Fzyr pdfFiller Com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank 2021

Understanding the 5200 Form

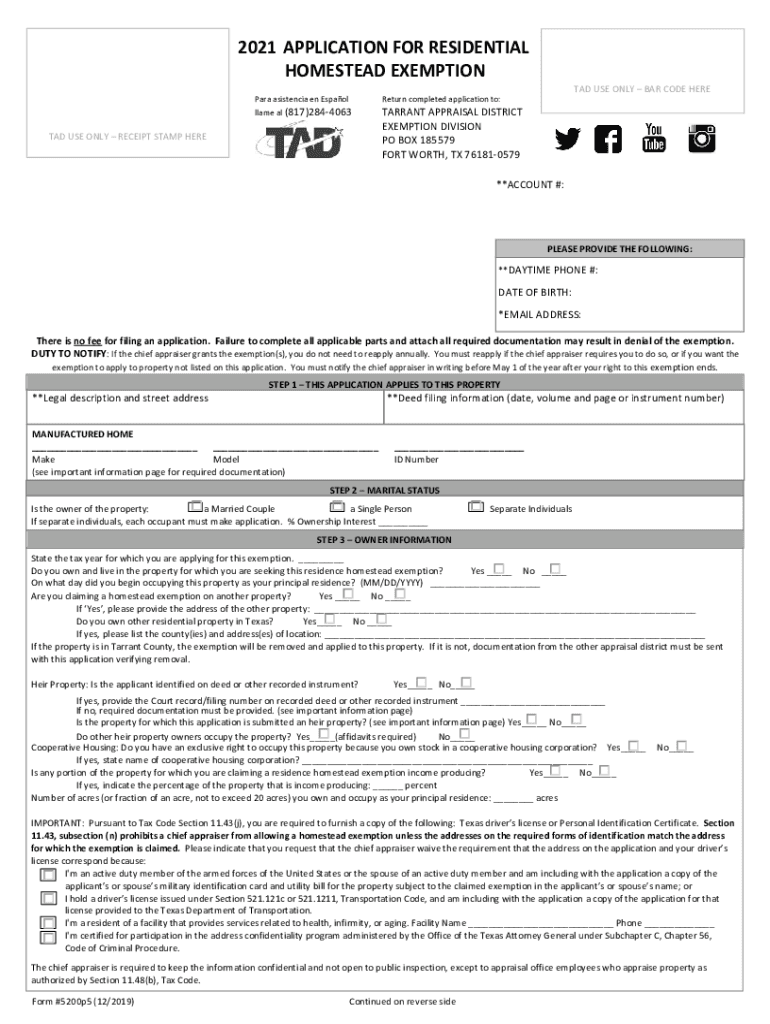

The 5200 form, often referred to as the Texas 5200 homestead form, is a crucial document for property owners in Texas seeking to claim a homestead exemption. This exemption can significantly reduce property taxes for eligible homeowners. The form requires specific information about the property and the owner, including details such as the property's location, ownership status, and the owner's social security number. Understanding the purpose and requirements of the 5200 form is essential for ensuring that homeowners receive the tax benefits they are entitled to.

Steps to Complete the 5200 Form

Completing the 5200 form involves several key steps to ensure accuracy and compliance with Texas regulations. Homeowners should start by gathering necessary documents, including proof of ownership and identification. Next, they need to accurately fill out the form, providing details about the property and the owner's eligibility for the exemption. After completing the form, it is important to review all information for accuracy before submission. Finally, homeowners can submit the form either online or by mail, depending on their preference and local regulations.

Legal Use of the 5200 Form

The legal use of the 5200 form is governed by Texas property tax laws. This form must be submitted to the local appraisal district to claim the homestead exemption. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or denial of the exemption. The form serves as a legal declaration of the homeowner's intent to claim the exemption and must be filed within specific deadlines to be eligible for tax relief.

Eligibility Criteria for the 5200 Form

To qualify for the homestead exemption using the 5200 form, homeowners must meet certain eligibility criteria. Generally, the property must be the owner's primary residence, and the owner must not have claimed a homestead exemption on another property. Additionally, the owner must be a U.S. citizen or a legal resident and must provide proof of identity. Understanding these criteria is essential for homeowners to ensure they meet the requirements before submitting the form.

Form Submission Methods

Homeowners have several options for submitting the 5200 form. They can choose to file the form online through their local appraisal district's website, which often provides a streamlined process. Alternatively, the form can be printed and mailed to the appropriate office. Some homeowners may also opt to deliver the form in person. Each submission method has its own advantages, and homeowners should select the one that best suits their needs and preferences.

Key Elements of the 5200 Form

The 5200 form contains several key elements that must be completed for the application to be valid. These elements include the property address, the owner's name and contact information, and the date of occupancy. Additionally, the form requires information regarding any other properties owned by the applicant and whether any other exemptions are being claimed. Ensuring that all key elements are correctly filled out is vital for a successful application.

Filing Deadlines for the 5200 Form

Filing deadlines for the 5200 form are critical for homeowners seeking to claim their homestead exemption. Typically, the form must be submitted by April 30 of the tax year for which the exemption is being claimed. Homeowners should be aware of these deadlines to avoid missing out on potential tax savings. It is advisable to check with the local appraisal district for any specific deadlines or changes that may apply.

Quick guide on how to complete fzyrpdffillercom2020 form tx 5200 fill online printable fillable blank

Finalize Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank seamlessly on any gadget

Digital document handling has become widely embraced by companies and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and store it securely online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank effortlessly

- Obtain Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important parts of the documents or mask confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require creating new document copies. airSlate SignNow meets your document management needs with just a few clicks from a device of your choice. Alter and electronically sign Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fzyrpdffillercom2020 form tx 5200 fill online printable fillable blank

Create this form in 5 minutes!

How to create an eSignature for the fzyrpdffillercom2020 form tx 5200 fill online printable fillable blank

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The best way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The best way to create an e-signature for a PDF on Android devices

People also ask

-

What is the 5200 form used for?

The 5200 form is commonly used for various business purposes, such as submitting documentation for contracts or agreements. It facilitates the process of electronic signing by allowing users to add legally binding signatures to important documents. Understanding its use is crucial for businesses looking to streamline their operations.

-

How does airSlate SignNow help with the 5200 form?

airSlate SignNow provides an efficient platform to eSign and manage the 5200 form digitally. Users can easily upload the form, invite others to sign electronically, and track the document’s status in real-time. This streamlines the signing process and reduces turnaround time signNowly.

-

Is there a cost associated with using the 5200 form on airSlate SignNow?

Yes, while airSlate SignNow offers various pricing plans, the costs may vary based on the features included and the number of users. However, the platform is known for its cost-effective solutions, enabling businesses to manage the 5200 form without incurring high expenses.

-

What features does airSlate SignNow offer for the 5200 form?

airSlate SignNow offers several features for the 5200 form, including document templates, automated workflows, and secure storage. Additionally, users can access a user-friendly interface that simplifies the signing process and ensures compliance with legal standards. These features enhance efficiency and accuracy.

-

Can the 5200 form be integrated with other software?

Yes, airSlate SignNow allows for integration with various software applications, making it easy to incorporate the 5200 form into existing workflows. Popular integrations include CRM systems and cloud storage solutions, which help businesses streamline their operations further and maintain organized records.

-

Why should I choose airSlate SignNow for handling the 5200 form?

Choosing airSlate SignNow for the 5200 form provides a user-friendly, secure, and cost-effective solution for document management. With its robust features, businesses can ensure that their documentation processes are efficient, compliant, and easily auditable. Additionally, the platform's customer support is responsive, assisting users whenever they need help.

-

What security measures are in place for the 5200 form on airSlate SignNow?

airSlate SignNow takes document security seriously, particularly for sensitive documents like the 5200 form. The platform employs encryption, secure access controls, and compliance with international standards to protect user data. This ensures that all transactions and stored documents remain secure and confidential.

Get more for Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank

- Alabama release form

- Alabama judgment form

- Summary administration for estates not more than 2500000 small estates alabama form

- Tenant defense form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497295976 form

- Al annual form

- Notices resolutions simple stock ledger and certificate alabama form

- Minutes for organizational meeting alabama alabama form

Find out other Fzyr pdffiller com2020 Form TX 5200 Fill Online, Printable, Fillable, Blank

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form