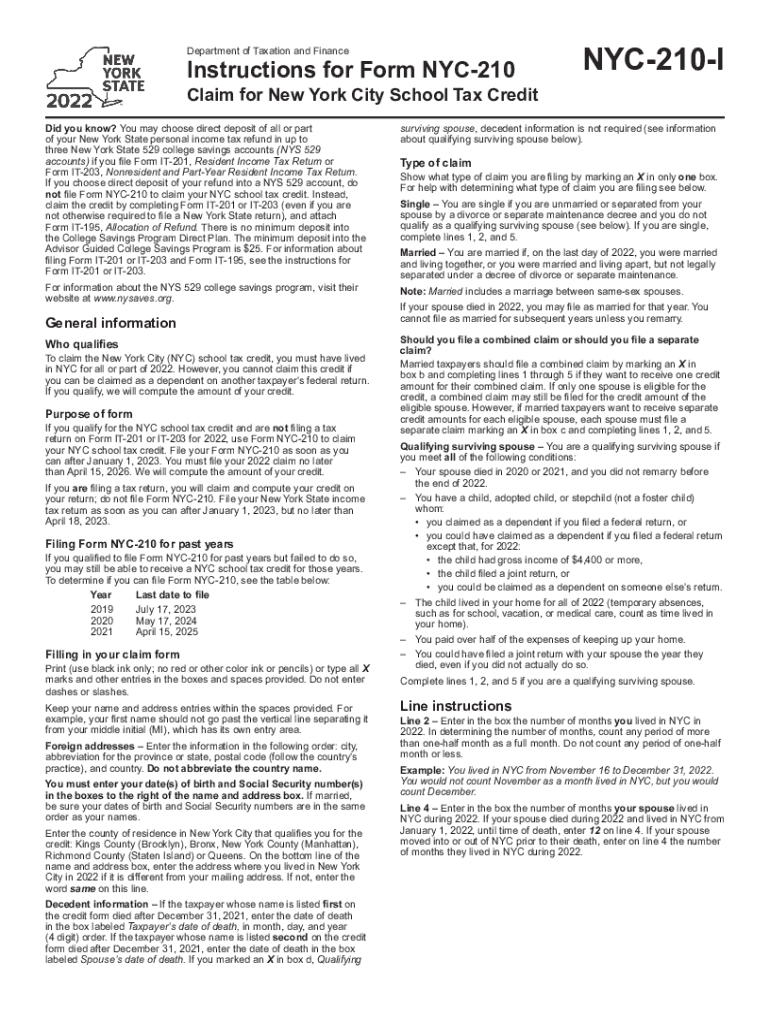

Instructions for Form NYC 210 Claim for New York City School Tax Credit Tax Year 2022

Instructions for Completing the NYC 210 Form for School Tax Credit

The NYC 210 form is essential for claiming the New York City School Tax Credit. Understanding the instructions is crucial for ensuring accurate completion and submission. The form requires specific information about your residency, income, and eligibility for the credit. It is important to carefully read each section of the instructions to avoid errors that could delay processing or result in a denial of the claim.

Key sections of the instructions include eligibility criteria, required documentation, and specific details on how to report income. Ensure that all information is filled out completely and accurately, as incomplete submissions may lead to complications.

Steps to Complete the NYC 210 Form

Completing the NYC 210 form involves several steps that must be followed meticulously. Begin by gathering all necessary documents, including proof of residency and income statements. Next, fill out the form by providing your personal information, including your name, address, and Social Security number.

Follow the instructions for each section, ensuring that you provide accurate figures for your income and any deductions. After completing the form, review it thoroughly for any mistakes or omissions. Finally, sign and date the form before submitting it according to the specified methods outlined in the instructions.

Eligibility Criteria for the NYC 210 Form

To qualify for the New York City School Tax Credit using the NYC 210 form, certain eligibility criteria must be met. Applicants must be residents of New York City and have a valid Social Security number. Additionally, there are income limits that determine eligibility; these limits can vary based on filing status and household size.

It is also essential to have children enrolled in a public or private school within the city. Review the specific income thresholds and residency requirements in the instructions to confirm your eligibility before proceeding with the application.

Required Documents for the NYC 210 Form

When filing the NYC 210 form, several documents are required to support your claim for the School Tax Credit. These documents typically include proof of residency, such as a utility bill or lease agreement, and income statements like W-2 forms or 1099s.

Additionally, if you are claiming dependents, you may need to provide their Social Security numbers and proof of their school enrollment. Ensuring that all required documents are included with your submission can help facilitate a smoother processing experience.

Form Submission Methods for the NYC 210

The NYC 210 form can be submitted through various methods, allowing flexibility for applicants. You can choose to file the form online through the appropriate city tax portal, which is often the fastest method for processing. Alternatively, you may opt to mail a paper copy of the completed form to the designated address provided in the instructions.

In-person submissions are also an option at certain city tax offices, though this may require scheduling an appointment. Regardless of the submission method chosen, ensure that you keep a copy of the completed form and any supporting documents for your records.

Penalties for Non-Compliance with the NYC 210 Form

Failure to comply with the requirements of the NYC 210 form can result in penalties. Common issues include late submissions, inaccuracies in reported income, or failure to provide necessary documentation. Such mistakes can lead to delays in processing or denial of the tax credit.

In some cases, penalties may also include fines or interest on unpaid taxes. It is crucial to adhere to all guidelines and deadlines outlined in the instructions to avoid these potential consequences.

Quick guide on how to complete instructions for form nyc 210 claim for new york city school tax credit tax year 2022

Prepare Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year effortlessly on any device

Online document management has become widely accepted among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to edit and electronically sign Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year with ease

- Find Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Decide how you'd like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form nyc 210 claim for new york city school tax credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc 210 claim for new york city school tax credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYC 210 form 2021 PDF?

The NYC 210 form 2021 PDF is a tax form used for New York City's income tax reporting. It is essential for residents to report their earnings accurately. Accessing this form in PDF format makes it easier to fill out and submit your tax information.

-

How can I obtain the NYC 210 form 2021 PDF?

The NYC 210 form 2021 PDF can be downloaded directly from the official New York City Department of Finance website. You can easily find it in the forms section and save or print it as needed for your records.

-

Is there a cost associated with the NYC 210 form 2021 PDF?

No, the NYC 210 form 2021 PDF is available for free from official sources. However, utilizing airSlate SignNow for document signing and e-filing may incur minimal costs, providing a convenient way to manage your paperwork.

-

Can I eSign the NYC 210 form 2021 PDF using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the NYC 210 form 2021 PDF easily. With a user-friendly interface, you can sign your document electronically, which speeds up the process and enhances convenience.

-

What features does airSlate SignNow offer for the NYC 210 form 2021 PDF?

airSlate SignNow offers various features for managing the NYC 210 form 2021 PDF, including customizable templates, automated notifications, and cloud storage for easy access. These features enhance document management and ensure that your forms are always up-to-date.

-

How does airSlate SignNow improve the eSigning process for the NYC 210 form 2021 PDF?

airSlate SignNow streamlines the eSigning process for the NYC 210 form 2021 PDF by providing a secure and fast platform for signature collection. You can send the form for signatures and receive them back quickly, making tax submission more efficient.

-

Does airSlate SignNow integrate with other software for handling the NYC 210 form 2021 PDF?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your ability to manage the NYC 210 form 2021 PDF alongside other business tools. This integration improves workflow and simplifies document handling across platforms.

Get more for Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Unconditional waiver and release of claim of lien upon progress payment south carolina form

- Quitclaim deed from husband and wife to llc south carolina form

- Warranty deed from husband and wife to llc south carolina form

- Sc judgment form

- Conditional waiver and release of claim of lien upon final payment south carolina form

- Landlord notice premises form

- South carolina notice 497325636 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497325637 form

Find out other Instructions For Form NYC 210 Claim For New York City School Tax Credit Tax Year

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe