Nyc 210 Form 2019

What is the Nyc 210 Form

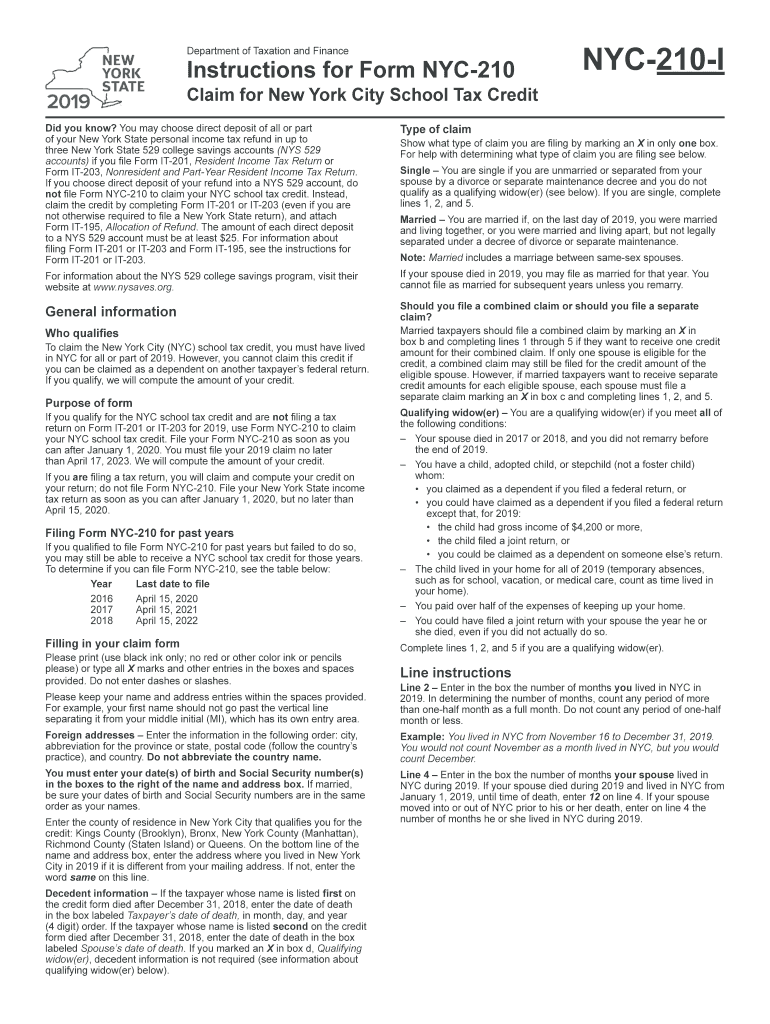

The Nyc 210 form, officially known as the NYC School Tax Credit Form, is a tax document used by eligible New York City residents to claim a tax credit for school-related expenses. This form helps taxpayers receive a credit against their New York City income tax, which can significantly reduce their overall tax liability. The Nyc 210 form is particularly relevant for those who have children attending public or private schools within the city.

How to Use the Nyc 210 Form

Using the Nyc 210 form involves several straightforward steps. First, gather all necessary documentation, including proof of school enrollment and any receipts for eligible expenses. Next, accurately complete the form by providing personal information, details about your dependents, and the amounts you wish to claim. Once completed, ensure that all information is correct to avoid delays in processing. Finally, submit the form through the appropriate channels, either online or by mail, depending on your preference.

Steps to Complete the Nyc 210 Form

Completing the Nyc 210 form requires careful attention to detail. Start by downloading the form from a reliable source. Fill in your name, address, and Social Security number at the top of the form. Next, list your dependents and their respective school information. Document any qualifying expenses, such as tuition or educational supplies, in the designated sections. Review the form for accuracy and completeness, then sign and date it before submission. Following these steps will help ensure that your claim is processed smoothly.

Legal Use of the Nyc 210 Form

The Nyc 210 form is legally binding when completed and submitted in accordance with New York City tax regulations. To ensure its legal validity, it is essential to provide truthful and accurate information. The form must be signed by the taxpayer, affirming that all details are correct. Additionally, compliance with relevant tax laws is crucial to avoid potential penalties or issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc 210 form are typically aligned with the annual tax filing season. Taxpayers should be aware of the specific dates for submission to ensure they do not miss out on claiming their credits. Generally, the form must be filed by the same deadline as the New York City income tax return, which is usually April fifteenth. It is advisable to check for any updates or changes to these dates each tax year.

Eligibility Criteria

To qualify for the Nyc 210 form, taxpayers must meet specific eligibility criteria. Generally, applicants must be residents of New York City and have at least one dependent child enrolled in a qualifying school. The school must be recognized by the New York State Education Department. Additionally, there may be income limits that determine eligibility for the tax credit. It is important to review these criteria carefully to ensure compliance.

Form Submission Methods

The Nyc 210 form can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file the form online through the New York City Department of Finance website, ensuring a quick and efficient process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times, so selecting the most suitable option is essential for timely filing.

Quick guide on how to complete form nyc 210 claim for new york city school tax credit

Effortlessly Prepare Nyc 210 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Nyc 210 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Nyc 210 Form with Ease

- Obtain Nyc 210 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Nyc 210 Form to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nyc 210 claim for new york city school tax credit

Create this form in 5 minutes!

How to create an eSignature for the form nyc 210 claim for new york city school tax credit

How to generate an eSignature for the Form Nyc 210 Claim For New York City School Tax Credit online

How to make an eSignature for the Form Nyc 210 Claim For New York City School Tax Credit in Google Chrome

How to generate an electronic signature for putting it on the Form Nyc 210 Claim For New York City School Tax Credit in Gmail

How to make an electronic signature for the Form Nyc 210 Claim For New York City School Tax Credit from your smart phone

How to create an electronic signature for the Form Nyc 210 Claim For New York City School Tax Credit on iOS

How to generate an electronic signature for the Form Nyc 210 Claim For New York City School Tax Credit on Android devices

People also ask

-

What is Form NYC 210 and how can airSlate SignNow help with it?

Form NYC 210 is a pivotal document for businesses operating in New York City, often required for various regulatory purposes. With airSlate SignNow, you can easily prepare, send, and eSign Form NYC 210, ensuring compliance while streamlining your document workflows.

-

Is there a cost associated with using airSlate SignNow for Form NYC 210?

Yes, airSlate SignNow offers affordable pricing plans that can accommodate businesses of all sizes. Our pricing structure allows you to send and eSign Form NYC 210 without breaking the bank while providing a cost-effective solution for your document needs.

-

What features does airSlate SignNow offer for managing Form NYC 210?

airSlate SignNow provides a variety of features tailored to managing Form NYC 210, including customizable templates, real-time tracking, and automated reminders. These features help ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing Form NYC 210?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage Form NYC 210 effortlessly alongside your other business tools.

-

How does airSlate SignNow ensure the security of Form NYC 210?

Security is a top priority for airSlate SignNow. When handling Form NYC 210, we utilize advanced encryption and compliance measures to safeguard your sensitive information throughout the entire signing process.

-

What are the benefits of using airSlate SignNow for Form NYC 210?

Using airSlate SignNow for Form NYC 210 streamlines your document workflow, reduces turnaround time, and enhances collaboration among team members. This efficiency translates to increased productivity for your business.

-

How do I get started with airSlate SignNow for my Form NYC 210 needs?

To get started with airSlate SignNow, simply sign up on our website and explore our user-friendly interface. You can easily create, send, and track Form NYC 210 in just a few clicks, making the process hassle-free.

Get more for Nyc 210 Form

- Jefferson county pistol permit form

- Lee county pistol permit form

- Concealed carry in alabama form

- Bmv title search form

- Centrelink medical certificate su415 form

- Global entry application form

- Illinois state police concealed carry firearm training bcertificateb form

- How to get a school varience in washoe county nv form

Find out other Nyc 210 Form

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online