Form RP 425 B Application for Basic STAR Exemption for the 2025 2026 School Year Revised 724 2024-2026

Understanding the RP-425 B Application for Basic STAR Exemption

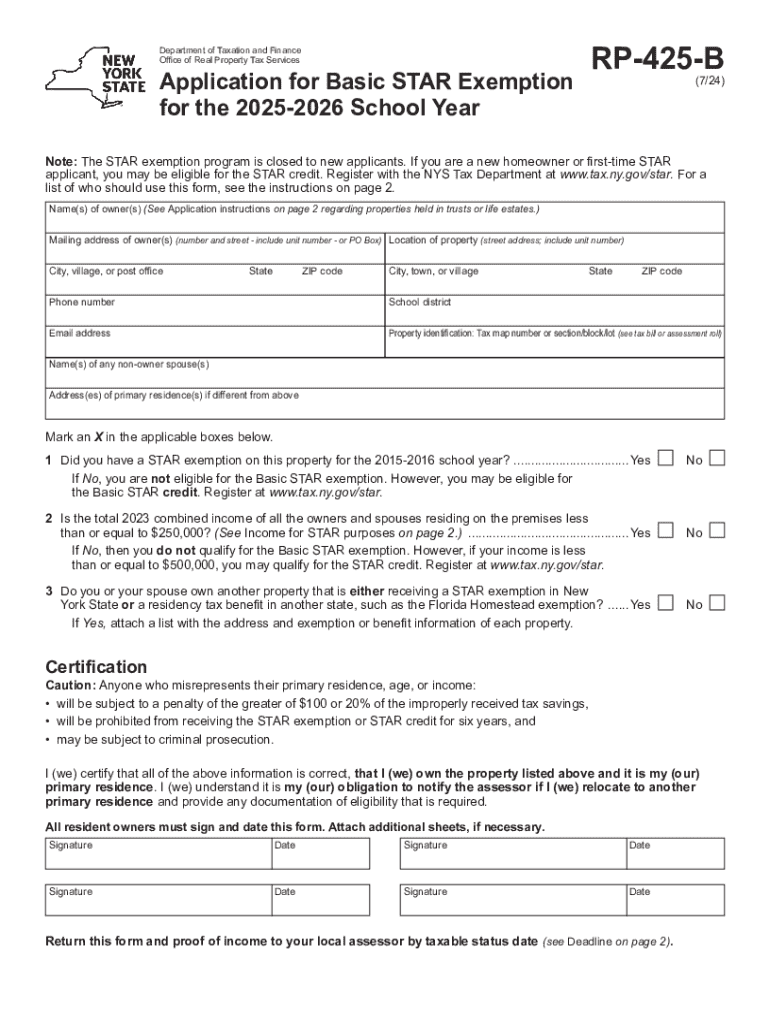

The RP-425 B application is essential for homeowners in New York seeking the Basic STAR exemption for the 2 school year. This exemption provides significant property tax relief to eligible homeowners, making it crucial to understand the form's purpose and requirements. The application is designed to ensure that property owners receive the appropriate tax benefits based on their income and residency status. Homeowners must complete this form accurately to qualify for the exemption, which can lead to substantial savings on their property taxes.

Steps to Complete the RP-425 B Application

Completing the RP-425 B application involves several key steps. First, homeowners should gather necessary documentation, including proof of income and residency. The form requires specific information about the property, including the address and the owner's details. Homeowners must also provide their Social Security numbers and income information to verify eligibility. After filling out the form, it must be submitted to the appropriate local assessor's office by the specified deadline. Ensuring that all information is accurate and complete is vital to avoid delays in processing the application.

Eligibility Criteria for Basic STAR Exemption

To qualify for the Basic STAR exemption in New York, homeowners must meet specific eligibility criteria. Primarily, applicants must own their primary residence and occupy it as their main home. Additionally, the household income must not exceed the threshold set by the state, which is updated annually. It is essential for applicants to check the current income limits to determine their eligibility. Furthermore, the property must be used exclusively for residential purposes, and any co-owners must also meet the eligibility requirements.

Required Documents for the Application

When applying for the Basic STAR exemption using the RP-425 B form, homeowners must provide several documents to support their application. This includes proof of income, such as tax returns or W-2 forms, to demonstrate that they meet the income eligibility criteria. Additionally, applicants should include identification that verifies their residency, such as a driver's license or utility bill. It is advisable to keep copies of all submitted documents for personal records and future reference.

Filing Deadlines for the RP-425 B Application

Homeowners must be aware of the filing deadlines for the RP-425 B application to ensure they receive the Basic STAR exemption. Typically, the application must be submitted by a specific date in the spring, which may vary each year. Missing the deadline could result in the loss of the exemption for that school year. It is important for applicants to check the latest information regarding deadlines and plan accordingly to avoid any issues.

Submission Methods for the RP-425 B Application

The RP-425 B application can be submitted through various methods, providing flexibility for homeowners. Applicants may choose to submit the form online, if their local assessor's office offers this option. Alternatively, they can mail the completed form to the appropriate office or deliver it in person. Each submission method has its own requirements, so homeowners should verify the preferred method with their local assessor to ensure proper processing.

Common Mistakes to Avoid on the RP-425 B Application

When completing the RP-425 B application, homeowners should be mindful of common mistakes that could lead to delays or denial of the exemption. One frequent error is providing incorrect or incomplete information, such as mismatched Social Security numbers or missing income documentation. Failing to sign the application or submit it by the deadline can also result in complications. Homeowners are encouraged to review their applications thoroughly before submission to minimize the risk of errors.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 b application for basic star exemption for the 2025 2026 school year revised 724

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 b application for basic star exemption for the 2025 2026 school year revised 724

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York Basic STAR Exemption?

The New York Basic STAR Exemption is a property tax exemption that provides a reduction in school taxes for eligible homeowners. This exemption is designed to help reduce the financial burden on homeowners in New York, making it easier to manage property expenses.

-

How do I apply for the New York Basic STAR Exemption?

To apply for the New York Basic STAR Exemption, homeowners must complete an application form and submit it to their local assessor's office. It's important to ensure that you meet the eligibility requirements, which include income limits and property ownership criteria.

-

What are the eligibility requirements for the New York Basic STAR Exemption?

Eligibility for the New York Basic STAR Exemption typically requires that the homeowner's income does not exceed a certain threshold, and the property must be the primary residence. Additionally, the homeowner must be the owner of the property and occupy it as their primary residence.

-

How much can I save with the New York Basic STAR Exemption?

The savings from the New York Basic STAR Exemption can vary based on the assessed value of your property and local tax rates. Generally, homeowners can expect to see a signNow reduction in their school property taxes, which can lead to substantial annual savings.

-

Can I combine the New York Basic STAR Exemption with other exemptions?

Yes, homeowners can often combine the New York Basic STAR Exemption with other property tax exemptions, such as the Enhanced STAR Exemption for seniors. It's advisable to check with your local assessor's office to understand how these exemptions can work together to maximize your savings.

-

Is there a deadline for applying for the New York Basic STAR Exemption?

Yes, there is typically a deadline for applying for the New York Basic STAR Exemption, which varies by locality. Homeowners should check with their local assessor's office to ensure they submit their application on time to receive the exemption for the upcoming tax year.

-

How does the New York Basic STAR Exemption affect my property value?

The New York Basic STAR Exemption does not directly affect the assessed value of your property; rather, it reduces the amount of school taxes you owe. However, by lowering your tax burden, it can make your property more attractive to potential buyers.

Get more for Form RP 425 B Application For Basic STAR Exemption For The 2025 2026 School Year Revised 724

Find out other Form RP 425 B Application For Basic STAR Exemption For The 2025 2026 School Year Revised 724

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form