Form RP 425 B Application for Basic STAR Exemption for the 2025 School Year Revised 723 2023

Understanding the RP-425 B Application for Basic STAR Exemption

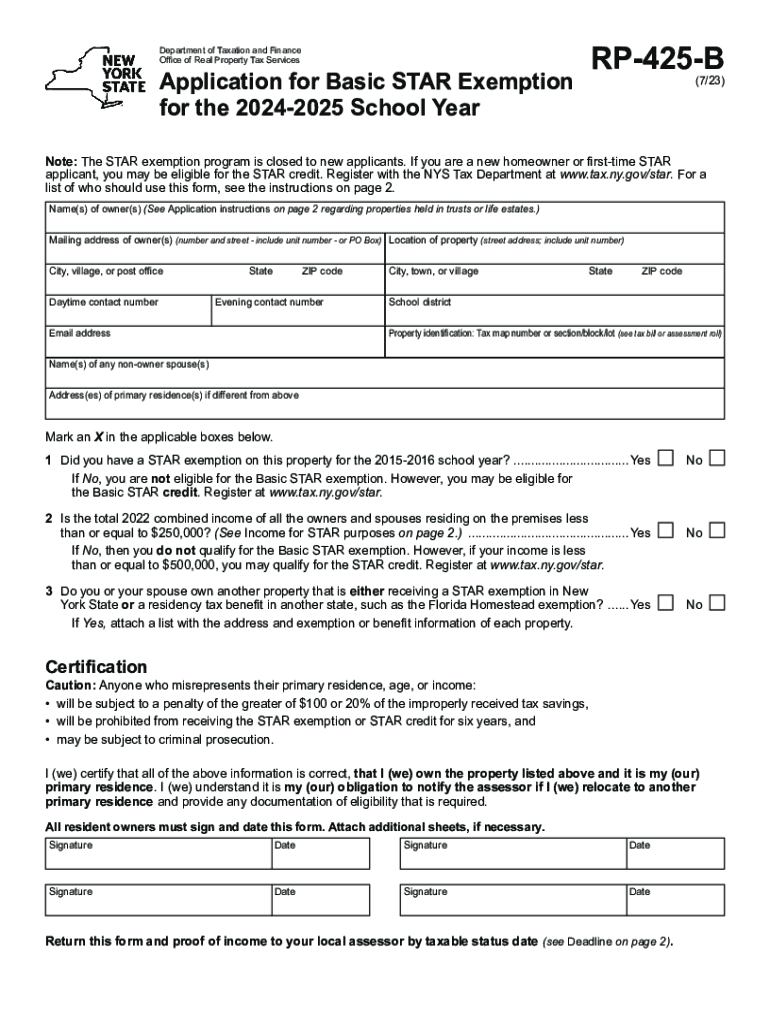

The RP-425 B Application for Basic STAR Exemption is a crucial form for homeowners in New York seeking to benefit from property tax reductions. This exemption is designed for primary residences and provides significant savings on school taxes. To qualify, applicants must meet specific eligibility criteria, including income limits and residency requirements. The application is essential for ensuring that homeowners receive the financial relief they deserve.

Steps to Complete the RP-425 B Application

Completing the RP-425 B Application involves several key steps:

- Gather necessary documents, including proof of income and residency.

- Fill out the application form accurately, ensuring all required information is provided.

- Review the completed application for any errors or omissions.

- Submit the application to the appropriate local tax assessor's office by the designated deadline.

Following these steps carefully can help streamline the process and ensure a successful application.

Eligibility Criteria for the Basic STAR Exemption

To qualify for the Basic STAR exemption, applicants must meet specific criteria, which include:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property.

- Income must not exceed the state-mandated limit, which is adjusted annually.

- All applicants must be U.S. citizens or legal residents.

Understanding these criteria is essential for homeowners looking to take advantage of the Basic STAR exemption.

Required Documents for the RP-425 B Application

When preparing to submit the RP-425 B Application, homeowners need to gather several important documents:

- Proof of income, such as tax returns or W-2 forms.

- Documentation confirming ownership of the property, like a deed.

- Identification verification, which may include a driver's license or state ID.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods for the RP-425 B Application

Homeowners can submit the RP-425 B Application through various methods:

- Online submission through the local tax assessor's website, if available.

- Mailing the completed application to the designated local tax office.

- In-person submission at the local tax assessor's office during business hours.

Choosing the right submission method can help ensure timely processing of the application.

Filing Deadlines for the RP-425 B Application

It is important for applicants to be aware of the filing deadlines for the RP-425 B Application. Typically, applications must be submitted by a specific date each year, often in the spring, to be eligible for the following school year's tax exemption. Staying informed about these deadlines can prevent missed opportunities for tax savings.

Quick guide on how to complete form rp 425 b application for basic star exemption for the 2025 school year revised 723

Complete Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow furnishes you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723 on any device with the airSlate SignNow Android or iOS applications and simplify any document-oriented process today.

The easiest way to edit and eSign Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723 without hassle

- Obtain Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723 and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to preserve your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723 and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rp 425 b application for basic star exemption for the 2025 school year revised 723

Create this form in 5 minutes!

How to create an eSignature for the form rp 425 b application for basic star exemption for the 2025 school year revised 723

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York Basic STAR Exemption?

The New York Basic STAR Exemption is a property tax exemption that reduces the amount of school taxes for eligible homeowners in New York. By applying for this exemption, homeowners can save signNowly on their annual school tax bill. It's important to check eligibility requirements to ensure you can take advantage of the New York Basic STAR Exemption.

-

How does the New York Basic STAR Exemption benefit homeowners?

The New York Basic STAR Exemption allows homeowners to benefit from reduced school property taxes, which can lead to substantial savings over time. These savings can be utilized for other necessary expenses, making the New York Basic STAR Exemption an attractive financial relief for residential property owners. Properly applying for this exemption can enhance your financial situation signNowly.

-

What are the eligibility requirements for the New York Basic STAR Exemption?

To qualify for the New York Basic STAR Exemption, you must own and live in your home, and your income must meet the specified threshold. Generally, the program is designed for primary residences and not for rental properties or vacation homes. Homeowners should check with their local assessors to ensure compliance with the New York Basic STAR Exemption eligibility criteria.

-

How do I apply for the New York Basic STAR Exemption?

To apply for the New York Basic STAR Exemption, you need to complete an application form and submit it to your local assessor’s office. The process may vary by municipality, so it’s essential to follow specific instructions provided by your local jurisdiction. Make sure to gather all necessary documentation to facilitate a smooth application for the New York Basic STAR Exemption.

-

Is there a deadline for applying for the New York Basic STAR Exemption?

Yes, there are specific deadlines to apply for the New York Basic STAR Exemption, which can vary depending on the county or municipality in New York. Typically, the application must be submitted by the first taxable status date of the year to be eligible for that tax year. Always check with your local assessor's office to ensure you meet the deadlines for the New York Basic STAR Exemption.

-

Can I receive the New York Basic STAR Exemption if I have a mortgage?

Yes, homeowners with a mortgage are eligible for the New York Basic STAR Exemption, as long as they meet the other eligibility criteria. The exemption primarily depends on ownership and residency rather than mortgage status. Thus, if you qualify based on the required conditions, you can benefit from the New York Basic STAR Exemption regardless of your mortgage.

-

What happens if I don't apply for the New York Basic STAR Exemption?

If you don’t apply for the New York Basic STAR Exemption, you may miss out on signNow savings on your school property taxes. Homeowners who qualify but do not claim the exemption will end up paying more taxes than necessary. It is highly advised to apply, as the exemption can provide a solid financial benefit to your household.

Get more for Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723

- Reschedule training forms

- Contractors release form

- Hdcp reseller associate agreement digital content protection llc form

- Wh 347 fill in form

- Band booking agreement bandzoogle form

- Move date time moving contract sebastianmovingand form

- Medicare private pay contract marciajwoodphdcom form

- Skill trades rfq template old dominion university odu form

Find out other Form RP 425 B Application For Basic STAR Exemption For The 2025 School Year Revised 723

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now