Comptroller Texas Govforms05 102 A05 102 Texas Franchise Tax Public Information Report 2018

Understanding the Texas Public Information Report 2022

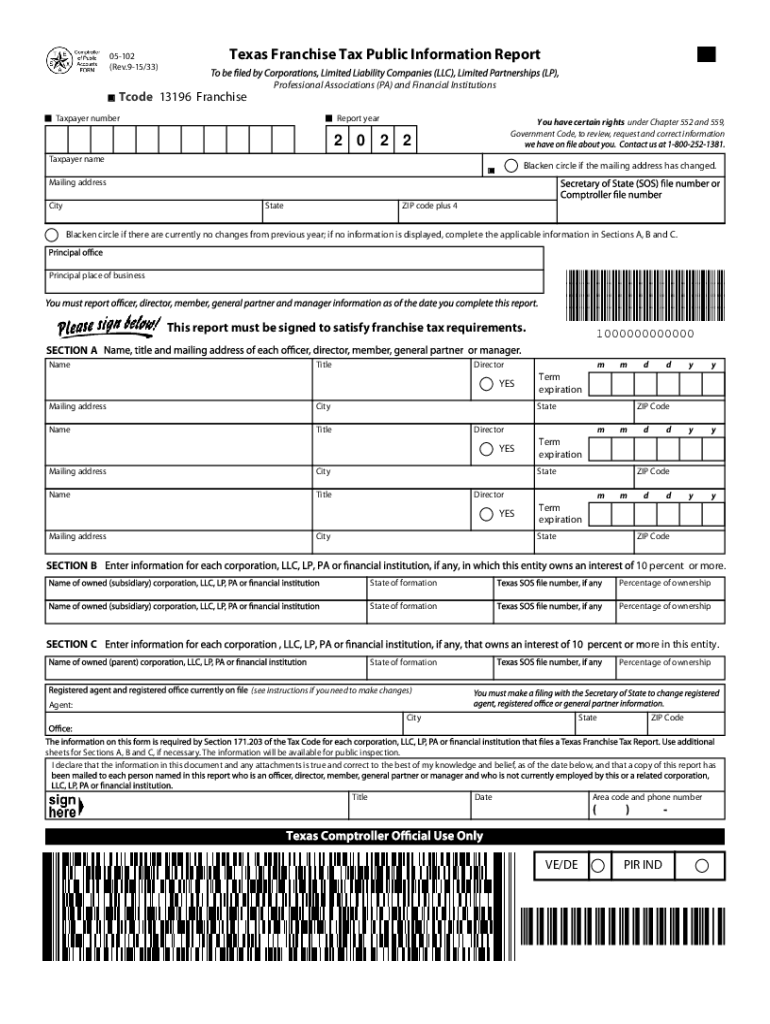

The Texas Public Information Report, specifically the Form 05-102, is a crucial document for businesses operating in Texas. This report is primarily used to provide necessary information to the Texas Comptroller of Public Accounts regarding a business's financial status and compliance with franchise tax obligations. It serves as a means to ensure transparency and accountability in business operations within the state.

This form is essential for various business entities, including corporations, limited liability companies (LLCs), and partnerships. By submitting this report, businesses confirm their compliance with Texas tax laws and contribute to the state's revenue system.

Steps to Complete the Texas Public Information Report

Completing the Texas Public Information Report involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide to help you through the process:

- Gather necessary information about your business, including its legal name, address, and federal employer identification number (EIN).

- Determine the reporting period for the franchise tax, which is typically based on your business's fiscal year.

- Complete the Form 05-102 by providing required financial data, including revenue and expenses.

- Review the completed form for accuracy, ensuring all information is up-to-date and correctly entered.

- Submit the form electronically through the Texas Comptroller's website or via mail, depending on your preference.

Required Documents for Filing

When preparing to file the Texas Public Information Report, it is important to have certain documents on hand. These may include:

- Your business's federal employer identification number (EIN).

- Financial statements, including income statements and balance sheets.

- Previous year's franchise tax report, if applicable.

- Any additional documentation that supports your revenue and expense claims.

Having these documents ready will streamline the completion of the Form 05-102 and help ensure compliance with state requirements.

Legal Use of the Texas Public Information Report

The Texas Public Information Report holds legal significance as it is a formal declaration of a business's financial status to the state. Properly completing and submitting this form is essential for maintaining good standing with the Texas Comptroller's office. Failure to file or inaccuracies in the report can lead to penalties, including fines or loss of business privileges.

Moreover, the information provided in this report is often used for various legal and administrative purposes, making its accuracy critical for any business entity.

Form Submission Methods

Businesses have several options for submitting the Texas Public Information Report. The available methods include:

- Online Submission: The most efficient method, allowing for immediate processing and confirmation of submission.

- Mail Submission: Businesses can print the completed form and send it to the Texas Comptroller's office via postal mail.

- In-Person Submission: For those who prefer face-to-face interaction, forms can be submitted at designated Comptroller offices.

Choosing the right submission method can help ensure timely processing and compliance with state regulations.

Penalties for Non-Compliance

Failure to file the Texas Public Information Report or inaccuracies within the report can result in significant penalties. These may include:

- Monetary fines that accumulate over time.

- Interest on unpaid franchise taxes.

- Potential loss of business privileges in Texas.

To avoid these consequences, it is essential for businesses to adhere to filing deadlines and ensure the accuracy of the information provided in the Form 05-102.

Quick guide on how to complete comptrollertexasgovforms05 102 a05 102 texas franchise tax public information report

Complete Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Handle Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report with ease

- Locate Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report and then click Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for such tasks.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or an invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form hunting, or inaccuracies that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report and guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct comptrollertexasgovforms05 102 a05 102 texas franchise tax public information report

Create this form in 5 minutes!

How to create an eSignature for the comptrollertexasgovforms05 102 a05 102 texas franchise tax public information report

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an e-signature for a PDF on Android

People also ask

-

What is a Texas public information report 2022?

A Texas public information report 2022 is a document that provides essential information about a business entity registered in Texas. It includes details such as the entity's name, address, registered agent, and business status, making it crucial for compliance and transparency in business operations.

-

How can I access the Texas public information report 2022?

You can access the Texas public information report 2022 through the Texas Secretary of State's website. By providing the necessary entity details, you can easily retrieve the report online, ensuring quick access to vital business information.

-

What are the benefits of obtaining a Texas public information report 2022?

Obtaining a Texas public information report 2022 helps businesses verify credibility and legitimacy in transactions. It enhances transparency, builds trust with clients and partners, and is often required during legal and business processes.

-

Are there any fees associated with acquiring a Texas public information report 2022?

Yes, there are nominal fees associated with obtaining a Texas public information report 2022, which can vary based on the entity type and specific services requested. It's important to check the Texas Secretary of State's website for the most accurate pricing information.

-

How does airSlate SignNow facilitate signing Texas public information reports 2022?

airSlate SignNow provides a streamlined solution for electronically signing Texas public information reports 2022. Users can easily upload the document, add e-signatures, and share it securely, enhancing efficiency and reducing paper waste.

-

Can I integrate airSlate SignNow with other software for managing Texas public information reports 2022?

Yes, airSlate SignNow offers seamless integrations with various software and platforms, allowing you to manage Texas public information reports 2022 efficiently. This facilitates easy sharing and document management across different applications.

-

Is airSlate SignNow a cost-effective solution for handling the Texas public information report 2022?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for managing documents, including the Texas public information report 2022. With competitive pricing and a range of features, businesses can save time and money while maintaining compliance.

Get more for Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report

- Warranty deed from corporation to individual arkansas form

- Quitclaim deed from corporation to llc arkansas form

- Quitclaim deed from corporation to corporation arkansas form

- Warranty deed from corporation to corporation arkansas form

- Quitclaim deed from corporation to two individuals arkansas form

- Warranty deed from corporation to two individuals arkansas form

- Arkansas trust form

- Warranty deed from husband and wife to a trust arkansas form

Find out other Comptroller texas govforms05 102 a05 102 Texas Franchise Tax Public Information Report

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later