Dat Maryland GovrealpropertyPagesMaryland Homestead Tax Credit Maryland Department of 2022-2026

Eligibility Criteria for the 5200 Homestead Exemption

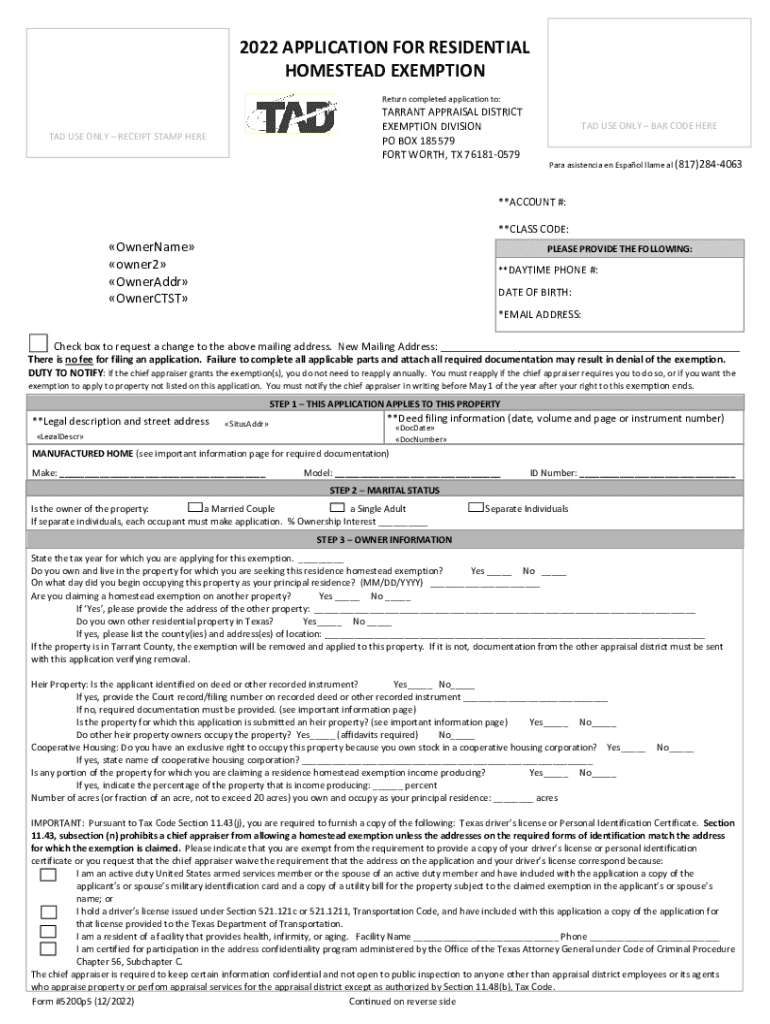

The 5200 homestead exemption is designed to provide property tax relief to eligible homeowners in Texas. To qualify, applicants must meet specific criteria, including:

- Ownership of the property as the primary residence.

- Occupancy of the home as the principal residence on January first of the tax year.

- Not claiming a homestead exemption on any other property.

- Meeting any additional local requirements set by the county appraisal district.

Understanding these eligibility criteria is crucial for ensuring that homeowners can take advantage of the tax benefits available through the 5200 homestead form.

Steps to Complete the 5200 Homestead Form

Completing the 5200 homestead exemption form involves several important steps. Here is a straightforward guide to help you navigate the process:

- Gather necessary documentation, including proof of ownership and residency.

- Obtain the 5200 homestead exemption form from the local appraisal district or download it online.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the completed form to the appropriate appraisal district office by the deadline.

Following these steps will help ensure that your application is processed smoothly and efficiently.

Required Documents for the 5200 Homestead Exemption

When applying for the 5200 homestead exemption, certain documents are necessary to support your application. These typically include:

- Proof of identity, such as a driver’s license or state ID.

- Documentation of property ownership, such as a deed or title.

- Evidence of residency, which may include utility bills or bank statements showing your name and address.

Having these documents ready will facilitate a quicker approval process for your homestead exemption application.

Form Submission Methods for the 5200 Homestead Exemption

The 5200 homestead exemption form can be submitted through various methods, depending on the policies of your local appraisal district. Common submission methods include:

- Online submission via the appraisal district's website.

- Mailing the completed form to the designated office address.

- In-person submission at the local appraisal district office.

Choosing the appropriate submission method can help ensure that your application is received and processed in a timely manner.

IRS Guidelines Related to the 5200 Homestead Exemption

While the 5200 homestead exemption primarily pertains to state property taxes, it is important to understand how it interacts with federal tax guidelines. Homeowners may benefit from:

- Potential deductions related to property taxes on federal income tax returns.

- Understanding how the exemption affects capital gains tax if the property is sold.

Consulting IRS guidelines can provide clarity on how the homestead exemption impacts your overall tax situation.

Application Process and Approval Time for the 5200 Homestead Exemption

The application process for the 5200 homestead exemption typically involves submitting the completed form along with the required documents. Once submitted, the approval time can vary based on the appraisal district's workload and policies. Generally, homeowners can expect:

- Initial processing within a few weeks of submission.

- Notification of approval or denial by mail.

Understanding the timeline can help homeowners plan accordingly and ensure they receive the benefits of the exemption in a timely manner.

Quick guide on how to complete datmarylandgovrealpropertypagesmaryland homestead tax credit maryland department of

Effortlessly Prepare Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a reliable eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of on any device with the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and electronically sign Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of with ease

- Obtain Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct datmarylandgovrealpropertypagesmaryland homestead tax credit maryland department of

Create this form in 5 minutes!

People also ask

-

What is the 5200 homestead exemption?

The 5200 homestead exemption is a tax benefit for homeowners that can reduce the assessed value of your property, ultimately lowering your property tax bill. This exemption is available to qualifying individuals who meet certain residency and ownership criteria. Understanding the 5200 homestead exemption can help you save money and effectively budget your housing expenses.

-

How can airSlate SignNow help with filing for the 5200 homestead exemption?

airSlate SignNow simplifies the process of filing for the 5200 homestead exemption by providing an easy-to-use platform for electronically signing and submitting necessary documents. With features like templates and automated workflows, you can ensure that all your paperwork is correctly filled out and submitted promptly. This streamlines your application process and facilitates timely access to your tax benefits.

-

Are there any fees associated with applying for the 5200 homestead exemption using airSlate SignNow?

Using airSlate SignNow to eSign documents for the 5200 homestead exemption may incur certain service fees, but these are typically low compared to the potential tax savings. The costs primarily depend on the subscription plan selected, which offers various services to fit your needs. Considering the savings from the exemption, the investment in our services can be very worthwhile.

-

What features does airSlate SignNow offer to support the 5200 homestead exemption process?

airSlate SignNow offers a variety of features to support the 5200 homestead exemption process, including eSignature capabilities, document templates, and secure file storage. These tools enable you to manage the filing process efficiently and keep track of your documents in one centralized location. By leveraging these features, you can eliminate paperwork hassles and focus on enjoying your tax benefits.

-

What are the benefits of using airSlate SignNow for the 5200 homestead exemption?

Using airSlate SignNow for the 5200 homestead exemption offers several benefits, including increased efficiency, reduced administrative burdens, and enhanced document security. Our platform ensures that you can easily sign and manage your papers electronically, which speeds up the filing process and reduces the risk of errors. Additionally, with our intuitive interface, you can feel confident navigating your exemption filing.

-

Can airSlate SignNow integrate with other tools for managing the 5200 homestead exemption?

Yes, airSlate SignNow can integrate with various tools and software to streamline the management of the 5200 homestead exemption. This includes popular document management systems and cloud storage services, ensuring that all your files are seamlessly connected. Such integrations enhance the efficiency of filing and tracking your tax exemption application.

-

Who is eligible for the 5200 homestead exemption?

Eligibility for the 5200 homestead exemption typically includes homeowners who occupy the property as their primary residence, meet state and local guidelines, and apply within the specified timeframe. It's essential to review your local regulations as they can vary by jurisdiction. Utilizing airSlate SignNow can ensure your application is accurately prepared and submitted on time.

Get more for Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of

- Name change notification form oregon

- Commercial building or space lease oregon form

- Oregon relative caretaker legal documents package oregon form

- Oregon standby temporary guardian legal documents package oregon form

- Oregon bankruptcy guide and forms package for chapters 7 or 13 oregon

- Bill of sale with warranty by individual seller oregon form

- Bill of sale with warranty for corporate seller oregon form

- Bill of sale without warranty by individual seller oregon form

Find out other Dat maryland govrealpropertyPagesMaryland Homestead Tax Credit Maryland Department Of

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself