Www Taxformfinder Orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon for Previously Filed 2021

Understanding the Virginia Form 760 PMT Payment Coupon

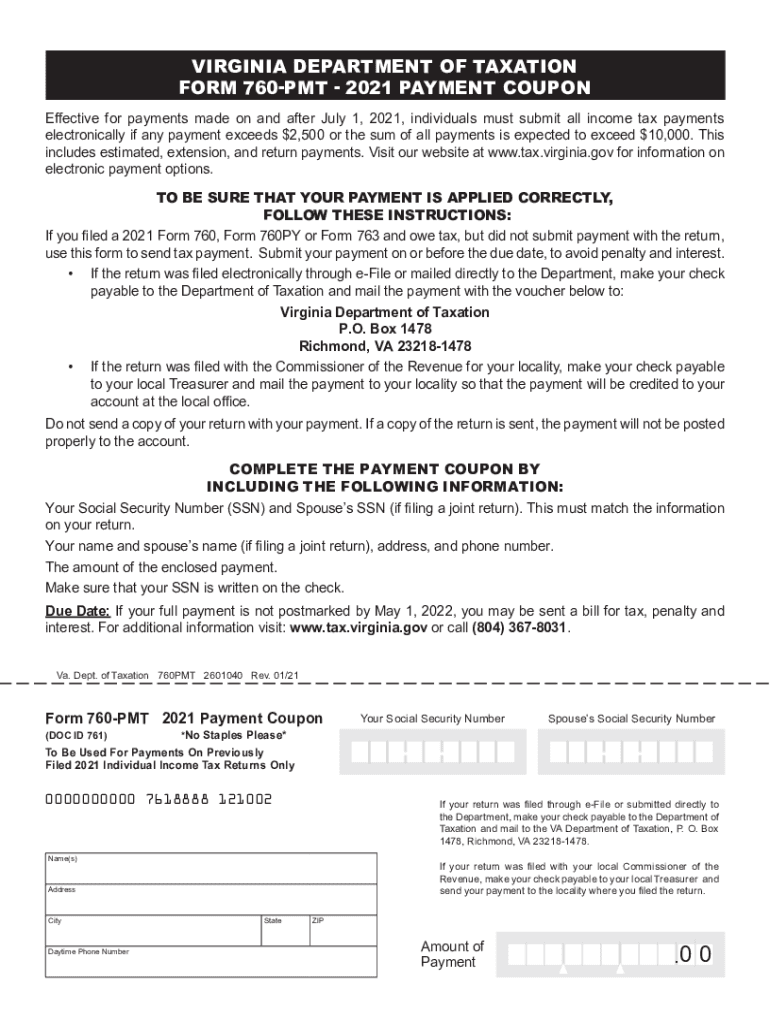

The Virginia Form 760 PMT is a payment coupon used for submitting estimated payments for individual income tax. This form is essential for taxpayers who have previously filed a Virginia income tax return and need to make additional payments. It serves as a convenient method to ensure that tax obligations are met on time, helping to avoid penalties and interest that may accrue from late payments.

Steps to Complete the Virginia Form 760 PMT

Completing the Virginia Form 760 PMT involves several straightforward steps:

- Gather necessary information: Collect your previous tax return details, including your adjusted gross income and any credits or deductions.

- Determine your estimated payment amount: Calculate the amount you owe based on your previous year's tax liability and any changes in your income.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number, along with the payment amount.

- Review your entries: Ensure all information is accurate to prevent delays or issues with processing.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Virginia Form 760 PMT

The Virginia Form 760 PMT is legally recognized as a valid method for making tax payments. To ensure its legal standing, it must be completed accurately and submitted according to the guidelines set by the Virginia Department of Taxation. Compliance with these regulations helps maintain the integrity of your tax filings and protects against potential legal issues.

Filing Deadlines for the Virginia Form 760 PMT

Timely submission of the Virginia Form 760 PMT is crucial to avoid penalties. The payment coupon typically aligns with the state's estimated tax payment schedule, which includes deadlines for quarterly payments. It is important to stay informed about these dates to ensure compliance and avoid unnecessary fees.

Form Submission Methods for Virginia Form 760 PMT

Taxpayers have several options for submitting the Virginia Form 760 PMT:

- Online: Use the Virginia Department of Taxation's online portal for electronic submissions.

- By Mail: Send the completed form to the designated address provided by the Virginia Department of Taxation.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

Key Elements of the Virginia Form 760 PMT

Understanding the key elements of the Virginia Form 760 PMT can help ensure accurate completion:

- Taxpayer Information: Includes name, address, and Social Security number.

- Payment Amount: The total estimated payment due for the current tax year.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Quick guide on how to complete wwwtaxformfinderorgvirginiaform 760pmtvirginia form 760pmt payment coupon for previously filed

Complete Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed with ease

- Find Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or hide sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxformfinderorgvirginiaform 760pmtvirginia form 760pmt payment coupon for previously filed

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgvirginiaform 760pmtvirginia form 760pmt payment coupon for previously filed

How to generate an e-signature for a PDF in the online mode

How to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature right from your smart phone

The best way to create an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF on Android OS

People also ask

-

What is the 760 pmt. feature in airSlate SignNow?

The 760 pmt. feature in airSlate SignNow refers to our pricing plan designed to meet your e-signature needs without breaking the bank. This plan ensures that users can efficiently send and eSign documents while keeping costs predictable and manageable, making it an ideal choice for businesses looking to streamline their processes.

-

How does airSlate SignNow compare with other e-signature solutions in terms of the 760 pmt. pricing?

When comparing e-signature solutions, the 760 pmt. pricing of airSlate SignNow stands out as a cost-effective choice for businesses of all sizes. Our competitive pricing includes rich features that facilitate seamless document signing and provides great value, helping businesses save both time and money.

-

What functionalities does the 760 pmt. plan include?

The 760 pmt. plan provides comprehensive e-signature functionalities, including document templates, real-time tracking, and secure storage. With this plan, you can customize workflows, ensuring that your business operates efficiently while maintaining the highest security standards for your documents.

-

Can I integrate airSlate SignNow with other business tools while on the 760 pmt. plan?

Yes, the 760 pmt. plan offers easy integrations with popular business tools like CRMs, cloud storage services, and project management software. This enhances your productivity, allowing you to manage your documents and workflows from a single platform easily.

-

What are the benefits of using airSlate SignNow's 760 pmt. feature for my business?

Utilizing the 760 pmt. feature can signNowly streamline your document management processes. It empowers your team to send, sign, and store documents electronically, reducing the time spent on administrative tasks and improving overall efficiency while keeping costs in check.

-

Is the 760 pmt. plan suitable for small businesses?

Absolutely! The 760 pmt. plan is tailored for small businesses looking to implement an affordable e-signature solution without compromising on features. With our user-friendly interface and affordable pricing, small businesses can optimize their operations and enhance their document workflows.

-

What kind of customer support can I expect with the 760 pmt. plan?

With the 760 pmt. plan, clients enjoy dedicated customer support to assist with any queries or issues. Our support team is trained to ensure that you have a smooth experience while using airSlate SignNow, helping you maximize the value of your subscription.

Get more for Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed

- Limited power of attorney where you specify powers with sample powers included arkansas form

- Limited power of attorney for stock transactions and corporate powers arkansas form

- Special durable power of attorney for bank account matters arkansas form

- Arkansas small business startup package arkansas form

- Arkansas property management package arkansas form

- Annual minutes corporation form

- Arkansas corporation 497296759 form

- Ar professional corporation form

Find out other Www taxformfinder orgvirginiaform 760pmtVirginia Form 760PMT Payment Coupon For Previously Filed

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter