Www Tax Ny GovpdfcurrentformsForm NYC 210 Claim for New York City School Tax Credit Tax 2021

What is the NYC 210 form 2021?

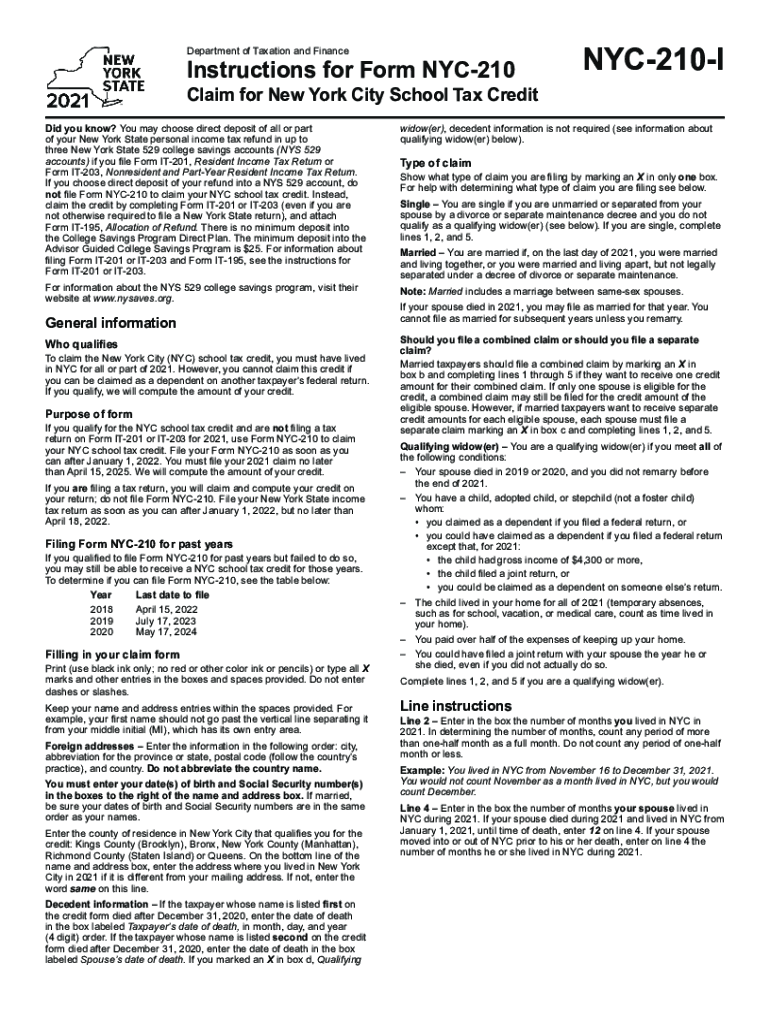

The NYC 210 form 2021, officially known as the Claim for New York City School Tax Credit, is a tax form that allows eligible residents of New York City to claim a credit on their tax returns. This credit is designed to provide financial relief to homeowners and renters who pay school taxes. Understanding this form is essential for anyone looking to benefit from the tax credit, as it outlines the eligibility criteria and the necessary steps for submission.

Steps to complete the NYC 210 form 2021

Filling out the NYC 210 form 2021 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of residency and any relevant tax information. Next, carefully fill out the form, ensuring that all sections are completed correctly. Pay particular attention to the eligibility requirements, as these will determine your ability to claim the credit. Once the form is completed, review it for errors before submitting it either online or by mail.

Eligibility Criteria for the NYC 210 form 2021

To qualify for the NYC 210 form 2021, applicants must meet specific eligibility criteria. Generally, this includes being a resident of New York City and having a valid tax identification number. Homeowners must have paid property taxes, while renters must provide proof of rent payments. Additionally, income limits may apply, which can affect the amount of credit available. It is important to review these criteria thoroughly to ensure compliance and maximize potential benefits.

Required Documents for the NYC 210 form 2021

When preparing to file the NYC 210 form 2021, certain documents are required to support your claim. These may include:

- Proof of residency, such as a utility bill or lease agreement.

- Tax identification number, typically your Social Security number or Employer Identification Number.

- Documentation of property taxes paid, if applicable.

- Proof of rent payments, if claiming as a renter.

Having these documents ready will streamline the application process and help avoid delays.

Form Submission Methods for the NYC 210 form 2021

The NYC 210 form 2021 can be submitted through various methods, allowing for flexibility based on individual preferences. Applicants can choose to file online through the official tax website, which often provides a faster processing time. Alternatively, the form can be mailed to the designated tax office or submitted in person at local tax offices. Each method has its own set of guidelines, so it is advisable to review these before proceeding with submission.

Legal use of the NYC 210 form 2021

The NYC 210 form 2021 is legally recognized for claiming the New York City School Tax Credit, provided that all guidelines and requirements are met. It is important to ensure that the information provided is accurate and truthful to avoid potential penalties or legal issues. The form must be completed in accordance with state and local tax laws, which govern its use and the eligibility for the tax credit.

Quick guide on how to complete wwwtaxnygovpdfcurrentformsform nyc 210 claim for new york city school tax credit tax

Accomplish Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax effortlessly on any device

Online document management has gained signNow popularity among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax with ease

- Find Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to share your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwtaxnygovpdfcurrentformsform nyc 210 claim for new york city school tax credit tax

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxnygovpdfcurrentformsform nyc 210 claim for new york city school tax credit tax

How to create an e-signature for your PDF file in the online mode

How to create an e-signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

How to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an e-signature for a PDF file on Android

People also ask

-

What is the NYC 210 form 2021?

The NYC 210 form 2021 is a tax form used by individuals to report their income and calculate their tax liabilities in New York City. This form is essential for ensuring compliance with local tax regulations and helps to streamline the filing process.

-

How can airSlate SignNow help with the NYC 210 form 2021?

airSlate SignNow simplifies the process of preparing and eSigning the NYC 210 form 2021 by providing an intuitive platform for document management. With our electronic signature solution, you can easily prepare and send this form securely, ensuring timely submission.

-

What are the pricing options for using airSlate SignNow for the NYC 210 form 2021?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you're an individual or a corporation, our subscription options include features suitable for efficiently managing forms like the NYC 210 form 2021 at an affordable cost.

-

Is it easy to eSign the NYC 210 form 2021 using airSlate SignNow?

Yes, eSigning the NYC 210 form 2021 with airSlate SignNow is user-friendly and straightforward. Our platform guides you through the signing process, allowing you to complete documents quickly and securely from any device.

-

Does airSlate SignNow ensure compliance for the NYC 210 form 2021?

airSlate SignNow is designed to help you stay compliant with legal and regulatory requirements when filling out the NYC 210 form 2021. Our platform uses encryption and robust security measures to ensure that your documents are safe and valid.

-

Can I integrate airSlate SignNow with other tools for managing the NYC 210 form 2021?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your NYC 210 form 2021 within existing workflows. This makes it easy to streamline data entry and document handling across platforms.

-

What features does airSlate SignNow offer for the NYC 210 form 2021?

airSlate SignNow offers a suite of features designed for the NYC 210 form 2021, including electronic signatures, document templates, and automated workflows. These tools help you save time and reduce errors while managing your tax documentation.

Get more for Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax

Find out other Www tax ny govpdfcurrentformsForm NYC 210 Claim For New York City School Tax Credit Tax

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation