Fillable Online Form it 604 Claim for QEZE Tax Reduction

What is the Fillable Online Form IT 604 Claim For QEZE Tax Reduction

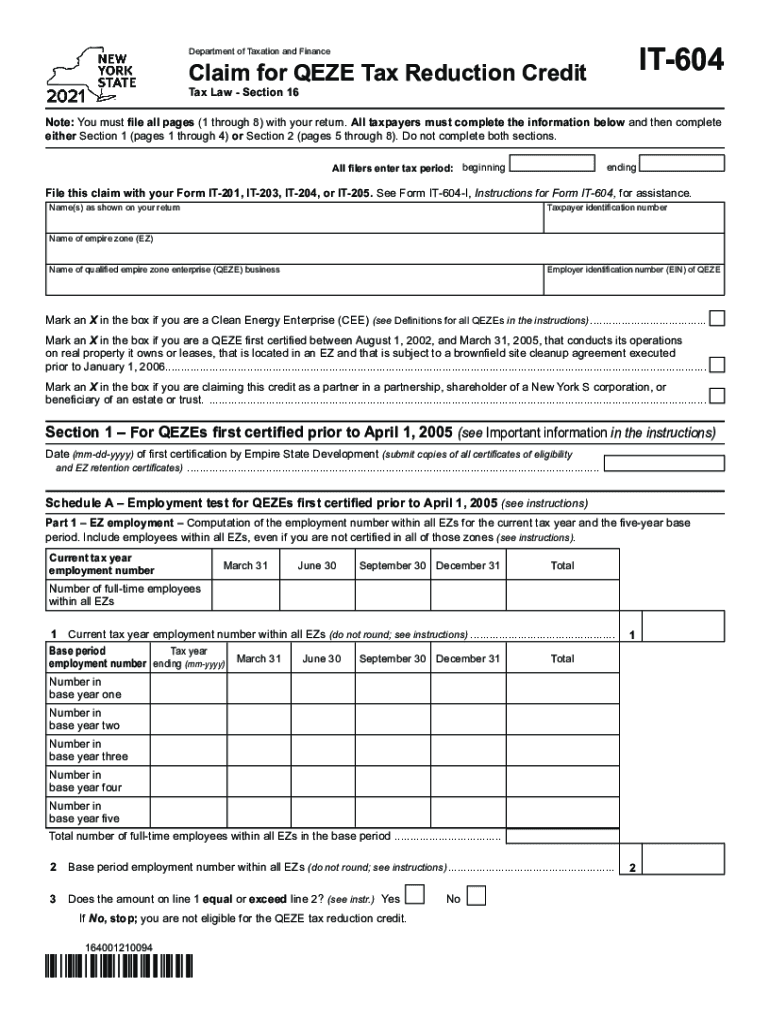

The IT 604 form is a critical document used by businesses in New York State to claim a tax reduction under the Qualified Empire Zone Enterprise (QEZE) program. This form allows eligible businesses to reduce their tax liabilities, promoting economic growth and job creation in designated zones. The fillable online version of the IT 604 form simplifies the process, enabling users to complete and submit their claims electronically, ensuring accuracy and efficiency.

How to Use the Fillable Online Form IT 604 Claim For QEZE Tax Reduction

Using the fillable online IT 604 form is straightforward. Begin by accessing the form on a compatible device. Carefully fill in the required fields, ensuring all information is accurate. Users should provide details such as business identification, tax year, and specific QEZE benefits being claimed. Once completed, review the form for any errors before submitting it electronically. This method enhances the submission process, allowing for quicker processing times by tax authorities.

Steps to Complete the Fillable Online Form IT 604 Claim For QEZE Tax Reduction

Completing the IT 604 form involves several key steps:

- Access the fillable online form through a secure platform.

- Input your business information, including name, address, and tax identification number.

- Specify the tax year for which you are claiming the QEZE benefits.

- Detail the specific tax reductions you are eligible for under the QEZE program.

- Review all entered information for accuracy.

- Submit the form electronically to the appropriate tax authority.

Legal Use of the Fillable Online Form IT 604 Claim For QEZE Tax Reduction

The IT 604 form is legally recognized when completed according to the guidelines set forth by the New York State Department of Taxation and Finance. To ensure legality, businesses must comply with all relevant regulations regarding eligibility and documentation. Utilizing a secure eSignature solution, such as signNow, can further validate the submission, providing a digital certificate that confirms the authenticity of the signature and the document.

Eligibility Criteria for the Fillable Online Form IT 604 Claim For QEZE Tax Reduction

Eligibility for the IT 604 form requires businesses to meet specific criteria set by the QEZE program. Generally, businesses must operate within a designated Empire Zone, have a valid business registration, and demonstrate compliance with state regulations. Additionally, the business must be engaged in qualified activities that contribute to economic development within the zone. Understanding these criteria is essential for successful claims.

Filing Deadlines / Important Dates

Filing deadlines for the IT 604 form are crucial for businesses seeking tax reductions. Typically, the form must be submitted by the due date of the tax return for the year in which the benefits are claimed. It is advisable to check the New York State Department of Taxation and Finance website for specific dates, as they may vary annually. Timely submission ensures that businesses do not miss out on potential tax savings.

Quick guide on how to complete fillable online form it 604 claim for qeze tax reduction

Complete Fillable Online Form IT 604 Claim For QEZE Tax Reduction effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Fillable Online Form IT 604 Claim For QEZE Tax Reduction on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Fillable Online Form IT 604 Claim For QEZE Tax Reduction with ease

- Find Fillable Online Form IT 604 Claim For QEZE Tax Reduction and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Online Form IT 604 Claim For QEZE Tax Reduction and ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online form it 604 claim for qeze tax reduction

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an e-signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the ita 604 and how does it work?

The ita 604 is a unique document management and e-signature solution offered by airSlate SignNow. It streamlines the process of sending, signing, and managing documents electronically, enhancing workflow efficiency. With a user-friendly interface, ita 604 ensures businesses can easily implement e-signatures into their processes.

-

What are the key features of the ita 604?

The ita 604 includes several powerful features such as customizable templates, real-time tracking, and secure document storage. Additionally, it allows for in-person signing and provides advanced security measures to protect sensitive information. These features make the ita 604 an essential tool for businesses looking to optimize document management.

-

How much does the ita 604 cost?

The pricing for the ita 604 varies based on the specific package and features you choose. airSlate SignNow offers competitive pricing, ensuring that businesses of all sizes can find a suitable plan. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team.

-

Can the ita 604 integrate with other software?

Yes, the ita 604 seamlessly integrates with a variety of popular software and applications. This includes CRMs, project management tools, and cloud storage services, enhancing your existing workflows. Such integrations allow for greater flexibility and efficiency in your document management processes.

-

What are the benefits of using the ita 604 for businesses?

Using the ita 604 provides numerous benefits, including increased speed in document processing and improved collaboration among team members. It also reduces the risk of errors associated with manual signatures and paper documentation. This ultimately leads to signNow time and cost savings for businesses.

-

Is the ita 604 compliant with industry standards?

Absolutely, the ita 604 meets key industry compliance standards, such as ESIGN and UETA. This ensures that electronic signatures are legally binding and secure. Compliance with these standards is crucial for businesses looking to protect their data and maintain regulatory adherence.

-

What customer support options are available for the ita 604?

airSlate SignNow provides extensive customer support for the ita 604, including live chat, email support, and a comprehensive knowledge base. Their dedicated support team is available to assist users with any questions or issues they might encounter. This ensures a smooth and efficient experience for all users.

Get more for Fillable Online Form IT 604 Claim For QEZE Tax Reduction

- California noncompliance 497299101 form

- California interlock form

- Notice to employers of ignition interlock restriction california form

- California annual 497299104 form

- Notices resolutions simple stock ledger and certificate california form

- Organizational meeting form

- Sample transmittal letter form

- Js 44 civil cover sheet federal district court california form

Find out other Fillable Online Form IT 604 Claim For QEZE Tax Reduction

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now