How Do I Get an E ZRep Form TR Tax Information 2021-2026

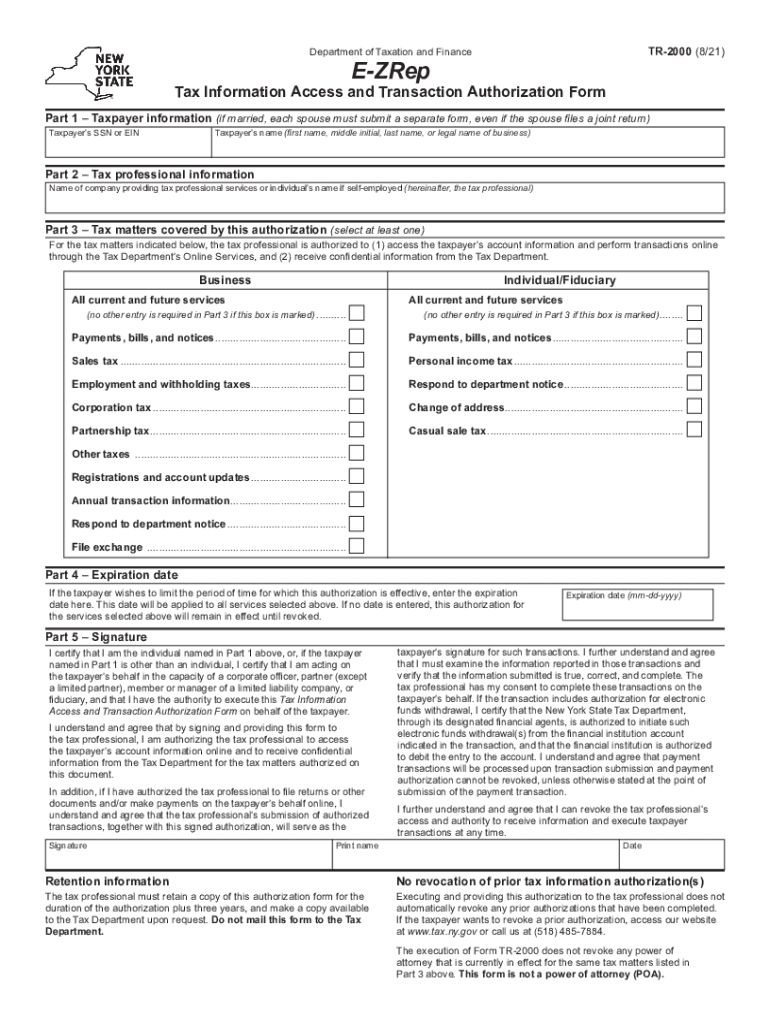

What is the NY 2000 Form?

The NY 2000 form, also known as the NY TR 2000 form, is a tax document used by individuals and businesses in New York to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax regulations. It is particularly relevant for taxpayers who may qualify for certain deductions or credits that can reduce their overall tax burden.

Key Elements of the NY 2000 Form

Understanding the key elements of the NY 2000 form is crucial for accurate completion. The form typically includes sections for personal information, income reporting, and deductions. Taxpayers must provide their Social Security number, filing status, and details about any income sources, such as wages, dividends, or business income. Additionally, there are areas designated for claiming specific tax credits and deductions, which can significantly impact the final tax amount owed or refunded.

Steps to Complete the NY 2000 Form

Completing the NY 2000 form involves several important steps:

- Gather necessary documentation, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out your personal information accurately, ensuring that your name and Social Security number are correct.

- Report all sources of income, ensuring that each entry is complete and accurate.

- Calculate your total deductions and credits, applying any applicable tax laws.

- Review the completed form for accuracy before submission.

Legal Use of the NY 2000 Form

The NY 2000 form is legally binding when completed correctly and submitted to the appropriate tax authorities. It is essential to follow all instructions and regulations set forth by the New York State Department of Taxation and Finance. Failure to comply with these regulations can result in penalties or audits, making it crucial to ensure that all information is accurate and truthful.

Filing Deadlines for the NY 2000 Form

Taxpayers must be aware of the filing deadlines associated with the NY 2000 form to avoid penalties. Typically, the form is due on April fifteenth for most individuals. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year.

Form Submission Methods

The NY 2000 form can be submitted through several methods, providing flexibility for taxpayers. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if assistance is needed.

Quick guide on how to complete how do i get an e zrep form tr 2000 tax information

Effortlessly Prepare How Do I Get An E ZRep Form TR Tax Information on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Handle How Do I Get An E ZRep Form TR Tax Information on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign How Do I Get An E ZRep Form TR Tax Information with Ease

- Locate How Do I Get An E ZRep Form TR Tax Information and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and eSign How Do I Get An E ZRep Form TR Tax Information and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how do i get an e zrep form tr 2000 tax information

Create this form in 5 minutes!

How to create an eSignature for the how do i get an e zrep form tr 2000 tax information

The way to generate an e-signature for your PDF online

The way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to ny 2000?

airSlate SignNow is a powerful eSignature solution that allows businesses to send, sign, and manage documents seamlessly. With its easy-to-use interface, it meets the needs of users looking for an efficient and cost-effective platform like ny 2000. This makes it ideal for companies aiming to streamline their document workflows.

-

How much does airSlate SignNow cost for users in ny 2000?

The pricing for airSlate SignNow varies depending on the package chosen, but it remains competitive for users looking for value in ny 2000. Various plans cater to different business needs, ensuring that all organizations can find a suitable option that fits their budget without compromising on features.

-

What features does airSlate SignNow offer for businesses in ny 2000?

airSlate SignNow offers a range of features designed to enhance efficiency for businesses in ny 2000, including customizable templates, in-person signing, and advanced security options. These features ensure that users have a reliable solution for managing documents while maintaining compliance and security.

-

Can airSlate SignNow integrate with other software for users in ny 2000?

Yes, airSlate SignNow supports integrations with various applications, appealing to users in ny 2000. This connectivity allows businesses to streamline their processes further by linking SignNow with tools like CRMs, project management applications, and more for seamless document handling.

-

What are the benefits of using airSlate SignNow for users in ny 2000?

Using airSlate SignNow provides multiple benefits to users in ny 2000, such as increased productivity, reduced turnaround times for document signing, and cost savings. The intuitive design helps businesses get documents signed faster, leading to improved efficiency and customer satisfaction.

-

Is airSlate SignNow suitable for small businesses in ny 2000?

Absolutely! airSlate SignNow is particularly well-suited for small businesses in ny 2000 that require an affordable, efficient eSignature solution. Its flexibility and scalability ensure that even small teams can benefit from advanced features without overspending.

-

How secure is airSlate SignNow for users in ny 2000?

airSlate SignNow prioritizes security for its users in ny 2000, incorporating features such as encryption, audit trails, and secure cloud storage. These measures ensure that your documents remain protected and compliant with industry regulations, giving you peace of mind.

Get more for How Do I Get An E ZRep Form TR Tax Information

Find out other How Do I Get An E ZRep Form TR Tax Information

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free