WW12858 Detroit Tax 12516 102 PM Page 1 2016-2026

Understanding the D941 501 Form in Detroit

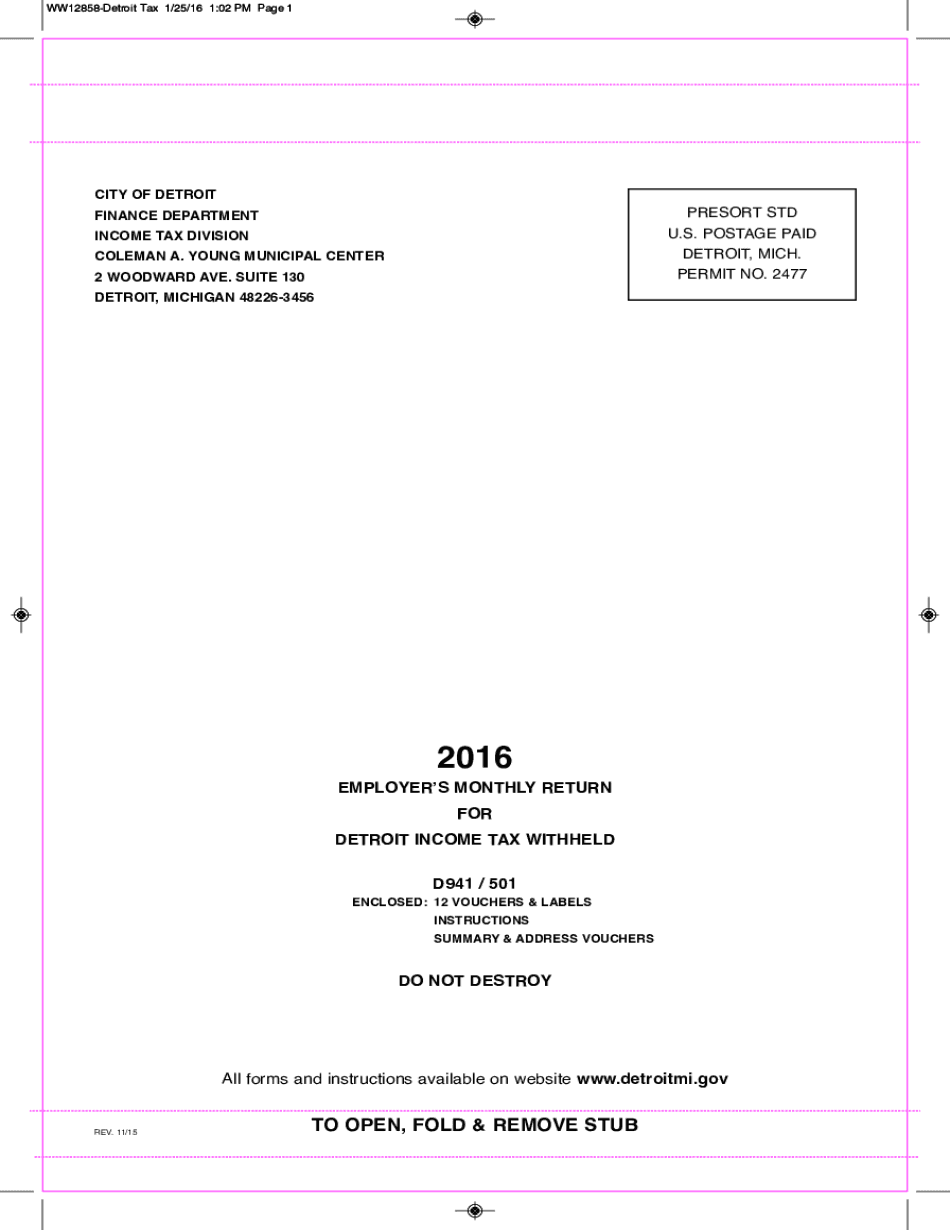

The D941 501 form is a crucial document for residents and businesses in the City of Detroit. It is primarily used for tax purposes, specifically related to withholding tax filings. This form is essential for ensuring compliance with local tax regulations and helps in accurately reporting income and tax withheld from employees. Understanding its purpose and requirements is vital for both individuals and businesses operating within the city.

Steps to Complete the D941 501 Form

Completing the D941 501 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your business details, employee information, and tax identification number.

- Fill out the form accurately, ensuring all fields are completed, including income details and withholding amounts.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and compliance requirements.

Filing Deadlines for the D941 501 Form

It is important to be aware of the filing deadlines associated with the D941 501 form. Typically, this form must be submitted on a quarterly basis. The deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Missing these deadlines can result in penalties, so timely submission is crucial.

Legal Use of the D941 501 Form

The D941 501 form is legally binding when completed correctly and submitted on time. It serves as an official record of tax withholding and is essential for both compliance and audit purposes. To ensure its legal standing, it is recommended to use a reliable electronic signature solution, which can provide a digital certificate and maintain compliance with relevant laws.

Required Documents for the D941 501 Form

When preparing to complete the D941 501 form, certain documents are required to ensure accuracy and compliance:

- Employer Identification Number (EIN)

- Employee information, including names and Social Security numbers

- Records of wages paid and taxes withheld

- Previous tax filings for reference

Having these documents ready will streamline the completion process and help avoid errors.

Form Submission Methods

The D941 501 form can be submitted through various methods, allowing flexibility for users:

- Online Submission: Many businesses prefer to file electronically for speed and convenience.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some may choose to deliver the form directly to local tax offices.

Choosing the right submission method can depend on personal preference and the specific requirements of the City of Detroit.

Quick guide on how to complete ww12858 detroit tax 12516 102 pm page 1

Complete WW12858 Detroit Tax 12516 102 PM Page 1 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without delays. Manage WW12858 Detroit Tax 12516 102 PM Page 1 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign WW12858 Detroit Tax 12516 102 PM Page 1 easily

- Locate WW12858 Detroit Tax 12516 102 PM Page 1 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign WW12858 Detroit Tax 12516 102 PM Page 1 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ww12858 detroit tax 12516 102 pm page 1

Create this form in 5 minutes!

How to create an eSignature for the ww12858 detroit tax 12516 102 pm page 1

The way to generate an e-signature for your PDF online

The way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an e-signature for a PDF document on Android

People also ask

-

What is the fws form 3 2369 and why is it important?

The fws form 3 2369 is a crucial document used for various administrative purposes. It ensures compliance with federal regulations and streamlines the workflow for businesses. Understanding its significance can help organizations manage their processes effectively.

-

How can airSlate SignNow help in managing the fws form 3 2369?

airSlate SignNow offers a seamless way to send, receive, and eSign the fws form 3 2369 electronically. This signNowly reduces the time spent on paperwork and enhances efficiency. Additionally, it ensures that your documents are securely stored and easily accessible.

-

What features does airSlate SignNow provide for fws form 3 2369 processing?

With airSlate SignNow, you can edit, sign, and share the fws form 3 2369 with just a few clicks. The platform includes custom templates, automated workflows, and reminders for document status, making it easier to manage your paperwork. These features enhance collaboration and improve turnaround times.

-

Is there a cost associated with using airSlate SignNow for the fws form 3 2369?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on the selected plan, you can access features specifically designed for the fws form 3 2369 and other documents. This ensures you get the best value for your investment.

-

Can airSlate SignNow integrate with other software for managing fws form 3 2369?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and Microsoft Office. These integrations help you streamline the management of the fws form 3 2369 and other documents directly from the applications you already use.

-

What are the benefits of eSigning the fws form 3 2369 with airSlate SignNow?

eSigning the fws form 3 2369 through airSlate SignNow provides instant verification and legally binding signatures. This process saves time and reduces physical paperwork, which can enhance productivity. It also provides an audit trail, ensuring all changes are documented.

-

How secure is the airSlate SignNow platform for handling fws form 3 2369?

airSlate SignNow prioritizes document security, employing advanced encryption methods to protect your data. When handling the fws form 3 2369, you can trust that your information is safeguarded against unauthorized access. Additionally, the platform is compliant with regulatory standards.

Get more for WW12858 Detroit Tax 12516 102 PM Page 1

- Ca lease 497298595 form

- Warning notice due to complaint from neighbors california form

- Lease subordination agreement california form

- Ca regulations form

- Cancellation lease agreement form

- Amendment of residential lease california form

- Agreement for payment of unpaid rent california form

- Commercial lease transfer agreement sample form

Find out other WW12858 Detroit Tax 12516 102 PM Page 1

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast