Form VA 5 Employers Monthly Return of Virginia Income Tax 2021-2026

What is the VA 5 Employers Monthly Return Of Virginia Income Tax

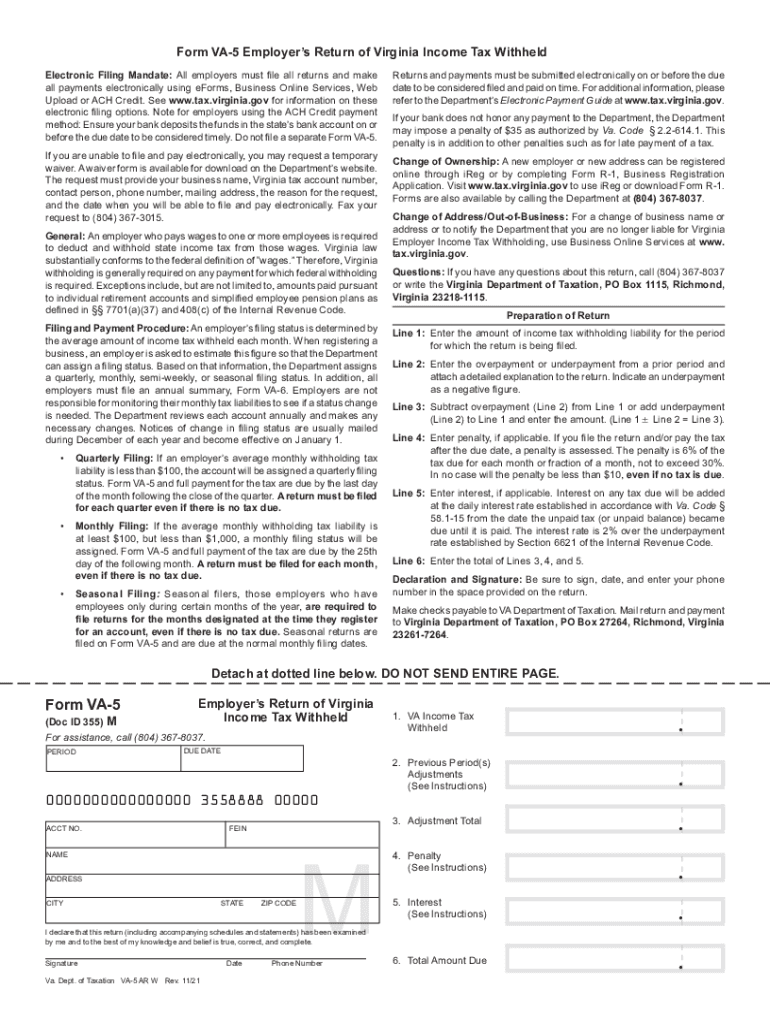

The VA 5 form, officially known as the Employers Monthly Return Of Virginia Income Tax, is a crucial document that employers in Virginia must submit to report and remit state income tax withheld from employees' wages. This form is essential for maintaining compliance with Virginia tax laws and ensures that the state receives the appropriate tax revenue from employers on a monthly basis. The VA 5 form is specifically designed for employers who withhold income tax from their employees' paychecks, making it a key component of the state's tax collection system.

Steps to complete the VA 5 Employers Monthly Return Of Virginia Income Tax

Completing the VA 5 form involves several important steps to ensure accuracy and compliance. First, employers need to gather all necessary payroll information for the month, including total wages paid and the amount of income tax withheld. Next, employers should accurately fill out each section of the form, ensuring that all figures are correct and match the payroll records. After completing the form, employers must review it for any errors before submitting it. Finally, the completed VA 5 form must be submitted to the Virginia Department of Taxation by the specified deadline, along with any taxes owed.

Legal use of the VA 5 Employers Monthly Return Of Virginia Income Tax

The VA 5 form is legally binding and must be completed in accordance with Virginia state tax laws. Employers are required to file this form monthly to report the income tax withheld from employee wages. Failure to file the VA 5 form or inaccuracies in reporting can lead to penalties and interest charges. It is essential for employers to understand their legal obligations regarding this form to avoid any compliance issues. The form serves as a record of tax payments and is subject to review by state tax authorities.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the VA 5 form to avoid penalties. The form is due on the 15th day of the month following the reporting month. For example, the VA 5 form for January must be submitted by February 15. It is important for employers to mark these deadlines on their calendars to ensure timely submission and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The VA 5 form can be submitted through various methods to accommodate employers' preferences. Employers can file the form online through the Virginia Department of Taxation's website, which provides a secure and efficient way to submit tax information. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the state. In-person submissions are also accepted at designated tax offices. Each submission method has its own advantages, and employers should choose the one that best suits their needs.

Penalties for Non-Compliance

Non-compliance with the VA 5 filing requirements can result in significant penalties for employers. These penalties may include late fees, interest on unpaid taxes, and potential legal action from the state. It is crucial for employers to understand the importance of timely and accurate submissions to avoid these consequences. Regularly reviewing payroll processes and ensuring compliance with filing deadlines can help mitigate the risk of penalties.

Quick guide on how to complete form va 5 employers monthly return of virginia income tax

Complete Form VA 5 Employers Monthly Return Of Virginia Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form VA 5 Employers Monthly Return Of Virginia Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form VA 5 Employers Monthly Return Of Virginia Income Tax with ease

- Obtain Form VA 5 Employers Monthly Return Of Virginia Income Tax and click Get Form to get started.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using features that airSlate SignNow provides specifically for that purpose.

- Craft your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form VA 5 Employers Monthly Return Of Virginia Income Tax and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form va 5 employers monthly return of virginia income tax

Create this form in 5 minutes!

How to create an eSignature for the form va 5 employers monthly return of virginia income tax

How to generate an e-signature for your PDF file online

How to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an e-signature for a PDF document on Android devices

People also ask

-

What is va 5 in the context of airSlate SignNow?

Va 5 refers to a specific feature within airSlate SignNow that enhances document management by allowing users to easily send and eSign documents. This feature is designed to improve workflow efficiency and ensure secure document handling for businesses of all sizes.

-

How does the pricing for the va 5 feature work?

The pricing for the va 5 feature in airSlate SignNow is structured to be cost-effective, offering various plans that accommodate different business needs. You can choose a plan based on the frequency of document signing and the number of users, ensuring you only pay for what you need.

-

What are the key benefits of using va 5 for document signing?

Using va 5 for document signing offers numerous benefits, including a streamlined process for sending and receiving documents, enhanced security with encrypted signatures, and compliance with legal standards. This feature helps businesses save time and reduce paperwork while improving overall organization.

-

Can va 5 integrate with other software platforms?

Yes, va 5 seamlessly integrates with various software platforms such as CRM systems and cloud storage services. This integration allows users to enhance their document workflows and access signed documents from multiple sources without hassle.

-

How secure is the va 5 feature for handling sensitive documents?

The va 5 feature in airSlate SignNow emphasizes security by employing encryption for all signed documents and implementing strict access controls. This ensures that sensitive data remains protected throughout the signing process, giving businesses peace of mind.

-

Is there a mobile version of the va 5 feature available?

Absolutely, the va 5 feature is accessible via mobile devices, allowing users to send and eSign documents on-the-go. This mobile-friendly option ensures that business processes continue uninterrupted, regardless of location.

-

What types of documents can be signed using va 5?

Va 5 supports a variety of document types, including contracts, NDAs, and agreements, enabling users to manage diverse signing needs. This versatility makes airSlate SignNow a valuable tool for businesses across multiple industries.

Get more for Form VA 5 Employers Monthly Return Of Virginia Income Tax

- Notice to beneficiaries of being named in will arkansas form

- Estate planning questionnaire and worksheets arkansas form

- Document locator and personal information package including burial information form arkansas

- Demand to produce copy of will from heir to executor or person in possession of will arkansas form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497296814 form

- Az odometer statement form

- Bill of sale for automobile or vehicle including odometer statement and promissory note arizona form

- Promissory note in connection with sale of vehicle or automobile arizona form

Find out other Form VA 5 Employers Monthly Return Of Virginia Income Tax

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement