Fillable Form Bc 100 Indiana Business Tax Closure 2021

What is the Fillable Form BC 100 Indiana Business Tax Closure

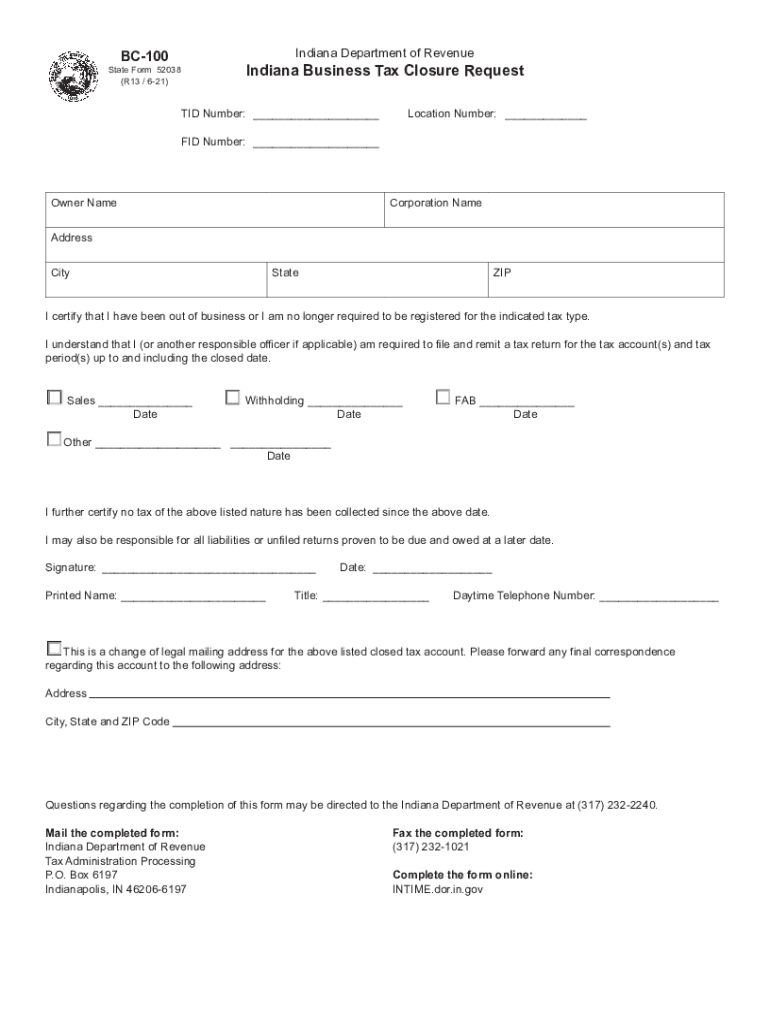

The BC 100 form is a crucial document for businesses in Indiana that are seeking to formally close their operations. This form serves as the Indiana Business Tax Closure request, allowing businesses to notify the state of their intent to cease operations and settle any outstanding tax obligations. By completing the BC 100 form, businesses can ensure they are compliant with state regulations and avoid potential penalties associated with failing to formally close their business.

Steps to Complete the Fillable Form BC 100 Indiana Business Tax Closure

Completing the BC 100 form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Indicate the reason for closure, whether it’s due to dissolution, sale, or another reason.

- Complete the sections regarding outstanding tax liabilities and confirm that all taxes have been paid.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the appropriate Indiana tax authority.

Legal Use of the Fillable Form BC 100 Indiana Business Tax Closure

The BC 100 form is legally binding once submitted, provided it meets all required criteria. It is essential for businesses to ensure that the form is filled out accurately to avoid legal repercussions. The form acts as an official record of closure, which can be referenced in case of future inquiries by tax authorities. Compliance with state laws regarding business closure is necessary to avoid potential fines or legal issues.

Required Documents for the BC 100 Indiana Business Tax Closure

When preparing to submit the BC 100 form, businesses should have the following documents ready:

- Tax identification number (TIN) or employer identification number (EIN).

- Financial records showing the settlement of any outstanding tax obligations.

- Documentation supporting the reason for closure, such as dissolution paperwork or sale agreements.

Form Submission Methods for the BC 100 Indiana Business Tax Closure

The BC 100 form can be submitted through several methods, ensuring flexibility for businesses. The available submission methods include:

- Online submission via the Indiana Department of Revenue website.

- Mailing the completed form to the designated state tax office.

- In-person delivery at local tax offices for immediate processing.

Eligibility Criteria for the BC 100 Indiana Business Tax Closure

To be eligible to use the BC 100 form, businesses must meet specific criteria. These include:

- The business must be registered in Indiana and have an active tax identification number.

- All outstanding tax liabilities must be settled prior to submitting the form.

- The business must be in the process of ceasing operations, either through dissolution or sale.

Quick guide on how to complete fillable form bc 100 indiana business tax closure

Complete Fillable Form Bc 100 Indiana Business Tax Closure seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Fillable Form Bc 100 Indiana Business Tax Closure on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Fillable Form Bc 100 Indiana Business Tax Closure effortlessly

- Obtain Fillable Form Bc 100 Indiana Business Tax Closure and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just a few seconds and has the same legal standing as a traditional ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Fillable Form Bc 100 Indiana Business Tax Closure and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form bc 100 indiana business tax closure

Create this form in 5 minutes!

How to create an eSignature for the fillable form bc 100 indiana business tax closure

How to create an e-signature for your PDF document in the online mode

How to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The way to generate an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it benefit businesses in bc 100 business?

airSlate SignNow is a digital signature platform that empowers businesses in bc 100 business to send and eSign documents easily and cost-effectively. By streamlining the document signing process, it saves time and enhances productivity, allowing companies to focus on their core activities.

-

How much does airSlate SignNow cost for businesses in bc 100 business?

Pricing for airSlate SignNow varies based on the plan selected, making it suitable for businesses in bc 100 business regardless of size. There are different pricing tiers that cater to small, medium, and large enterprises, ensuring that every business finds an option that fits its budget and needs.

-

What features does airSlate SignNow offer specifically for bc 100 business?

airSlate SignNow offers a range of features tailored for businesses in bc 100 business, including customizable templates, advanced security measures, and real-time tracking of document status. These features ensure that companies can manage their document workflows efficiently and securely.

-

Can airSlate SignNow integrate with other tools used in bc 100 business?

Yes, airSlate SignNow easily integrates with various applications that are commonly used in bc 100 business, such as CRM systems and project management tools. This seamless integration fosters a unified workflow, enhancing operational efficiency within organizations.

-

What are the benefits of using airSlate SignNow for document management in bc 100 business?

Using airSlate SignNow for document management in bc 100 business provides signNow benefits, including reduced turnaround time for contracts and agreements, improved compliance, and enhanced collaboration among teams. These advantages allow businesses to operate more smoothly and effectively.

-

Is airSlate SignNow suitable for small businesses in bc 100 business?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses in bc 100 business. The platform’s user-friendly interface and affordable pricing make it accessible for smaller companies looking to enhance their document management processes.

-

How secure is airSlate SignNow for businesses in bc 100 business?

Security is a top priority for airSlate SignNow, especially for businesses in bc 100 business. The platform employs robust security measures, including encryption and secure cloud storage, ensuring that sensitive documents remain protected throughout the signing process.

Get more for Fillable Form Bc 100 Indiana Business Tax Closure

- Arkansas statutory 497296633 form

- Arkansas attorney form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497296635 form

- Annual minutes arkansas arkansas form

- Notices resolutions simple stock ledger and certificate arkansas form

- Minutes for organizational meeting arkansas arkansas form

- Ar sample letter form

- Lead based paint disclosure for sales transaction arkansas form

Find out other Fillable Form Bc 100 Indiana Business Tax Closure

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online