Tr 2018

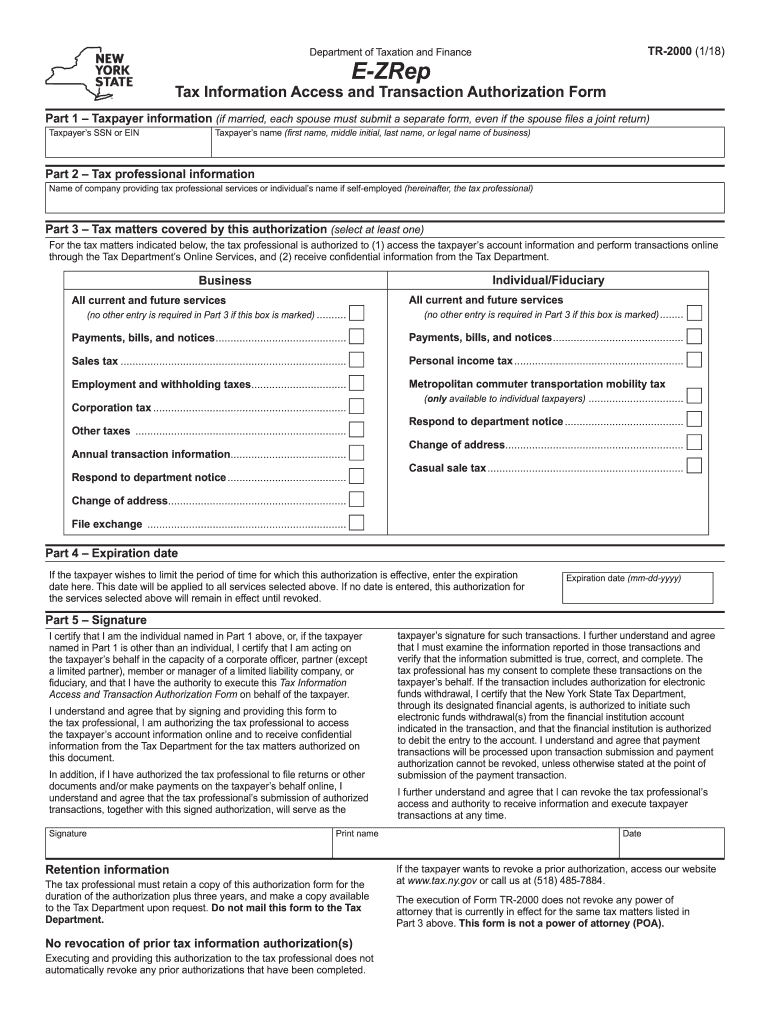

What is the Tr 2000 Form?

The Tr 2000 form, commonly referred to as the NY EZ Rep form, is a document used in New York State for tax purposes. It allows taxpayers to authorize representatives to access their tax information and handle matters with the New York State Department of Taxation and Finance. This form is particularly useful for individuals who may need assistance with their tax filings or inquiries, ensuring that their representatives can act on their behalf in a legally recognized manner.

How to Use the Tr 2000 Form

To effectively utilize the Tr 2000 form, you must first gather the necessary information, including your personal details and the representative's information. The form requires you to specify the type of access you are granting, such as the ability to discuss your tax information or file returns on your behalf. After filling out the form, you must sign it to validate the authorization. Once completed, the form can be submitted to the New York State Department of Taxation and Finance, allowing your representative to act accordingly.

Steps to Complete the Tr 2000 Form

Completing the Tr 2000 form involves several straightforward steps:

- Download the form from the New York State Department of Taxation and Finance website.

- Fill in your name, address, and Social Security number in the designated fields.

- Provide the representative's name, address, and contact information.

- Indicate the specific tax matters you are authorizing them to handle.

- Sign and date the form to confirm your authorization.

After completing these steps, ensure that you keep a copy for your records before submitting the form as instructed.

Legal Use of the Tr 2000 Form

The Tr 2000 form holds legal significance as it grants permission for a designated representative to access sensitive tax information. This authorization is recognized under New York State law, ensuring that your representative can act on your behalf in tax-related matters. It is crucial to complete the form accurately and ensure that your representative is trustworthy, as they will have access to your personal tax information.

Required Documents

When submitting the Tr 2000 form, you may need to provide additional documentation to verify your identity and the authority of your representative. Commonly required documents include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any previous tax returns or relevant tax documents that may assist your representative.

- Proof of your representative's credentials, if applicable.

Having these documents ready can streamline the process and ensure compliance with any requirements set by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Tr 2000 form to avoid any penalties or issues. The form should be submitted before the due date of your tax return to ensure that your representative can act on your behalf in a timely manner. Typically, tax returns in New York are due on April fifteenth, unless otherwise specified. Always check for any updates or changes to deadlines that may occur due to specific circumstances or new legislation.

Quick guide on how to complete form e zrep 2018 2019

Your assistance manual on how to prepare your Tr

If you're wondering how to generate and submit your Tr, here are some concise guidelines to simplify the tax filing process.

To begin, you simply need to create your airSlate SignNow account to enhance the way you manage documentation online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax forms with ease. With its editor, you can toggle between text, checkboxes, and eSignatures and return to adjust answers when necessary. Optimize your tax organization through advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your Tr quickly:

- Create your account and start working on PDFs in a matter of minutes.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Select Get form to open your Tr in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if needed).

- Examine your document and fix any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper can lead to return errors and delay refunds. Of course, prior to e-filing your taxes, check the IRS website for filing guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct form e zrep 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form e zrep 2018 2019

How to create an eSignature for your Form E Zrep 2018 2019 in the online mode

How to create an electronic signature for your Form E Zrep 2018 2019 in Google Chrome

How to make an electronic signature for signing the Form E Zrep 2018 2019 in Gmail

How to create an eSignature for the Form E Zrep 2018 2019 right from your mobile device

How to generate an eSignature for the Form E Zrep 2018 2019 on iOS devices

How to create an eSignature for the Form E Zrep 2018 2019 on Android devices

People also ask

-

What is airSlate SignNow and how does it work with Tr.?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and eSign documents seamlessly. With Tr., users can streamline their document workflow, ensuring that signing processes are efficient and secure. This platform is designed to simplify the signing experience, making it ideal for organizations of all sizes.

-

What are the pricing options for airSlate SignNow and how does Tr. fit in?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including a free trial option. The Tr. feature set is included in all plans, allowing users to access essential tools for electronic signatures and document management at an affordable rate. This ensures that businesses can find a plan that suits their budget and requirements.

-

Can I integrate airSlate SignNow with other software using Tr.?

Yes, airSlate SignNow offers integration capabilities with a variety of third-party applications through Tr. This allows businesses to connect their existing systems, such as CRMs and document storage solutions, enhancing productivity and streamlining workflows. The easy integrations ensure that users can maintain a cohesive digital ecosystem.

-

What are the key features of airSlate SignNow that leverage Tr.?

The key features of airSlate SignNow that utilize Tr. include customizable templates, advanced signing options, and real-time tracking. These features empower businesses to create a tailored signing experience, improving efficiency and compliance. By leveraging Tr., users can ensure that their document processes are both effective and user-friendly.

-

What benefits does using airSlate SignNow provide for businesses with Tr.?

Using airSlate SignNow with Tr. provides numerous benefits for businesses, such as reduced turnaround times for document signing and enhanced security measures. This solution allows teams to collaborate more effectively, ensuring that important documents are signed swiftly and securely. Ultimately, businesses can save time and resources while improving customer satisfaction.

-

Is airSlate SignNow secure when using Tr. for document signing?

Absolutely, airSlate SignNow prioritizes security by employing advanced encryption and compliance measures when using Tr. This ensures that all signed documents are protected against unauthorized access and tampering. Users can trust that their sensitive information remains secure throughout the signing process.

-

How can airSlate SignNow help streamline my document workflow with Tr.?

airSlate SignNow can signNowly streamline your document workflow by automating the signing process using Tr. This means that you can send, track, and manage documents all in one platform, reducing manual tasks and errors. By optimizing your workflow, your team can focus on more strategic initiatives while ensuring timely document completion.

Get more for Tr

- Complete withdrawal form point park university pointpark

- 1 2 2 lab determining longitude and latitude form

- Backward classes certificate form

- Nsa guest player form

- 15 south main street bel air md 21014 form

- Rental licensingbaltimore city department of housing form

- Sale financing settlement or lease of other real estate form

- Side lot program application form

Find out other Tr

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement