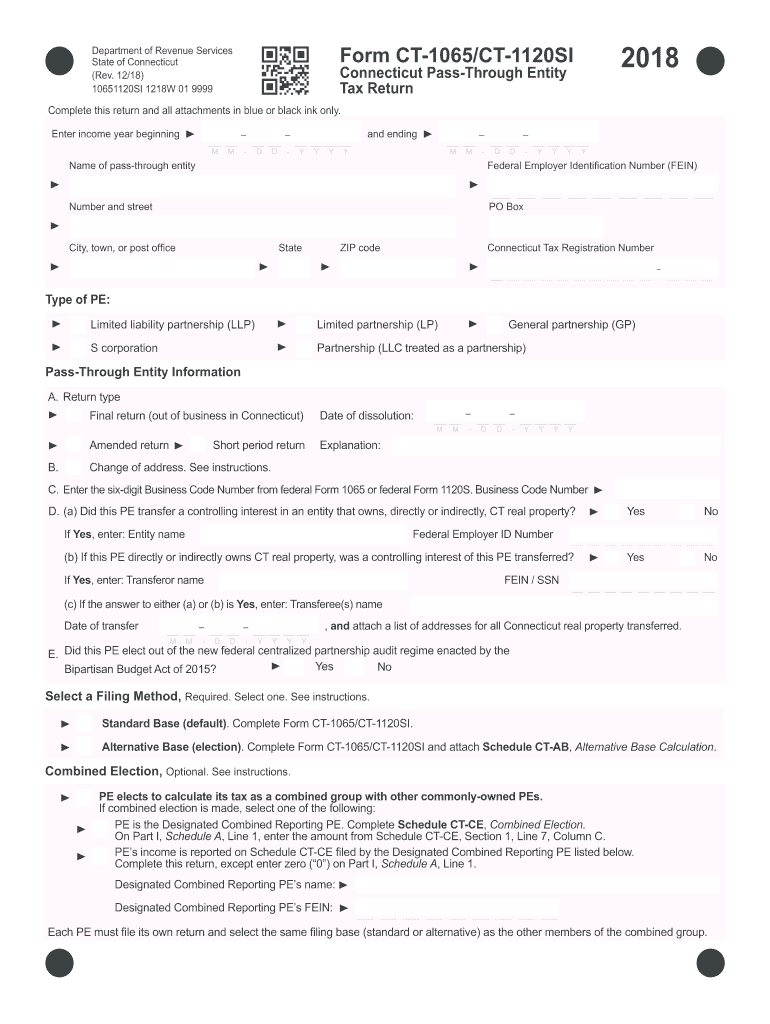

The CT Form 1065 is a tax return form used by partnerships in Connecticut to report income, deductions, gains, and losses. This form is essential for partnerships operating within the state, as it provides the necessary information for the Connecticut Department of Revenue Services to assess the partnership's tax obligations. The form includes various sections that require detailed financial data, ensuring that all relevant income and expenses are accurately reported.

How to use the CT Form 1065

To use the CT Form 1065 effectively, partnerships must gather all necessary financial documentation, including income statements, expense reports, and any other relevant financial records. The form should be filled out completely, ensuring that all sections are addressed. It is advisable to consult the instructions provided with the form to understand the specific requirements and guidelines for completion. Once completed, the form can be submitted either electronically or via mail, depending on the preference of the partnership.

Filing Deadlines / Important Dates

The due date for filing the CT Form 1065 typically aligns with the federal partnership tax return due date, which is usually the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year basis, this means the form is generally due by March 15. It is crucial for partnerships to be aware of any extensions that may apply, as well as any changes to deadlines that may occur due to state regulations or federal guidelines.

Steps to complete the CT Form 1065

Completing the CT Form 1065 involves several key steps:

- Gather all necessary financial documents, including income and expense records.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form by the due date, either electronically or by mail.

Required Documents

When completing the CT Form 1065, partnerships must have several documents on hand to ensure accurate reporting. These typically include:

- Income statements detailing all sources of revenue.

- Expense reports that outline all deductible costs.

- Partnership agreements that may affect tax calculations.

- Any prior year tax returns for reference.

Penalties for Non-Compliance

Failing to file the CT Form 1065 by the due date can result in significant penalties for partnerships. These penalties may include fines and interest on any unpaid taxes. Additionally, non-compliance can lead to increased scrutiny from the Connecticut Department of Revenue Services, which may result in audits or further legal action. It is important for partnerships to adhere to filing deadlines and ensure that all information is reported accurately to avoid these consequences.

Quick guide on how to complete form ct 1065 2018 2019

Your assistance manual on how to prepare your Ct Form 1065

If you’re curious about how to generate and dispatch your Ct Form 1065, here are some quick guidelines on how to simplify tax processing.

To begin, you just need to register your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a highly intuitive and powerful document solution that allows you to modify, create, and finalize your tax paperwork with ease. Using its editor, you can toggle between text, check marks, and eSignatures and return to amend responses when necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Ct Form 1065 in just minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Ct Form 1065 in our editor.

- Populate the required fillable fields with your details (text content, numbers, check marks).

- Employ the Signature Tool to affix your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in paper form can lead to increased return errors and delay reimbursements. Certainly, before e-filing your taxes, review the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 1065 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form ct 1065 2018 2019

How to generate an eSignature for your Form Ct 1065 2018 2019 in the online mode

How to generate an eSignature for the Form Ct 1065 2018 2019 in Chrome

How to generate an electronic signature for signing the Form Ct 1065 2018 2019 in Gmail

How to generate an eSignature for the Form Ct 1065 2018 2019 straight from your smart phone

How to make an electronic signature for the Form Ct 1065 2018 2019 on iOS

How to make an electronic signature for the Form Ct 1065 2018 2019 on Android devices

People also ask

-

What is the form 1065 ct due date for tax filings?

The form 1065 ct due date typically falls on the 15th day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the due date is March 15. It is crucial to meet this deadline to avoid potential penalties.

-

How can airSlate SignNow help with submitting form 1065 ct?

airSlate SignNow streamlines the process of preparing and submitting form 1065 ct by allowing you to easily eSign documents electronically. This eliminates the need for printing and mailing, ensuring you meet the form 1065 ct due date effortlessly. With our user-friendly platform, you can stay organized and efficient.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides valuable features that can help you manage documents efficiently, making it easier to meet your form 1065 ct due date. You can choose from monthly or annual subscriptions based on your budget.

-

What features does airSlate SignNow offer to help meet deadlines?

With airSlate SignNow, you gain access to features like automated reminders and document tracking, ensuring you never miss important deadlines like the form 1065 ct due date. Our platform makes it easy to manage your documents, collaborate with partners, and achieve seamless eSigning.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with a variety of popular applications, including CRM systems and cloud storage services. These integrations help you manage your workflow more effectively, allowing you to prepare for your form 1065 ct due date without hassle. Streamlined access to your documents is just a few clicks away.

-

What benefits does eSigning provide for form 1065 ct?

eSigning with airSlate SignNow offers several benefits, including the reduction of paperwork and faster turnaround times. By utilizing eSignatures, you can quickly gather necessary approvals and ensure that your form 1065 ct is submitted on time. This convenience ultimately helps your business remain compliant and efficient.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely. airSlate SignNow employs industry-standard security measures, including encryption and multi-factor authentication, to protect your sensitive documents. You can confidently manage your form 1065 ct and other tax-related files, knowing that your data is secure from unauthorized access.

Get more for Ct Form 1065

- Laser toenail fungus consent form

- Nj state cobra form hc

- Reiki consent form 15212651

- Senior clearance form

- Mckinney vento form

- Instructions for transportation mileage log form

- Azdot govmotor vehiclesforms and publicationsforms and publicationsadot arizona department of

- Family caregiver agreement template form

Find out other Ct Form 1065

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer