Va5 Form 2015

What is the Va5 Form

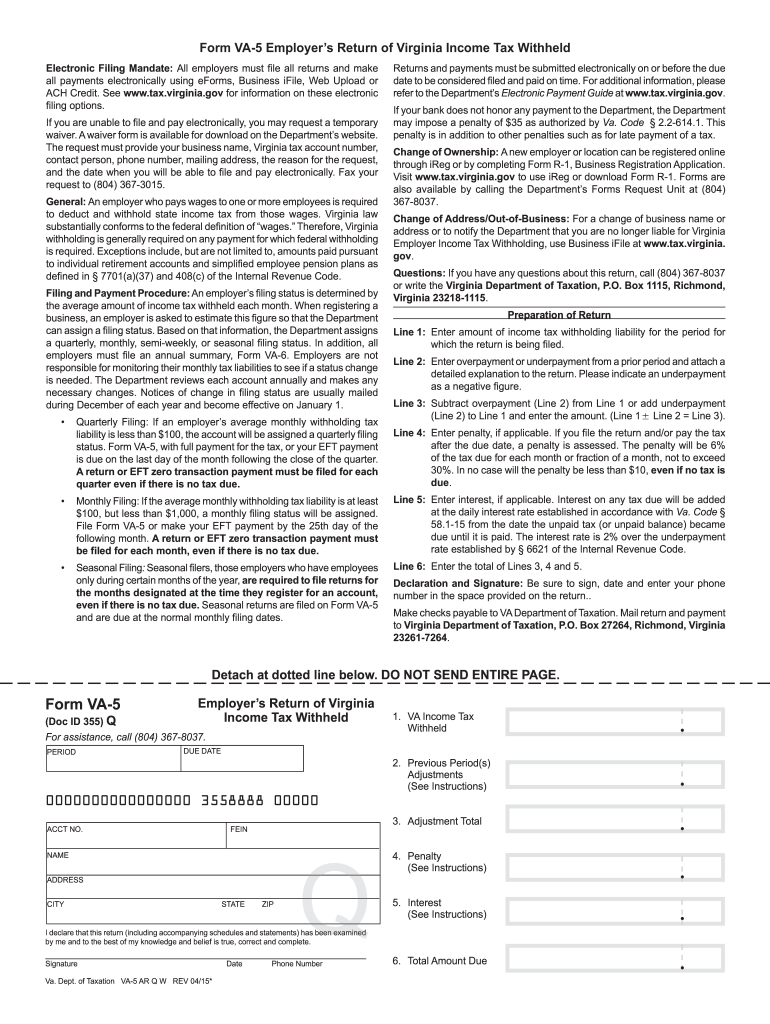

The Va5 form, officially known as the Virginia Department of Taxation Form Va5, is a tax document used primarily for reporting and remitting state income tax withholdings. This form is essential for employers in Virginia who need to report the amount of state income tax withheld from employees' wages. The Va5 form plays a critical role in ensuring compliance with state tax laws and helps maintain accurate records for both employers and the Virginia Department of Taxation.

Steps to Complete the Va5 Form

Completing the Va5 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the employer's identification number, employee details, and the total amount of state income tax withheld. Next, accurately fill in the required fields on the form, ensuring that all figures are correct. After completing the form, review it thoroughly for any errors. Finally, submit the Va5 form according to the filing instructions provided by the Virginia Department of Taxation, either online or via mail.

How to Obtain the Va5 Form

The Va5 form can be obtained directly from the Virginia Department of Taxation's official website. It is available in a downloadable format, allowing users to print and fill it out manually. Additionally, employers may find the form through tax preparation software that supports Virginia state tax filings. It is important to ensure that you have the most current version of the form to comply with any updates in tax regulations.

Legal Use of the Va5 Form

The legal use of the Va5 form is governed by Virginia state tax laws. Employers are required to use this form to report state income tax withholdings accurately. Failure to use the Va5 form correctly can result in penalties, including fines or interest on unpaid taxes. It is essential for employers to understand their obligations under state law and to ensure that the form is completed and submitted in a timely manner to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Va5 form are crucial for compliance with Virginia tax regulations. Typically, employers must submit the form on a quarterly basis, with specific due dates set by the Virginia Department of Taxation. It is important for employers to keep track of these deadlines to avoid late fees and penalties. Marking these dates on a calendar can help ensure timely submissions and maintain good standing with state tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The Va5 form can be submitted through various methods, offering flexibility for employers. The online submission option is available through the Virginia Department of Taxation's e-filing system, which provides a secure and efficient way to file. Alternatively, employers may choose to mail the completed form to the appropriate address provided by the department. In-person submissions may also be possible at designated tax offices, depending on local regulations and practices.

Quick guide on how to complete va 5 2015 2019 form

Your assistance manual on preparing your Va5 Form

If you're wondering how to finalize and send your Va5 Form, here are a few straightforward tips to ease the process of tax filing.

First, simply establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, prepare, and finalize your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and return to edit details as necessary. Streamline your tax administration with cutting-edge PDF editing, eSigning, and user-friendly sharing options.

Follow the instructions below to finalize your Va5 Form in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through different versions and schedules.

- Click Obtain form to open your Va5 Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Save modifications, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Remember that filing on paper can lead to increased mistakes and prolonged refunds. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct va 5 2015 2019 form

FAQs

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

-

Can I use the board best 5 subject marks out of 6 subjects in filling the JEE Main form 2019?

No, you can not. While filling form a question mark in front of marks box will tell you which subjects to consider for percentage. Generally you will have to consider marks of Maths, physics, Chemistry, english and any one of additional subjects.

Create this form in 5 minutes!

How to create an eSignature for the va 5 2015 2019 form

How to create an electronic signature for the Va 5 2015 2019 Form online

How to make an eSignature for the Va 5 2015 2019 Form in Google Chrome

How to generate an eSignature for signing the Va 5 2015 2019 Form in Gmail

How to make an eSignature for the Va 5 2015 2019 Form straight from your mobile device

How to generate an electronic signature for the Va 5 2015 2019 Form on iOS

How to make an electronic signature for the Va 5 2015 2019 Form on Android devices

People also ask

-

What is 'va va 5' and how does it relate to airSlate SignNow?

'Va va 5' refers to an innovative strategy that combines the features of airSlate SignNow for streamlining document signing processes. With airSlate SignNow, businesses can utilize 'va va 5' to enhance efficiency in their workflows, making document management seamless and intuitive.

-

How does pricing work for using airSlate SignNow with 'va va 5'?

The pricing for airSlate SignNow, with its 'va va 5' integrations, is competitive and offers various tiers depending on business needs. Whether you are a small business or a large enterprise, there’s a suitable plan that leverages 'va va 5' functionalities to ensure cost-effective solutions for eSigning documents.

-

What features does airSlate SignNow offer related to 'va va 5'?

airSlate SignNow includes a range of features that complement the 'va va 5' approach, such as customizable templates, advanced security protocols, and automated workflows. These features are designed to make eSigning documents not just quick, but also secure and compliant with industry standards.

-

What are the benefits of using airSlate SignNow with 'va va 5'?

Using airSlate SignNow with 'va va 5' offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. This integration means that businesses can focus on their core operations while using 'va va 5' to ensure documents are processed swiftly and accurately.

-

Can airSlate SignNow integrate with other platforms if I want to use 'va va 5'?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms that can enhance the 'va va 5' experience. By leveraging integrations with CRMs, cloud storage, and other tools, you can ensure that your eSigning process is synchronized and efficient.

-

Is there customer support available for 'va va 5' users of airSlate SignNow?

Absolutely! airSlate SignNow provides extensive customer support for all users, including those utilizing the 'va va 5' method. Whether you need assistance with technical issues or guidance on best practices, our support team is here to help.

-

Are there any tutorials or resources on using 'va va 5' with airSlate SignNow?

Yes, airSlate SignNow offers a wealth of resources, including tutorials and guides, specifically designed to help users implement 'va va 5' effectively. These resources are aimed at empowering users to maximize their document signing efficiency.

Get more for Va5 Form

- Report of physician if you are receiving a disability benefit this form is used to compile specific medical information in

- Follow up patient questionnaire for comprehensive spine center at newport hospital comprehensive spine center at newport form

- Autism spectrum disorder asd treatment request form providers select health of south carolina autism spectrum disorder asd

- Behavioral health and substance use disorder outpatient treatment notification form child and adolescent ages 17 and under

- Com group employee and individual application and enrollment form 1 100 employees florida the offering companyies listed below

- Beneficiary travel waiver of deductibles worksheet va health care eligibility amp enrollment beneficiary travel waiver of form

- Va form 0927b national veterans tee tournament participant registration application 0927b national veterans tee tournament

- Va ny harbor healthcare system conditions of temporary appointment memo va ny harbor healthcare system conditions of temporary form

Find out other Va5 Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement