DOR Business Tax in Gov 2020

Understanding the Indiana ST-200 Exemption Form

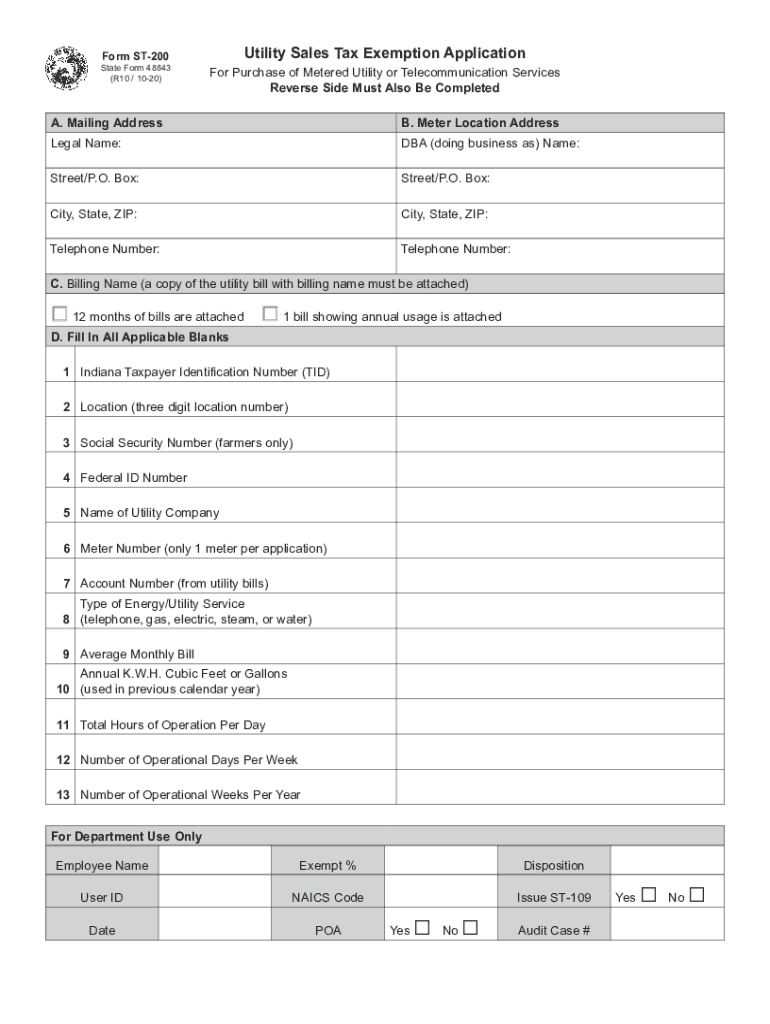

The Indiana ST-200 exemption form is a crucial document for businesses seeking to claim sales tax exemptions in the state of Indiana. This form is primarily used to certify that certain purchases are exempt from sales tax, which can significantly benefit eligible organizations. Understanding its purpose and the types of exemptions available can help businesses save on tax expenses.

Eligibility Criteria for the Indiana ST-200 Exemption Form

To qualify for the Indiana ST-200 exemption form, applicants must meet specific eligibility criteria. Generally, organizations such as non-profits, government entities, and certain types of businesses may qualify. The exemption often applies to purchases made for resale or for specific uses that are exempt under Indiana law. It is essential to review the state guidelines to ensure compliance and eligibility.

Steps to Complete the Indiana ST-200 Exemption Form

Filling out the Indiana ST-200 exemption form involves several key steps. First, gather all required information, including the purchaser's details and the nature of the exemption. Next, accurately complete each section of the form, ensuring that all necessary signatures are included. Finally, submit the form to the vendor or the appropriate authority as required. Attention to detail is crucial to avoid delays or rejections.

Form Submission Methods for the Indiana ST-200

The Indiana ST-200 exemption form can be submitted through various methods, depending on the vendor's preferences. Common submission methods include online submission, mailing a physical copy, or delivering it in person. It is advisable to confirm the preferred method with the vendor to ensure timely processing of the exemption request.

Legal Use of the Indiana ST-200 Exemption Form

The Indiana ST-200 exemption form is legally binding when completed and signed correctly. To ensure its validity, it must comply with state regulations regarding sales tax exemptions. This includes providing accurate information and obtaining the necessary signatures. Businesses should retain a copy of the submitted form for their records, as it may be required for future audits or compliance checks.

Key Elements of the Indiana ST-200 Exemption Form

Several key elements must be included in the Indiana ST-200 exemption form for it to be considered complete. These elements typically include the purchaser's name and address, the vendor's details, a description of the exempt items, and the specific reason for the exemption. Ensuring that all required fields are filled out accurately is vital for the form's acceptance.

Quick guide on how to complete dor business tax ingov

Effortlessly Prepare DOR Business Tax IN gov on Any Device

The management of digital documents has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and eSign your documents quickly without delays. Manage DOR Business Tax IN gov on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign DOR Business Tax IN gov with Ease

- Locate DOR Business Tax IN gov and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign DOR Business Tax IN gov and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dor business tax ingov

Create this form in 5 minutes!

How to create an eSignature for the dor business tax ingov

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is the Indiana ST-200 exemption form?

The Indiana ST-200 exemption form is a document used to claim sales tax exemption for certain purchases in Indiana. It allows eligible entities to avoid paying sales tax on qualifying items, making it an essential form for businesses and organizations in the state.

-

How can airSlate SignNow help with the Indiana ST-200 exemption form?

airSlate SignNow simplifies the process of completing and submitting the Indiana ST-200 exemption form by providing an intuitive platform for eSigning and document management. With our solution, users can quickly fill out the form, sign it electronically, and share it with the relevant parties, ensuring a smooth experience.

-

Is there a cost associated with using airSlate SignNow for the Indiana ST-200 exemption form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. Our affordable plans give you access to features that streamline the completion of the Indiana ST-200 exemption form and other documents, making it a cost-effective solution for your business.

-

What features does airSlate SignNow offer for managing the Indiana ST-200 exemption form?

With airSlate SignNow, you can access features like templates, eSignature capabilities, and document sharing, all designed to enhance your workflow. These features make it easier to manage the Indiana ST-200 exemption form efficiently and ensure your documents are compliant and secure.

-

Can I integrate airSlate SignNow with other applications while using the Indiana ST-200 exemption form?

Yes, airSlate SignNow supports integration with various applications, allowing you to streamline your processes when handling the Indiana ST-200 exemption form. Whether you use CRM systems, cloud storage solutions, or other document management tools, our seamless integrations enhance productivity.

-

What are the benefits of using airSlate SignNow for the Indiana ST-200 exemption form?

Using airSlate SignNow for the Indiana ST-200 exemption form provides numerous benefits, including time savings, improved collaboration, and enhanced security. Our platform ensures that your sensitive information is protected while allowing you to complete forms quickly and efficiently.

-

Is airSlate SignNow user-friendly for new users handling the Indiana ST-200 exemption form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for newcomers to navigate the platform for the Indiana ST-200 exemption form. Our intuitive interface and helpful tutorials ensure that anyone can get started without a steep learning curve.

Get more for DOR Business Tax IN gov

- Order cause regarding form

- Wpf ps 050200 order on show cause regarding contempt judgment orcn washington form

- Motion child support form 497429480

- Washington adjustment 497429481 form

- Notice relocation form

- Wpf drpscu070550 motion declaration for ex parte order to waive requirements for notice of intended relocation of children form

- Ex parte requirements form

- Notice relocation form

Find out other DOR Business Tax IN gov

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement