BC 100 BC 100, Indiana Business Tax Closure Request 2024-2026

Understanding the Indiana Tax Form BC 100

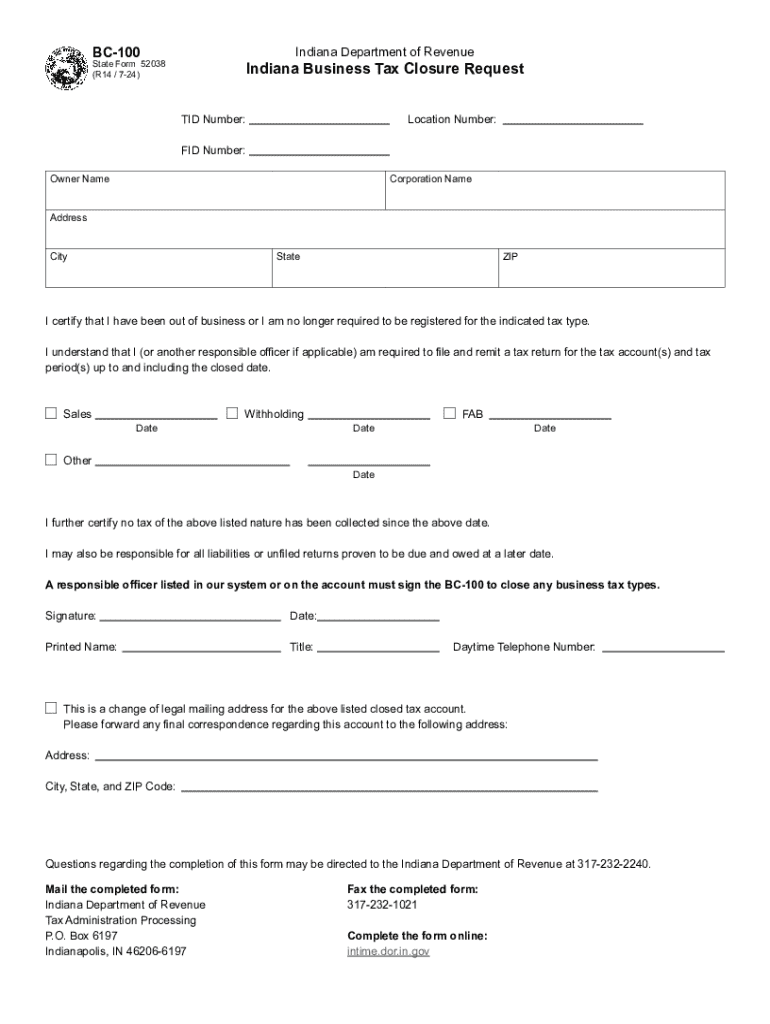

The Indiana tax form BC 100 is a crucial document for businesses wishing to formally request the closure of their business tax accounts in Indiana. This form serves as an official notification to the Indiana Department of Revenue that a business is ceasing operations and no longer needs to file tax returns or remit payments. Proper completion of this form ensures that the business is in good standing and avoids potential penalties associated with unfiled taxes.

Steps to Complete the Indiana Tax Form BC 100

Completing the Indiana BC 100 form involves several key steps:

- Gather necessary information, including your business name, tax identification number, and the date of closure.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions to prevent delays in processing.

- Submit the form to the Indiana Department of Revenue via the preferred submission method.

Following these steps will help ensure a smooth closure process for your business tax account.

How to Obtain the Indiana Tax Form BC 100

The BC 100 form can be obtained directly from the Indiana Department of Revenue's official website. It is typically available as a downloadable PDF file, allowing businesses to print and fill it out. Additionally, physical copies may be available at local tax offices for those who prefer in-person assistance. Ensure you have the latest version of the form to avoid any compliance issues.

Key Elements of the Indiana Tax Form BC 100

The Indiana BC 100 form includes several important sections that must be completed:

- Business Information: This section requires the name, address, and tax identification number of the business.

- Date of Closure: Clearly indicate the date on which the business ceased operations.

- Signature: An authorized representative of the business must sign the form to validate the request.

Each of these elements is vital for the processing of the closure request and must be filled out accurately.

Filing Deadlines and Important Dates for the Indiana BC 100

It is essential to be aware of the deadlines associated with the Indiana BC 100 form. Generally, businesses should submit the form as soon as they decide to cease operations. Timely submission helps avoid penalties and ensures that the business is properly closed in the eyes of the state. Check the Indiana Department of Revenue’s website for any specific deadlines that may apply to your situation.

Form Submission Methods for the Indiana BC 100

The Indiana BC 100 form can be submitted through various methods:

- Online: Some businesses may have the option to submit the form electronically through the Indiana Department of Revenue’s online portal.

- By Mail: Completed forms can be mailed to the designated address provided on the form.

- In-Person: Businesses can also deliver the form directly to local tax offices for immediate processing.

Choosing the right submission method depends on the urgency and preference of the business.

Create this form in 5 minutes or less

Find and fill out the correct bc 100 bc 100 indiana business tax closure request

Create this form in 5 minutes!

How to create an eSignature for the bc 100 bc 100 indiana business tax closure request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana tax form BC 100?

The Indiana tax form BC 100 is a business tax form used for reporting various business taxes in the state of Indiana. It is essential for businesses to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and submitting the Indiana tax form BC 100.

-

How can airSlate SignNow help with the Indiana tax form BC 100?

airSlate SignNow provides an easy-to-use platform for businesses to eSign and send documents, including the Indiana tax form BC 100. With its user-friendly interface, you can quickly fill out the form and obtain necessary signatures, streamlining your tax filing process. This efficiency can save you time and reduce the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Indiana tax form BC 100?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost will depend on the features you choose, but it remains a cost-effective solution for managing documents like the Indiana tax form BC 100. You can explore the pricing options on our website to find the best fit for your business.

-

What features does airSlate SignNow offer for managing the Indiana tax form BC 100?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the Indiana tax form BC 100. These features ensure that your documents are completed accurately and efficiently. Additionally, you can access your documents from anywhere, making it convenient for busy professionals.

-

Can I integrate airSlate SignNow with other software for the Indiana tax form BC 100?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow when dealing with the Indiana tax form BC 100. You can connect it with popular tools like CRM systems, accounting software, and cloud storage services. This integration capability helps streamline your document management process.

-

What are the benefits of using airSlate SignNow for the Indiana tax form BC 100?

Using airSlate SignNow for the Indiana tax form BC 100 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which can signNowly speed up your tax filing process. Additionally, it helps ensure that your documents are securely stored and easily accessible.

-

Is airSlate SignNow secure for submitting the Indiana tax form BC 100?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the Indiana tax form BC 100. You can confidently submit your sensitive information knowing that it is safeguarded against unauthorized access. Our platform is designed to meet industry standards for data protection.

Get more for BC 100 BC 100, Indiana Business Tax Closure Request

- Atoms vs ions worksheet form

- Printable puppy health guarantee template form

- Calculus 10th edition by ron larson and bruce edwards pdf download form

- Safaricom jobs for form four leavers 2022

- Health certificate for cardiovascular intensive sport activity cycling races events form

- Digital art commission contract form

- Toyota invoice pdf form

- Form 4

Find out other BC 100 BC 100, Indiana Business Tax Closure Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors