Current Business Corporation Tax Forms NYC Gov 2021

What is the Current Business Corporation Tax Forms NYC gov

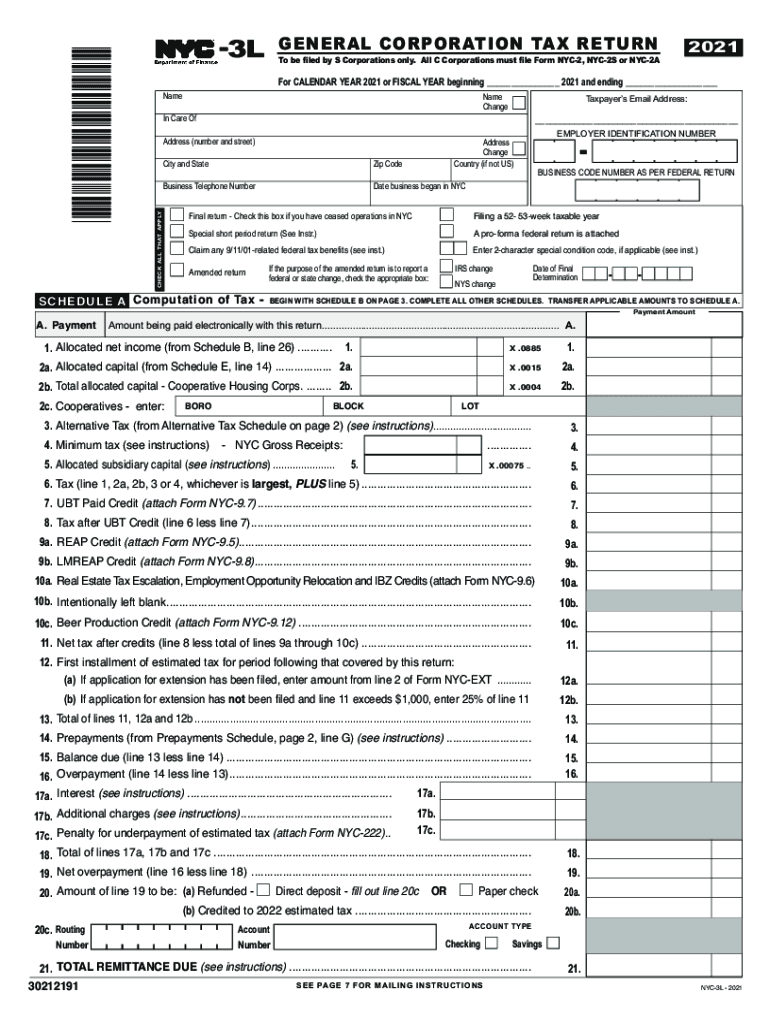

The Current Business Corporation Tax Forms, specifically the NYC 3L instructions for 2021, are essential documents for corporations operating within New York City. These forms are designed to help businesses report their income and calculate their tax obligations under the New York General Corporation Tax. The NYC 3L form is specifically tailored for corporations that are subject to the general corporation tax, ensuring compliance with local tax regulations. Understanding these forms is crucial for accurate reporting and avoiding penalties.

Steps to complete the Current Business Corporation Tax Forms NYC gov

Completing the NYC 3L instructions involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any relevant tax records. Next, carefully review the instructions provided with the form, as they outline specific requirements and calculations needed for your corporation's tax return. Fill out the form accurately, ensuring that all figures are correct and properly aligned with your financial data. Finally, double-check the completed form for any errors before submission to avoid delays or penalties.

Required Documents

When preparing to file the NYC 3L, certain documents are essential to ensure a complete and accurate submission. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Prior year tax returns for reference and consistency.

- Records of any tax credits or deductions that may apply.

- Documentation of any changes in business structure or ownership during the tax year.

Having these documents ready will streamline the process and help maintain compliance with tax regulations.

Legal use of the Current Business Corporation Tax Forms NYC gov

The legal use of the NYC 3L form is governed by state and local tax laws. To be considered valid, the form must be filled out completely and accurately, reflecting the corporation's financial activities for the tax year. Additionally, the form must be submitted by the designated deadline to avoid penalties. Utilizing a reliable eSignature tool, such as signNow, can enhance the legal standing of your submission by ensuring that all signatures are verified and compliant with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the NYC 3L form are critical to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due on April 15. It is important to stay informed about any changes to these deadlines, as local regulations can impact submission dates. Marking these dates on your calendar can help ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The NYC 3L form can be submitted through various methods, providing flexibility for corporations. Options include:

- Online Submission: Many businesses choose to file electronically through the NYC Department of Finance website, which offers a streamlined process.

- Mail: Corporations can also send their completed forms via traditional mail to the appropriate tax office.

- In-Person: For those who prefer direct interaction, submitting the form in person at designated tax offices is also an option.

Each method has its advantages, and businesses should choose the one that best fits their needs and compliance requirements.

Quick guide on how to complete current business corporation tax forms nycgov

Prepare Current Business Corporation Tax Forms NYC gov effortlessly across all devices

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Current Business Corporation Tax Forms NYC gov on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Current Business Corporation Tax Forms NYC gov seamlessly

- Obtain Current Business Corporation Tax Forms NYC gov and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Current Business Corporation Tax Forms NYC gov and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct current business corporation tax forms nycgov

Create this form in 5 minutes!

How to create an eSignature for the current business corporation tax forms nycgov

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing nyc 3l instructions 2021?

airSlate SignNow offers a suite of features to manage your nyc 3l instructions 2021 efficiently. These include customizable templates, robust eSigning capabilities, and document tracking. You can streamline your document workflow and ensure compliance with legal requirements.

-

How does airSlate SignNow ensure the security of my nyc 3l instructions 2021 documents?

Security is a priority for airSlate SignNow when dealing with nyc 3l instructions 2021 documents. The platform uses encryption, multi-factor authentication, and secure cloud storage to protect your sensitive information. Rest assured that your documents are safe and secure.

-

What is the pricing model for airSlate SignNow when using it for nyc 3l instructions 2021?

airSlate SignNow offers flexible pricing plans that cater to different business needs for nyc 3l instructions 2021. You can choose from individual, business, and enterprise plans depending on the features required. This ensures you get the most cost-effective solution for your specific requirements.

-

Can I integrate airSlate SignNow with other tools for nyc 3l instructions 2021?

Yes, airSlate SignNow supports various integrations with popular tools and applications for managing nyc 3l instructions 2021. You can connect with platforms like Google Workspace, Salesforce, and more. This allows you to enhance productivity by streamlining your workflow.

-

How can airSlate SignNow help me simplify the process of nyc 3l instructions 2021?

airSlate SignNow simplifies the process of managing nyc 3l instructions 2021 by providing an intuitive interface and automated workflows. You can quickly create, send, and eSign documents without the need for extensive training. This makes it easy for users to navigate through the process seamlessly.

-

What are the benefits of using airSlate SignNow for nyc 3l instructions 2021?

The benefits of using airSlate SignNow for nyc 3l instructions 2021 include increased efficiency, reduced paper usage, and enhanced accuracy in document management. By automating workflows, you save time and minimize errors, ultimately allowing your team to focus on more important tasks.

-

Is there a mobile app available for airSlate SignNow to manage nyc 3l instructions 2021?

Yes, airSlate SignNow offers a mobile app that allows you to manage your nyc 3l instructions 2021 documents on the go. The app provides access to all key features, enabling you to send, eSign, and manage documents directly from your mobile device. This flexibility ensures you stay productive no matter where you are.

Get more for Current Business Corporation Tax Forms NYC gov

- Arkansas property form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497296468 form

- Business credit application arkansas form

- Individual credit application arkansas form

- Interrogatories to plaintiff for motor vehicle occurrence arkansas form

- Interrogatories to defendant for motor vehicle accident arkansas form

- Llc notices resolutions and other operations forms package arkansas

- Residential real estate sales disclosure statement arkansas form

Find out other Current Business Corporation Tax Forms NYC gov

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast