Form RP 425 B Application for Basic STAR Exemption for the 2023 2024 School Year Revised 722 2022

Understanding the RP 425 B Application for Basic STAR Exemption

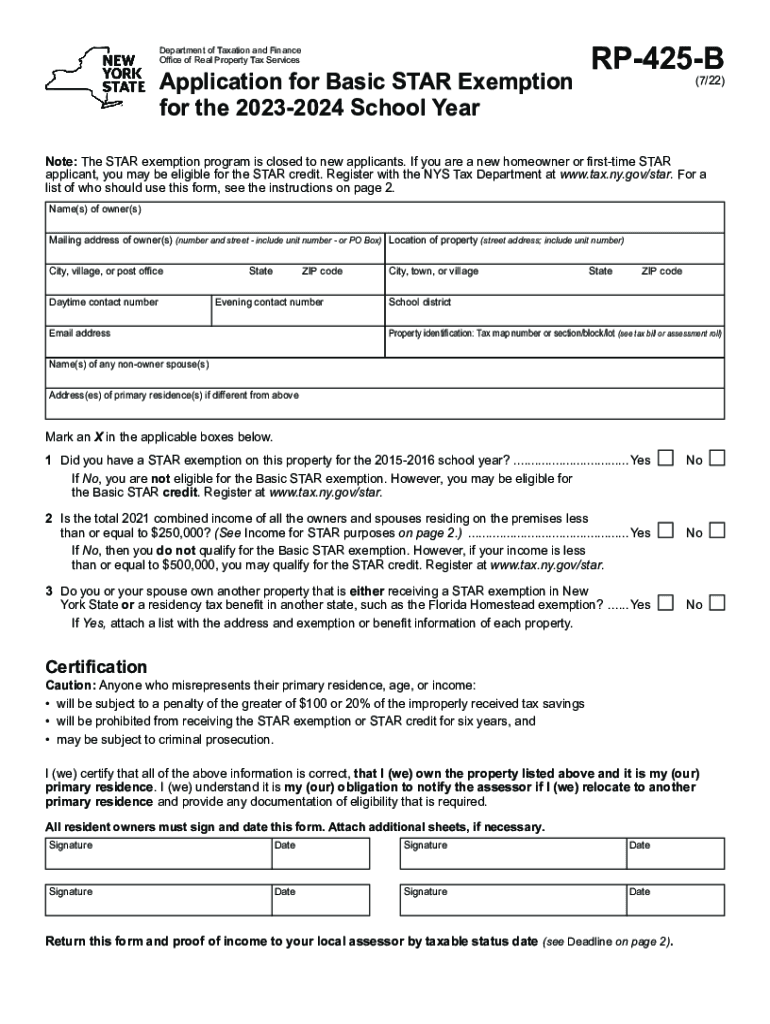

The RP 425 B form is a crucial document for homeowners in New York seeking the Basic School Tax Relief (STAR) exemption for the 2 school year. This exemption provides significant savings on school taxes, making it essential for eligible homeowners to complete this application accurately. The form requires specific information about the property and the homeowner's residency status. Understanding the purpose and requirements of this form is vital for ensuring that homeowners can benefit from the exemption.

Steps to Complete the RP 425 B Application

Completing the RP 425 B form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including property details and personal identification. Next, fill out the form carefully, ensuring that all sections are completed. Pay special attention to the eligibility criteria, as incorrect information can lead to delays or denial of the exemption. Once completed, review the form for any errors before submission. This careful approach helps streamline the application process and increases the likelihood of approval.

Eligibility Criteria for the Basic STAR Exemption

To qualify for the Basic STAR exemption using the RP 425 B form, homeowners must meet specific eligibility criteria. Primarily, the applicant must own the property and occupy it as their primary residence. Additionally, the homeowner's income must fall below a certain threshold, which is adjusted annually. It is important to verify these criteria before applying, as ineligibility can result in the denial of the exemption. Understanding these requirements ensures that applicants are well-informed and prepared when submitting their application.

Required Documents for Submission

When submitting the RP 425 B application, certain documents are necessary to support the application. Homeowners should provide proof of residency, such as a driver's license or utility bill, and any documentation that verifies income if required. Additionally, any previous correspondence regarding STAR exemptions should be included. Having these documents ready not only facilitates a smoother application process but also helps in addressing any potential questions from the reviewing authority.

Form Submission Methods for the RP 425 B

The RP 425 B application can be submitted through various methods, providing flexibility for homeowners. The form can be completed and submitted online through the appropriate state website, mailed directly to the local tax office, or delivered in person. Each method has its benefits, and homeowners should choose the one that best suits their needs and preferences. Ensuring that the form is submitted correctly and on time is essential for receiving the exemption benefits.

Important Filing Deadlines for the RP 425 B

Homeowners must be aware of the important filing deadlines associated with the RP 425 B application. Typically, the application must be submitted by a specific date in the spring to qualify for the exemption for the upcoming school year. Missing this deadline can result in the loss of potential tax savings. It is advisable for homeowners to mark these dates on their calendars and prepare their applications well in advance to avoid any last-minute issues.

Quick guide on how to complete form rp 425 b application for basic star exemption for the 2023 2024 school year revised 722

Complete Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest way to edit and electronically sign Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722 without any hassle

- Locate Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid files, cumbersome form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722 and ensure effective communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 b application for basic star exemption for the 2023 2024 school year revised 722

Create this form in 5 minutes!

People also ask

-

What is the rp 425 sb feature in airSlate SignNow?

The rp 425 sb feature in airSlate SignNow allows users to create and manage legally binding electronic signatures efficiently. This feature is designed to streamline document workflows and improve overall productivity in business operations.

-

How much does airSlate SignNow with rp 425 sb cost?

The pricing for airSlate SignNow with the rp 425 sb feature varies based on your business needs. We offer flexible subscription plans tailored to different user requirements, ensuring that you find a cost-effective solution for your organization.

-

What are the benefits of using rp 425 sb for document management?

Using the rp 425 sb feature enhances your document management processes by providing speed, efficiency, and security. It enables fast eSigning and reduces paper usage, leading to signNow cost savings and a more eco-friendly approach to business practices.

-

Can I integrate rp 425 sb with other software applications?

Yes, airSlate SignNow with rp 425 sb easily integrates with various software applications, including CRM systems and cloud storage services. This seamless integration enhances your existing workflows and increases overall efficiency in managing documents.

-

Is the rp 425 sb feature secure for sending sensitive documents?

Absolutely! The rp 425 sb feature in airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect sensitive information. You can confidently send and sign documents knowing they are safeguarded against unauthorized access.

-

What types of documents can I sign using rp 425 sb?

With the rp 425 sb feature, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes airSlate SignNow an ideal solution for businesses of all sizes looking to manage their documentation effectively.

-

How does rp 425 sb improve the eSigning experience?

The rp 425 sb feature enhances the eSigning experience by providing a user-friendly interface and intuitive navigation. Users can easily upload documents, request signatures, and track the signing process in real-time, all from a single platform.

Get more for Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722

- New jersey will 497319714 form

- Legal last will and testament form for divorced person not remarried with no children new jersey

- Legal last will and testament form for divorced person not remarried with minor children new jersey

- Legal last will and testament form for divorced person not remarried with adult and minor children new jersey

- Mutual wills package with last wills and testaments for married couple with adult children new jersey form

- Mutual wills package with last wills and testaments for married couple with no children new jersey form

- Wills minor children form

- Nj legal will form

Find out other Form RP 425 B Application For Basic STAR Exemption For The 2023 2024 School Year Revised 722

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form