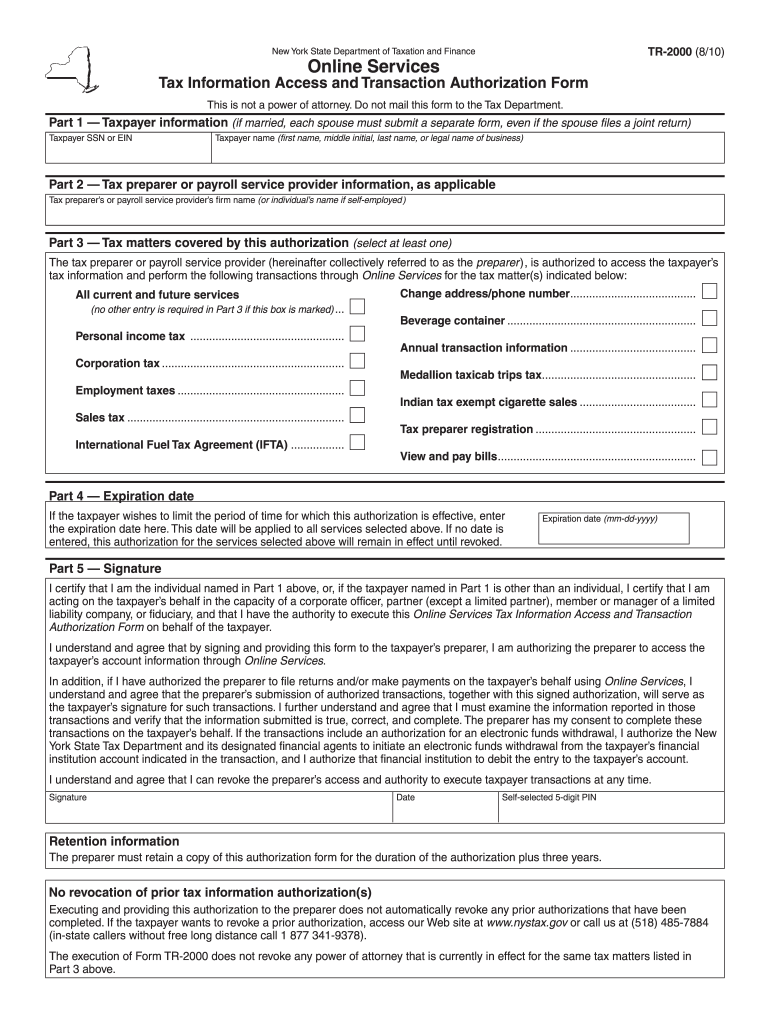

Ny Tr Fillable Form 2010

What is the Ny Tr Fillable Form

The Ny Tr Fillable Form is a digital document designed for individuals and businesses to report specific tax information to the state of New York. This form allows users to fill in required fields electronically, streamlining the process of tax reporting. It is essential for ensuring compliance with state tax regulations and can be submitted online or printed for mailing. The fillable format enhances accuracy and reduces errors commonly associated with handwritten forms.

How to use the Ny Tr Fillable Form

Using the Ny Tr Fillable Form is straightforward. Users can access the form online, where they can input their information directly into the designated fields. It is important to follow the instructions provided within the form to ensure all necessary information is included. After completing the form, users can either submit it electronically or print it for submission by mail. Ensuring that all sections are filled out correctly will help avoid delays in processing.

Steps to complete the Ny Tr Fillable Form

Completing the Ny Tr Fillable Form involves several key steps:

- Access the form online from a reliable source.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Provide the required financial details, such as income and deductions.

- Review the form for accuracy and completeness.

- Submit the form electronically or print it for mailing, ensuring you keep a copy for your records.

Legal use of the Ny Tr Fillable Form

The Ny Tr Fillable Form is legally recognized by the state of New York for tax reporting purposes. It must be completed in accordance with state guidelines to ensure its validity. Users should be aware of the legal implications of submitting inaccurate or incomplete information, which may result in penalties or delays in processing. Utilizing the eSignature feature through a compliant platform can further ensure the form's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Ny Tr Fillable Form vary depending on the type of tax being reported. Generally, individuals must submit their forms by April fifteenth of each year. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about these dates to avoid late fees or penalties. Keeping a calendar with reminders can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Ny Tr Fillable Form can be submitted using various methods:

- Online: Users can submit the form electronically through the state’s tax portal, which is the fastest method.

- Mail: The completed form can be printed and sent to the appropriate tax office via postal service.

- In-Person: Some individuals may choose to deliver their forms directly to a local tax office for immediate processing.

Quick guide on how to complete ny tr 2000 fillable form 2010

Your assistance manual on how to prepare your Ny Tr Fillable Form

If you’re looking to learn how to generate and submit your Ny Tr Fillable Form, below are a few straightforward instructions on how to simplify tax filing.

To commence, you just need to set up your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that allows you to modify, create, and complete your income tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and revisit to adjust responses as necessary. Optimize your tax administration with advanced PDF editing, electronic signing, and intuitive sharing options.

Follow the instructions below to finalize your Ny Tr Fillable Form in moments:

- Establish your account and start working on PDFs in a few minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your Ny Tr Fillable Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to insert your legally-binding electronic signature (if necessary).

- Verify your document and correct any mistakes.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper may lead to higher rates of errors and delays in refunds. Unsurprisingly, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ny tr 2000 fillable form 2010

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the ny tr 2000 fillable form 2010

How to create an eSignature for the Ny Tr 2000 Fillable Form 2010 in the online mode

How to generate an eSignature for the Ny Tr 2000 Fillable Form 2010 in Chrome

How to create an electronic signature for signing the Ny Tr 2000 Fillable Form 2010 in Gmail

How to make an electronic signature for the Ny Tr 2000 Fillable Form 2010 from your mobile device

How to create an eSignature for the Ny Tr 2000 Fillable Form 2010 on iOS devices

How to create an electronic signature for the Ny Tr 2000 Fillable Form 2010 on Android OS

People also ask

-

What is the Ny Tr Fillable Form and how does it work?

The Ny Tr Fillable Form allows users to create digital documents that can be easily filled out and signed online. With airSlate SignNow, you can customize the form to suit your needs, ensuring a seamless experience for both senders and recipients. This feature is ideal for businesses looking to streamline their document management process.

-

How can I create a Ny Tr Fillable Form using airSlate SignNow?

Creating a Ny Tr Fillable Form with airSlate SignNow is simple and intuitive. You can start by selecting a template or uploading your own document, then use our editing tools to add fillable fields and signatures. This ensures your form meets all your requirements for efficient data collection.

-

What are the pricing options for using the Ny Tr Fillable Form feature?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for the Ny Tr Fillable Form feature. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while enjoying full access to our powerful eSignature capabilities.

-

Can the Ny Tr Fillable Form be integrated with other software?

Yes, the Ny Tr Fillable Form can be seamlessly integrated with various third-party applications such as CRM systems, cloud storage services, and productivity tools. This integration enhances your workflow and ensures that your documents are easily accessible across platforms, improving overall efficiency.

-

What are the benefits of using the Ny Tr Fillable Form for my business?

Using the Ny Tr Fillable Form can signNowly enhance your business operations by reducing paperwork and speeding up the signing process. It also improves accuracy, as it minimizes the chances of errors associated with manual data entry. Furthermore, the ability to track document status ensures better accountability.

-

Is the Ny Tr Fillable Form secure for sensitive information?

Absolutely, the Ny Tr Fillable Form is designed with security in mind. airSlate SignNow employs industry-standard encryption and compliance with regulations to protect your sensitive information during transmission and storage. This guarantees that your data remains secure while you leverage the benefits of digital forms.

-

Can I customize the Ny Tr Fillable Form to match my branding?

Yes, airSlate SignNow allows you to fully customize the Ny Tr Fillable Form to align with your brand's identity. You can add your company logo, change colors, and modify the layout to create a professional-looking document that reflects your brand's values.

Get more for Ny Tr Fillable Form

- Form 15c consent motion to change ontario court services

- Transport document for lithium batteries form

- Harris teeter educational leave form

- Qaf no authorization required form medicaid clear health alliance

- Property lossdamage claim form garrun group

- Outlaw quadruped nutria amp beaver night take qnbnt permit form

- License application form kentucky

- Contractor registration application village of glen ellyn form

Find out other Ny Tr Fillable Form

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast