Form RP 425 B821 Application for Basic STAR Exemption 2021

What is the Form RP 425 B821 Application For Basic STAR Exemption

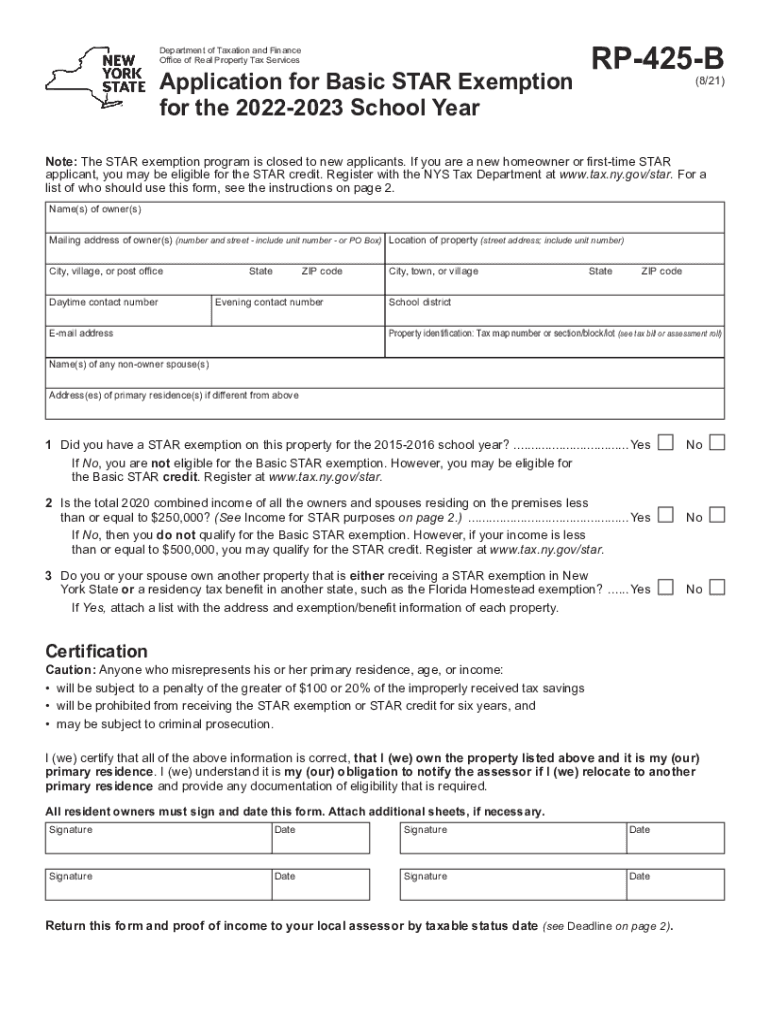

The Form RP 425 B821 is an official application used to apply for the Basic School Tax Relief (STAR) exemption in New York. This exemption is designed to provide property tax relief to eligible homeowners, reducing the amount of school taxes they owe. The form requires specific information about the property and the homeowner, including details such as the property address, owner information, and proof of eligibility. Completing this form correctly is essential to ensure that homeowners receive the tax benefits they qualify for.

Steps to Complete the Form RP 425 B821 Application For Basic STAR Exemption

Completing the Form RP 425 B821 involves several important steps:

- Gather necessary documentation, including proof of ownership and residency.

- Fill out the form with accurate information, ensuring all sections are completed.

- Double-check the form for any errors or missing information.

- Sign and date the application to validate it.

- Submit the form to your local assessor's office by the specified deadline.

Legal Use of the Form RP 425 B821 Application For Basic STAR Exemption

The Form RP 425 B821 is legally binding once submitted and accepted by the local assessor's office. To ensure its validity, it must be filled out in compliance with New York State laws governing property tax exemptions. Homeowners should be aware that providing false information on this form can lead to penalties, including the revocation of the exemption and potential fines.

Eligibility Criteria

To qualify for the Basic STAR exemption using the Form RP 425 B821, applicants must meet specific criteria:

- The property must be the primary residence of the homeowner.

- The homeowner must have a household income below a certain threshold, which is subject to change annually.

- The homeowner must be a resident of New York State.

Required Documents

When completing the Form RP 425 B821, applicants need to provide several documents to support their application:

- Proof of ownership, such as a deed or tax bill.

- Identification, such as a driver's license or state ID.

- Income documentation, if required, to verify eligibility.

Form Submission Methods (Online / Mail / In-Person)

The Form RP 425 B821 can be submitted using various methods, depending on local assessor's office procedures:

- Online submission through the local assessor's office website, if available.

- Mailing the completed form to the appropriate address provided by the local assessor.

- In-person submission at the local assessor's office during business hours.

Quick guide on how to complete form rp 425 b821 application for basic star exemption

Effortlessly Prepare Form RP 425 B821 Application For Basic STAR Exemption on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form RP 425 B821 Application For Basic STAR Exemption on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Form RP 425 B821 Application For Basic STAR Exemption with Ease

- Obtain Form RP 425 B821 Application For Basic STAR Exemption and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form RP 425 B821 Application For Basic STAR Exemption and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 b821 application for basic star exemption

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 b821 application for basic star exemption

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the basic star exemption?

The basic star exemption is a tax benefit available to homeowners in certain jurisdictions, reducing their property tax bills. It is designed to provide financial relief to eligible homeowners by lowering the taxable value of their property. Understanding how the basic star exemption works can help you save money on your taxes.

-

How can airSlate SignNow assist with basic star exemption applications?

AirSlate SignNow streamlines the process of applying for the basic star exemption by allowing you to eSign and send necessary documents quickly. Our user-friendly platform ensures that you can manage your applications from anywhere, making it more efficient. This is especially helpful during peak application periods.

-

Is there a cost associated with using airSlate SignNow for basic star exemption documents?

AirSlate SignNow offers a cost-effective solution for managing your basic star exemption documents. While there may be subscription plans available, the savings from efficiently handling your paperwork can outweigh the costs. We provide different pricing tiers to accommodate various needs, ensuring affordability for all users.

-

What features does airSlate SignNow offer for handling basic star exemption forms?

AirSlate SignNow includes features like customizable templates, secure cloud storage, and electronic signatures, all ideal for managing basic star exemption forms. You can easily track your documents and receive notifications when they are signed. These features enhance the overall efficiency of your application process.

-

Are there any benefits to using airSlate SignNow for my basic star exemption paperwork?

Using airSlate SignNow for basic star exemption paperwork offers numerous benefits, including time savings and enhanced accuracy in document handling. The platform automates many manual processes, reducing the chance of errors. Additionally, your documents are stored securely and accessible at all times.

-

Can airSlate SignNow integrate with other tools for basic star exemption management?

Yes, airSlate SignNow can integrate with various applications and software, making it a complete solution for basic star exemption management. Whether you need to connect with your CRM system or other document management tools, our integrations streamline the entire process. This connectivity enhances productivity and allows for smoother workflow.

-

What support does airSlate SignNow provide for basic star exemption users?

AirSlate SignNow offers comprehensive support for users handling basic star exemption applications. Our customer service team is available to assist with any questions or technical issues you may encounter. We are dedicated to ensuring you have a smooth experience while managing your important documents.

Get more for Form RP 425 B821 Application For Basic STAR Exemption

- Newly divorced individuals package arkansas form

- Arkansas statutory 497296674 form

- Contractors forms package arkansas

- Power of attorney for sale of motor vehicle arkansas form

- Arkansas revocation form

- Agents certification as to the validity of power of attorney and agents authority arkansas form

- Wedding planning or consultant package arkansas form

- Arkansas hunting form

Find out other Form RP 425 B821 Application For Basic STAR Exemption

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer