Indiana Utility Sales Tax Exemption Application Form St 200 2018

What is the Indiana Utility Sales Tax Exemption Application Form St 200

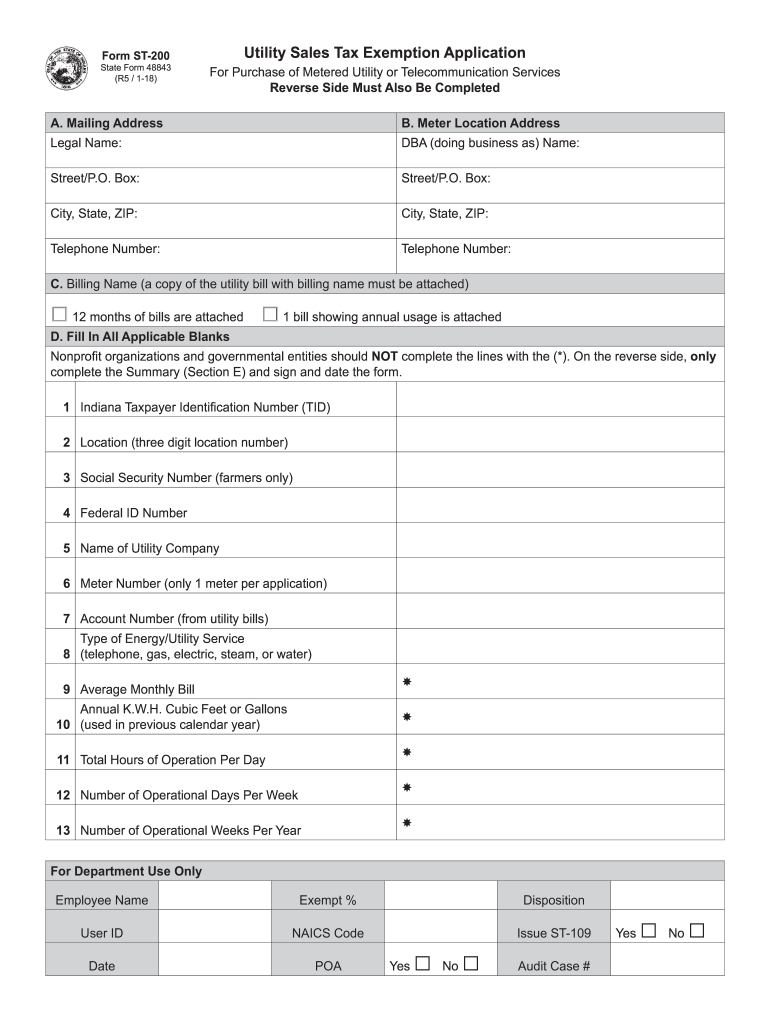

The Indiana Utility Sales Tax Exemption Application Form St 200 is a document designed for businesses and individuals seeking exemption from sales tax on certain utility purchases in the state of Indiana. This form allows eligible entities to apply for tax relief, thereby reducing their overall tax burden. The exemption is particularly relevant for organizations that utilize utilities for manufacturing, processing, or other qualifying activities. Understanding the specific criteria for eligibility is crucial for ensuring compliance and maximizing potential savings.

Steps to Complete the Indiana Utility Sales Tax Exemption Application Form St 200

Completing the Indiana Utility Sales Tax Exemption Application Form St 200 involves several key steps:

- Gather necessary documentation, including proof of eligibility and business identification.

- Fill out the form accurately, ensuring all required fields are completed. This includes providing details about the nature of your business and the utilities for which you are seeking exemption.

- Review the form for accuracy and completeness to avoid delays in processing.

- Submit the form through the appropriate channels, either online or by mail, as specified by the Indiana Department of Revenue.

Following these steps carefully will help facilitate a smooth application process.

Eligibility Criteria for the Indiana Utility Sales Tax Exemption Application Form St 200

To qualify for the Indiana Utility Sales Tax Exemption, applicants must meet specific eligibility criteria. Generally, the following conditions apply:

- The applicant must be a business or organization engaged in manufacturing, processing, or other qualifying activities.

- The utilities for which the exemption is requested must be directly used in the production process.

- Proper documentation must be provided to support the application, demonstrating how the utilities are utilized.

It is essential to review these criteria thoroughly to ensure that your application is valid and stands a good chance of approval.

How to Obtain the Indiana Utility Sales Tax Exemption Application Form St 200

The Indiana Utility Sales Tax Exemption Application Form St 200 can be obtained from the Indiana Department of Revenue's official website. The form is typically available in a downloadable format, allowing users to print and fill it out. Additionally, physical copies may be requested through the department's offices if needed. Ensuring you have the most current version of the form is important for compliance.

Form Submission Methods for the Indiana Utility Sales Tax Exemption Application Form St 200

Applicants have several options for submitting the Indiana Utility Sales Tax Exemption Application Form St 200:

- Online Submission: Many users prefer to submit the form electronically through the Indiana Department of Revenue's online portal, which may expedite processing times.

- Mail: The completed form can be mailed to the designated address provided on the form. Ensure that it is sent well before any deadlines to avoid delays.

- In-Person: Applicants may also choose to deliver the form in person at a local Indiana Department of Revenue office, which allows for immediate confirmation of receipt.

Selecting the most convenient submission method can help ensure a timely review of your application.

Quick guide on how to complete indiana form st 200 2018 2019

Your assistance manual on how to prepare your Indiana Utility Sales Tax Exemption Application Form St 200

If you’re wondering about how to fill out and submit your Indiana Utility Sales Tax Exemption Application Form St 200, here are a few brief guidelines to make tax reporting signNowly simpler.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, generate, and finalize your income tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to adjust details as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and convenient sharing.

Follow these steps to complete your Indiana Utility Sales Tax Exemption Application Form St 200 in just a few minutes:

- Create your account and start editing PDFs in no time.

- Utilize our directory to find any IRS tax document; browse through versions and schedules.

- Click Get form to open your Indiana Utility Sales Tax Exemption Application Form St 200 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save your changes, print a copy, send it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. It’s important to note that submitting a written form can increase return errors and delay refunds. Moreover, before e-filing your taxes, please check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct indiana form st 200 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the indiana form st 200 2018 2019

How to generate an electronic signature for your Indiana Form St 200 2018 2019 online

How to generate an electronic signature for the Indiana Form St 200 2018 2019 in Chrome

How to generate an electronic signature for putting it on the Indiana Form St 200 2018 2019 in Gmail

How to make an electronic signature for the Indiana Form St 200 2018 2019 straight from your mobile device

How to generate an electronic signature for the Indiana Form St 200 2018 2019 on iOS devices

How to create an eSignature for the Indiana Form St 200 2018 2019 on Android OS

People also ask

-

What is the Indiana ST 200 form and why is it important?

The Indiana ST 200 form is a state-specific tax form used for exempting certain purchases from sales tax in Indiana. Understanding this form is crucial for businesses that want to ensure compliance with state tax regulations while maximizing their tax exemptions.

-

How can airSlate SignNow help with the Indiana ST 200 form?

airSlate SignNow offers a streamlined solution for sending, receiving, and eSigning the Indiana ST 200 form. Our platform simplifies the document process, ensuring that you can easily prepare and sign forms without the hassle of paper and physical signatures.

-

Is there a cost associated with using airSlate SignNow for the Indiana ST 200 form?

Yes, airSlate SignNow provides flexible pricing plans to accommodate different business needs. To facilitate the eSigning of the Indiana ST 200 form efficiently, choose a plan that fits your usage and budget requirements.

-

Can I integrate airSlate SignNow into my existing systems for the Indiana ST 200 form?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, making it easy to incorporate our services for handling the Indiana ST 200 form. This ensures a seamless workflow between your current tools and the eSigning process.

-

What are the key features of airSlate SignNow for managing the Indiana ST 200 form?

Key features include customizable templates, secure eSigning, and cloud storage, all tailored to manage the Indiana ST 200 form efficiently. These features enhance collaboration, reduce turnaround time, and ensure that all transactions are legally binding.

-

What benefits does airSlate SignNow provide for handling the Indiana ST 200 form?

Using airSlate SignNow to manage the Indiana ST 200 form offers benefits such as increased efficiency, improved accuracy, and enhanced security. Our solution helps reduce paperwork and ensures all parties can quickly and easily complete necessary transactions online.

-

Is technical support available for using airSlate SignNow with the Indiana ST 200 form?

Yes, airSlate SignNow provides robust customer support, ensuring you have the assistance you need when working with the Indiana ST 200 form. Our support team is available to help troubleshoot any issues or answer questions to enhance your experience.

Get more for Indiana Utility Sales Tax Exemption Application Form St 200

- Passion roadmap form

- Strs verification for employer approved leaves form

- Consent decree of dissolution of marriage form

- Shoulder exam documentation template form

- Air assault packet 100079831 form

- Withdrawal form smu matriculation

- Cs7 request for installation of electricity kwh meter for form

- Form of psa fill and sign printable template online

Find out other Indiana Utility Sales Tax Exemption Application Form St 200

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word