Virginia Form 760 Instructions ESmart Tax 2022-2026

Understanding the Virginia Form 760

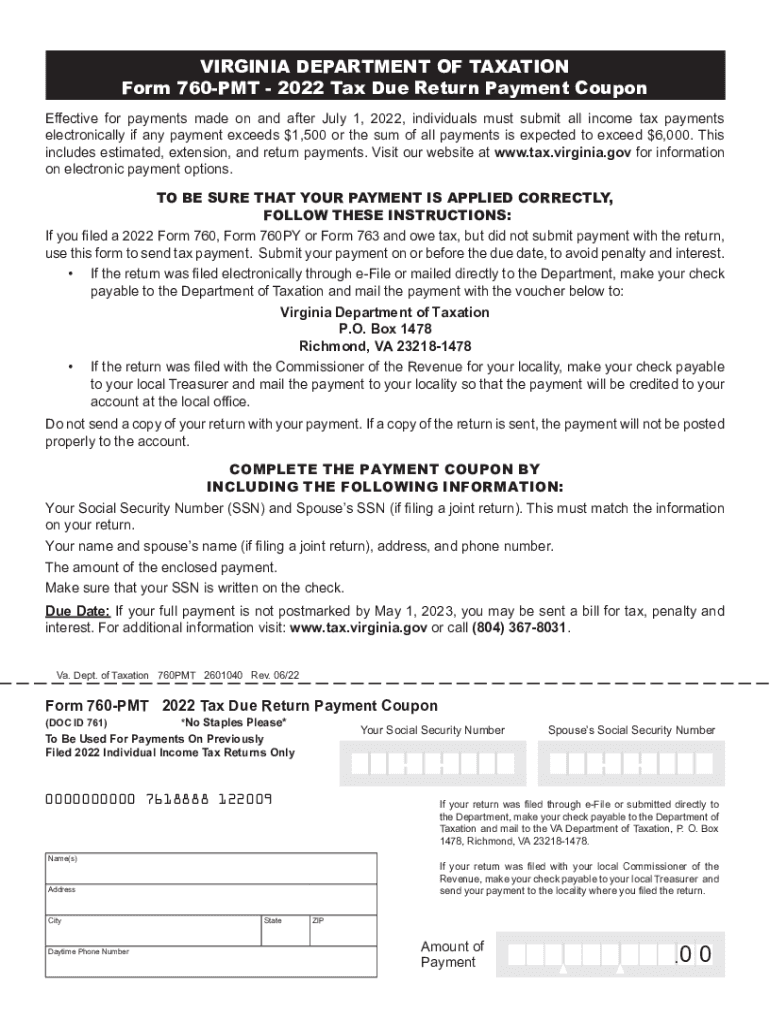

The Virginia Form 760 is a state income tax form used by residents of Virginia to report their income and calculate their tax liability. It is essential for individuals to accurately complete this form to ensure compliance with state tax laws. The form requires detailed information about income sources, deductions, and credits applicable to the taxpayer's situation. Understanding the requirements and instructions for the 760 payment is crucial for a successful filing.

Steps to Complete the Virginia Form 760

Completing the Virginia Form 760 involves several steps that ensure all necessary information is accurately reported. Here are the key steps:

- Gather all required documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, interest, and dividends.

- Claim applicable deductions and credits, such as the standard deduction or itemized deductions.

- Calculate your total tax liability using the provided tax tables or software.

- Review your completed form for accuracy before submitting it.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the Virginia Form 760 to avoid penalties. Typically, the deadline for submitting your 760 payment is May 1 of the year following the tax year. If May 1 falls on a weekend or holiday, the due date is extended to the next business day. Taxpayers are encouraged to file early to ensure they have ample time to address any issues that may arise.

Required Documents for Filing

When preparing to file the Virginia Form 760, certain documents are necessary to support the information reported. These documents include:

- W-2 forms from employers showing wages earned.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest.

Form Submission Methods

The Virginia Form 760 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Virginia Department of Taxation's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated tax offices, if available.

Legal Use of the Virginia Form 760

The Virginia Form 760 is legally binding when completed and submitted according to state regulations. To ensure its legality, taxpayers must adhere to the guidelines set forth by the Virginia Department of Taxation. This includes providing accurate information, maintaining records for potential audits, and meeting submission deadlines. Utilizing electronic tools for eSigning can enhance the legal standing of the submitted form, ensuring compliance with eSignature laws.

Quick guide on how to complete virginia form 760 instructions esmart tax

Effortlessly Prepare Virginia Form 760 Instructions ESmart Tax on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and securely save it in the cloud. airSlate SignNow offers all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Virginia Form 760 Instructions ESmart Tax seamlessly on any operating system with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The Simplest Method to Edit and Electronically Sign Virginia Form 760 Instructions ESmart Tax with Ease

- Find Virginia Form 760 Instructions ESmart Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or hide confidential information using tools specially designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management requirements in a few clicks from any device you prefer. Modify and electronically sign Virginia Form 760 Instructions ESmart Tax and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct virginia form 760 instructions esmart tax

Create this form in 5 minutes!

How to create an eSignature for the virginia form 760 instructions esmart tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 760 payment system in airSlate SignNow?

The 760 payment system in airSlate SignNow refers to the pricing plan that offers businesses a streamlined solution for document signing. With this plan, users can easily manage and eSign documents while enjoying cost-effective pricing. This feature is designed to accommodate businesses of all sizes, ensuring a seamless signing experience.

-

How does the 760 payment plan benefit my business?

The 760 payment plan provides signNow value to businesses by offering a user-friendly platform for document management. It allows businesses to save time and resources by digitizing the signing process, enhancing efficiency. Additionally, this plan is affordable, making it an ideal choice for small to medium-sized enterprises looking to minimize costs.

-

Are there any features included in the 760 payment plan?

Yes, the 760 payment plan includes numerous features that enhance document management. Users gain access to customizable templates, real-time tracking of document status, and secure cloud storage. These features facilitate a smoother workflow and ensure that all documents are safely stored and easily accessible.

-

Can I integrate the 760 payment solution with other software?

Absolutely! The 760 payment solution by airSlate SignNow is designed to integrate seamlessly with various software applications. Whether you use CRM systems, project management tools, or cloud storage services, you can easily connect and synchronize your workflows. This integration capability ensures that your document management process is more efficient.

-

Is the 760 payment plan suitable for small businesses?

Yes, the 760 payment plan is specifically tailored to suit small businesses looking for cost-effective solutions. It provides essential features at an affordable price, allowing small enterprises to leverage digital signing without breaking the bank. This plan is designed to support the growth and efficiency of smaller operations.

-

What types of documents can I eSign with the 760 payment plan?

With the 760 payment plan, you can eSign a wide variety of documents, including contracts, agreements, and forms. This flexibility ensures that businesses can quickly and securely manage all their signing needs in one place. Whether for internal approvals or client agreements, the 760 payment plan has you covered.

-

How does the security of the 760 payment solution work?

Security is a top priority with the 760 payment solution from airSlate SignNow. The platform employs advanced encryption protocols to protect your documents and personal information. Additionally, it offers user authentication features ensuring that only authorized individuals can access and sign the documents.

Get more for Virginia Form 760 Instructions ESmart Tax

Find out other Virginia Form 760 Instructions ESmart Tax

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT