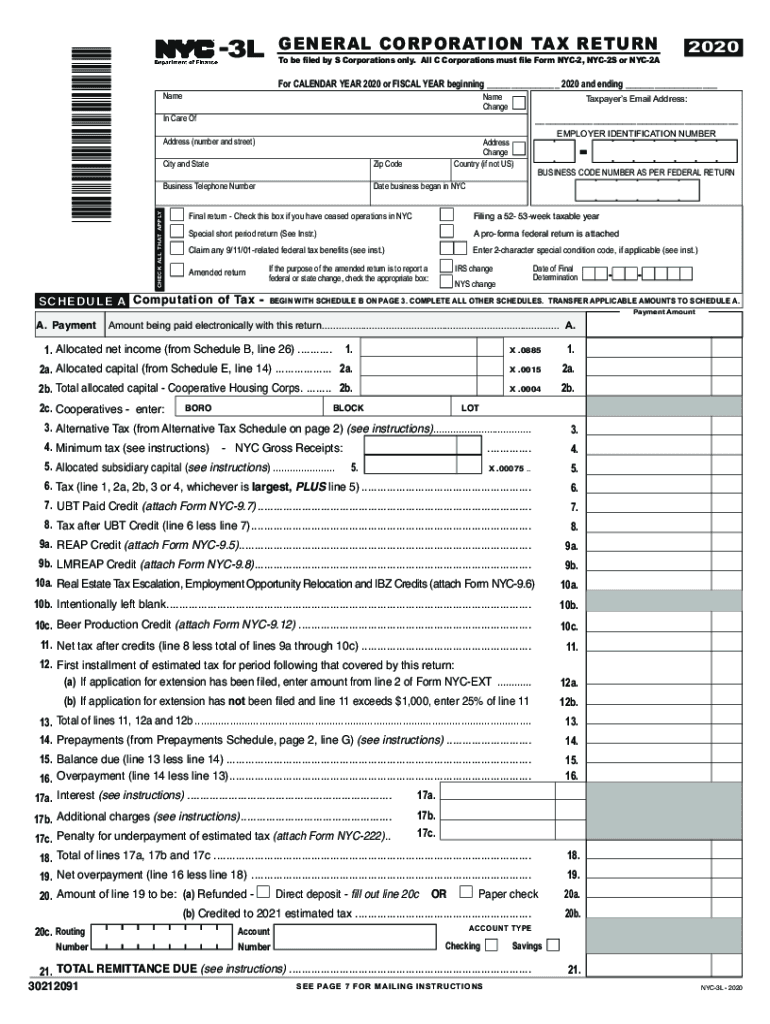

N Final Return Check This Box If You Have Ceased Operations in NYC 2020

Understanding the N Final Return for NYC

The N Final Return is a crucial document for businesses that have ceased operations in New York City. This form is specifically designed for entities that are no longer conducting business and need to report their final tax obligations. Completing this form accurately is essential for ensuring compliance with local tax regulations and avoiding potential penalties.

Steps to Complete the N Final Return

Filling out the N Final Return requires careful attention to detail. Here are the key steps involved:

- Gather all relevant financial documents, including income statements and expense records.

- Indicate the final date of operations on the form.

- Report any outstanding taxes owed, including any applicable penalties or interest.

- Ensure that all information is accurate and complete to avoid delays in processing.

- Submit the form by the designated deadline to prevent additional penalties.

Required Documents for the N Final Return

To successfully complete the N Final Return, certain documents are necessary. These include:

- Financial statements for the final year of operation.

- Proof of any tax payments made prior to filing.

- Documentation of business closure, such as dissolution papers if applicable.

Having these documents on hand will streamline the filing process and ensure that all required information is included.

Filing Deadlines for the N Final Return

Timely submission of the N Final Return is critical. The filing deadline typically aligns with the end of the tax year for the business. It is important to check for specific dates as they may vary based on the type of business entity. Missing the deadline can result in penalties, so staying informed about these dates is essential.

Penalties for Non-Compliance

Failure to file the N Final Return or inaccuracies in the submission can lead to significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes that accrues over time.

- Potential legal actions for continued non-compliance.

Understanding these consequences can motivate timely and accurate filing.

Digital vs. Paper Version of the N Final Return

Businesses have the option to submit the N Final Return electronically or via paper. The digital version offers several advantages:

- Faster processing times compared to paper submissions.

- Immediate confirmation of receipt from the tax authority.

- Reduced risk of lost or misplaced documents.

Choosing the digital route can enhance efficiency and ensure that the form is filed correctly.

Quick guide on how to complete n final return check this box if you have ceased operations in nyc

Effortlessly complete N Final Return Check This Box If You Have Ceased Operations In NYC on any device

The management of documents online has grown increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Handle N Final Return Check This Box If You Have Ceased Operations In NYC on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign N Final Return Check This Box If You Have Ceased Operations In NYC effortlessly

- Obtain N Final Return Check This Box If You Have Ceased Operations In NYC and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize applicable parts of the documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to finalize your changes.

- Choose your preferred method for submitting your form—via email, text message (SMS), invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign N Final Return Check This Box If You Have Ceased Operations In NYC to guarantee excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n final return check this box if you have ceased operations in nyc

Create this form in 5 minutes!

How to create an eSignature for the n final return check this box if you have ceased operations in nyc

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is included in the NYC 3L 2018 airSlate SignNow package?

The NYC 3L 2018 airSlate SignNow package includes essential features such as document sending, electronic signatures, and secure storage. With this package, users can efficiently manage their documents while ensuring compliance with New York City regulations from 2018. Additionally, the platform offers integrations with popular business applications to streamline your workflow.

-

How does airSlate SignNow support businesses using NYC 3L 2018?

airSlate SignNow provides businesses utilizing NYC 3L 2018 with a user-friendly interface and a range of tools to facilitate document management and eSigning. This ensures that organizations can easily adapt to compliance requirements and efficiently handle important paperwork. Our support team is also available to assist users with any specific needs related to the NYC 3L 2018 guidelines.

-

What are the pricing options for airSlate SignNow with NYC 3L 2018 compliance?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, ensuring compliance with NYC 3L 2018. Each plan includes various features tailored to your needs, from basic eSigning to advanced capabilities. You can easily select a subscription model that aligns with your organizational requirements.

-

How does airSlate SignNow enhance document security for NYC 3L 2018 users?

Document security is a top priority for airSlate SignNow, especially for organizations operating under NYC 3L 2018 regulations. Our platform employs advanced encryption protocols and secure storage solutions to protect sensitive information. Users can confidently send and sign documents knowing their data is safeguarded.

-

What integrations does airSlate SignNow offer for NYC 3L 2018?

airSlate SignNow offers robust integrations with a variety of popular business applications, enhancing productivity for users adhering to NYC 3L 2018. Integrate seamlessly with tools like Google Suite, Salesforce, and more to create a streamlined workflow. These integrations help optimize document processes, increasing efficiency.

-

Can I access airSlate SignNow on mobile devices while using NYC 3L 2018?

Yes, airSlate SignNow is fully accessible on mobile devices, making it easy for users to manage documents on-the-go, in line with NYC 3L 2018. The mobile app offers the same user-friendly experience as the desktop version, allowing you to send, sign, and store documents wherever you are. This flexibility is crucial for busy professionals.

-

What benefits does airSlate SignNow provide for organizations relying on NYC 3L 2018?

Organizations relying on NYC 3L 2018 can benefit greatly from airSlate SignNow's efficient document management and eSigning capabilities. The platform helps reduce turnaround times, minimizes paper usage, and ensures compliance with local regulations. These benefits not only streamline operations but also contribute to overall cost savings.

Get more for N Final Return Check This Box If You Have Ceased Operations In NYC

Find out other N Final Return Check This Box If You Have Ceased Operations In NYC

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract

- Can I Sign Montana Rental lease contract

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe