Form ST 200 Utility Sales Tax Exemption Application State 2021-2026

What is the Form ST 200 Utility Sales Tax Exemption Application?

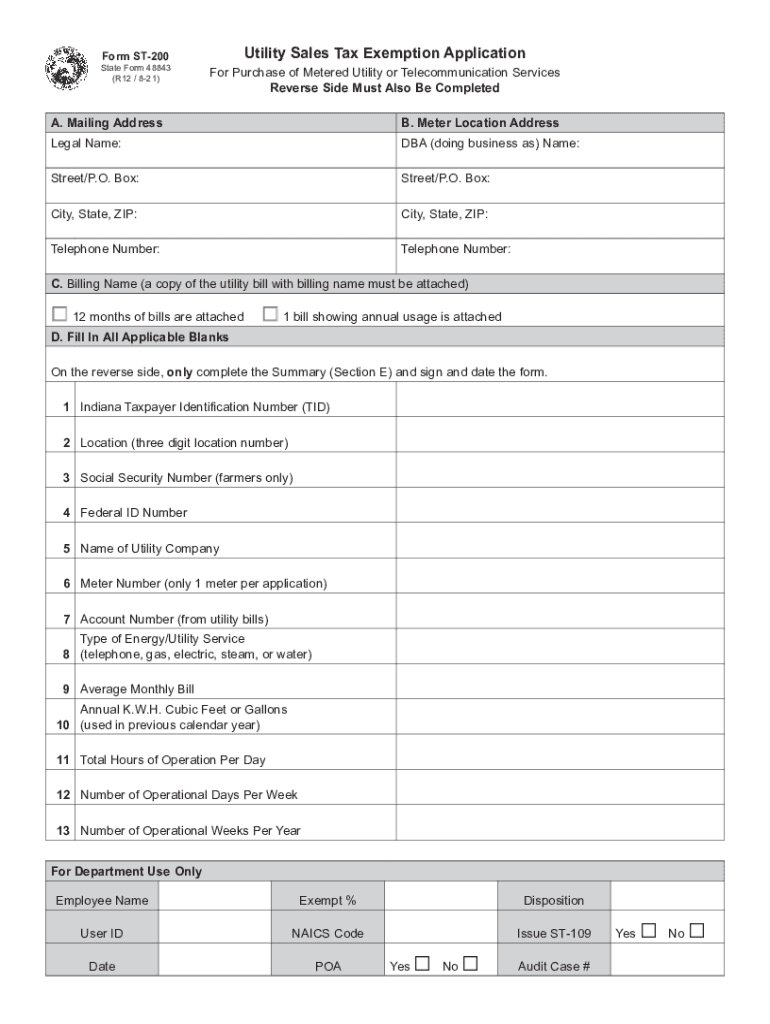

The Form ST 200 is a crucial document used in the state of Indiana for applying for a utility sales tax exemption. This form allows eligible entities, such as certain businesses and organizations, to claim exemption from sales tax on utility purchases. The exemption is designed to support specific industries and promote economic growth by reducing the tax burden associated with utility expenses. Understanding the purpose and eligibility criteria for the ST 200 is essential for organizations seeking to benefit from this exemption.

Steps to Complete the Form ST 200 Utility Sales Tax Exemption Application

Completing the Form ST 200 involves several key steps to ensure accurate submission. First, gather all necessary information, including the legal name of the entity, address, and tax identification number. Next, clearly indicate the type of utility services for which the exemption is being requested, such as electricity, gas, or water. It is important to provide detailed descriptions of how these utilities are used in your operations. Finally, review the form for accuracy and completeness before submitting it to the appropriate tax authority.

Eligibility Criteria for the Form ST 200 Utility Sales Tax Exemption Application

To qualify for the utility sales tax exemption through the Form ST 200, applicants must meet specific criteria set by the state of Indiana. Generally, eligible entities include non-profit organizations, manufacturing companies, and certain agricultural operations. Each category has distinct requirements, such as proof of tax-exempt status or documentation of utility usage. Familiarizing yourself with these criteria is vital to ensure that your application is accepted and processed without delays.

Legal Use of the Form ST 200 Utility Sales Tax Exemption Application

The legal use of the Form ST 200 is governed by state tax laws and regulations. When properly completed and submitted, the form serves as a formal request for exemption from sales tax on utility purchases. It is essential to ensure compliance with all applicable laws to avoid penalties or denial of the exemption. The form must be used only for its intended purpose, and any misuse or fraudulent claims can lead to serious legal consequences.

Required Documents for the Form ST 200 Utility Sales Tax Exemption Application

When submitting the Form ST 200, applicants must include several supporting documents to validate their eligibility. Commonly required documents include proof of tax-exempt status, utility bills, and evidence of how the utilities are used in the business operations. Additionally, organizations may need to provide financial statements or other documentation that demonstrates their operational status. Ensuring that all required documents are included will facilitate a smoother application process.

Form Submission Methods for the Form ST 200 Utility Sales Tax Exemption Application

The Form ST 200 can be submitted through various methods, depending on the preferences of the applicant and the requirements of the state tax authority. Common submission methods include online filing through the state’s tax portal, mailing a physical copy of the form, or delivering it in person to the local tax office. Each method has its own processing times and requirements, so it is advisable to choose the most convenient option that aligns with your needs.

Quick guide on how to complete form st 200 utility sales tax exemption application state

Handle Form ST 200 Utility Sales Tax Exemption Application State seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, as you can easily find the desired form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form ST 200 Utility Sales Tax Exemption Application State on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form ST 200 Utility Sales Tax Exemption Application State effortlessly

- Obtain Form ST 200 Utility Sales Tax Exemption Application State and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides precisely for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form ST 200 Utility Sales Tax Exemption Application State and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 200 utility sales tax exemption application state

Create this form in 5 minutes!

How to create an eSignature for the form st 200 utility sales tax exemption application state

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask

-

What is airSlate SignNow, and how does it work in st 200?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and electronically sign documents seamlessly. With airSlate SignNow in st 200, you can create, edit, and manage your documents all in one place, ensuring a smoother workflow and faster turnaround times.

-

What are the pricing plans available for airSlate SignNow in st 200?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Whether you are a small startup or a large enterprise, you can find an affordable plan in st 200 that provides access to comprehensive features for enhancing your document management process.

-

What features does airSlate SignNow offer in st 200?

In st 200, airSlate SignNow includes features like custom templates, mobile signing, and real-time status tracking of documents. These functionalities help streamline document workflows and enhance collaboration, making it easier for teams to work together efficiently.

-

How does airSlate SignNow ensure the security of documents in st 200?

airSlate SignNow prioritizes the security of your documents in st 200 by employing industry-standard encryption and secure authentication methods. Your sensitive information is protected throughout the signing process, giving you peace of mind while managing electronic documents.

-

Can airSlate SignNow be integrated with other software tools in st 200?

Yes, airSlate SignNow can be easily integrated with a wide range of software applications in st 200, including CRM, accounting, and project management tools. This integration capability allows you to enhance your productivity by connecting various systems and automating workflows.

-

What are the benefits of using airSlate SignNow in st 200 for businesses?

Using airSlate SignNow in st 200 offers multiple benefits, including improved efficiency, reduced turnaround times, and lower operational costs. By streamlining the signing process, businesses can focus on their core activities while ensuring compliance and reducing paper waste.

-

Is it easy to use airSlate SignNow in st 200 for new users?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those who are not tech-savvy. New users in st 200 can quickly learn how to navigate the platform and start sending and signing documents with minimal training required.

Get more for Form ST 200 Utility Sales Tax Exemption Application State

Find out other Form ST 200 Utility Sales Tax Exemption Application State

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit