Form it 634 Empire State Jobs Retention Program Credit Tax

What is the Form IT 634 Empire State Jobs Retention Program Credit Tax

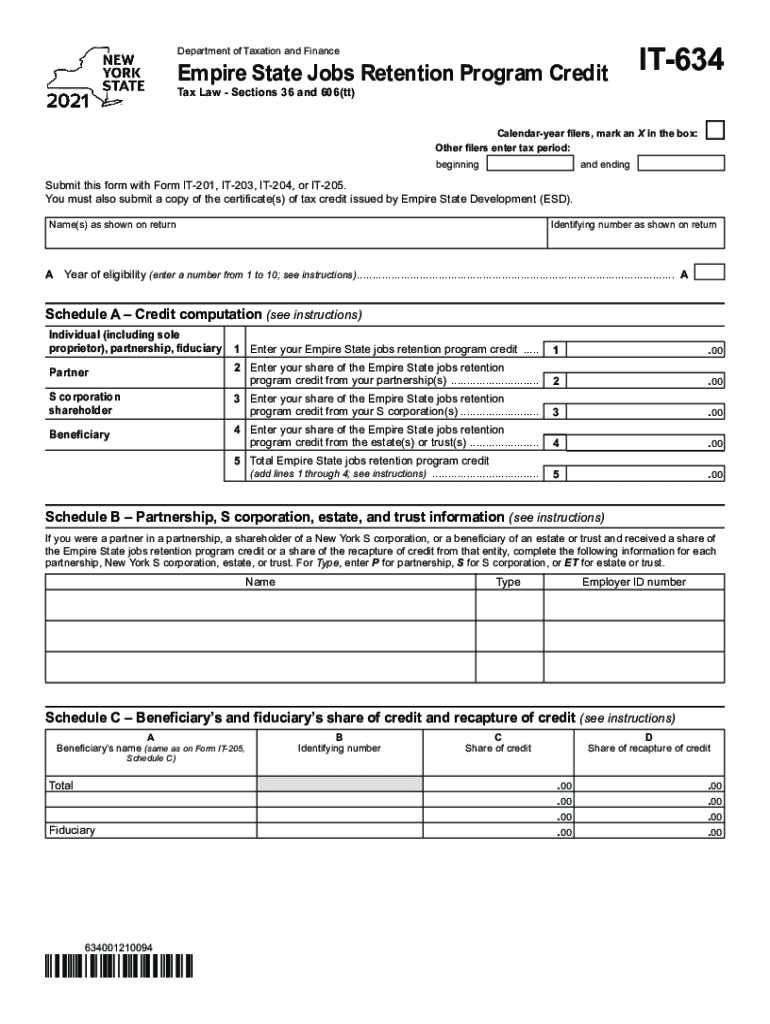

The Form IT 634 is a tax form used in New York to apply for the Empire State Jobs Retention Program Credit. This program is designed to encourage businesses to retain jobs in the state by providing a tax credit for eligible employers. The credit is aimed at supporting businesses that maintain or increase their workforce, particularly during challenging economic times. Understanding the purpose and implications of this form is essential for businesses looking to benefit from state incentives.

How to use the Form IT 634 Empire State Jobs Retention Program Credit Tax

To effectively use the Form IT 634, businesses must first determine their eligibility based on the specific criteria outlined by the New York State Department of Taxation and Finance. Once eligibility is established, the form must be filled out accurately, providing details about the business, the number of retained jobs, and the applicable tax credit amount. After completing the form, it should be submitted as part of the annual tax return, ensuring that all required documentation is included to support the claim.

Steps to complete the Form IT 634 Empire State Jobs Retention Program Credit Tax

Completing the Form IT 634 involves several key steps:

- Gather necessary information about your business, including tax identification numbers and employment details.

- Review the eligibility requirements to ensure your business qualifies for the credit.

- Fill out the form, providing accurate information regarding job retention and credit calculations.

- Attach any required documentation that supports your claim, such as payroll records or employment contracts.

- Submit the completed form with your tax return by the specified deadline.

Eligibility Criteria

Eligibility for the Form IT 634 requires businesses to meet specific criteria set by the state. Generally, businesses must demonstrate that they have retained a certain number of jobs within designated areas of New York. Additionally, the business must be in good standing with state tax obligations. It is important to review the detailed eligibility guidelines to ensure compliance and maximize the potential benefits of the tax credit.

Required Documents

When completing the Form IT 634, several documents may be required to substantiate your claim. These can include:

- Payroll records showing the number of employees retained.

- Tax identification numbers for the business and employees.

- Any correspondence from the New York State Department of Taxation and Finance regarding eligibility.

- Financial statements that reflect the business's operational status.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 634 can be submitted through various methods, depending on the preference of the business and the requirements set by the state. Businesses may choose to file the form electronically through approved tax software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to check for any specific submission guidelines to ensure timely processing.

Quick guide on how to complete form it 634 empire state jobs retention program credit tax

Complete Form IT 634 Empire State Jobs Retention Program Credit Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents efficiently without delays. Handle Form IT 634 Empire State Jobs Retention Program Credit Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax with ease

- Obtain Form IT 634 Empire State Jobs Retention Program Credit Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign functionality, which takes moments and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs within just a few clicks from any device you prefer. Modify and eSign Form IT 634 Empire State Jobs Retention Program Credit Tax while ensuring outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 634 empire state jobs retention program credit tax

How to generate an electronic signature for your PDF document online

How to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

How to make an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to New York 634?

airSlate SignNow is a powerful eSignature solution that helps businesses streamline document signing processes. Specifically, in New York 634, it serves as an efficient platform for sending and eSigning documents, ensuring compliance and security.

-

How much does airSlate SignNow cost in New York 634?

The pricing for airSlate SignNow in New York 634 is competitive and designed to accommodate businesses of all sizes. You can choose from various plans tailored to your specific needs, with options for monthly or annual billing.

-

What features does airSlate SignNow offer for users in New York 634?

airSlate SignNow boasts several features beneficial for users in New York 634, including customizable templates, automatic reminders, and a user-friendly interface. These features help enhance productivity and ensure smooth document workflows.

-

Can airSlate SignNow integrate with other applications in New York 634?

Yes, airSlate SignNow seamlessly integrates with numerous applications commonly used in New York 634, such as Google Workspace, Salesforce, and Microsoft Office. This flexibility allows businesses to streamline their processes and enhance collaboration.

-

What are the benefits of using airSlate SignNow in New York 634?

Using airSlate SignNow in New York 634 enables businesses to save time and reduce operational costs by digitizing the signing process. Additionally, it enhances security and compliance with legal regulations for document handling.

-

Is airSlate SignNow compliant with regulations applicable in New York 634?

Absolutely! airSlate SignNow adheres to all necessary legal standards and regulations applicable in New York 634, including eSignature laws. This compliance ensures that your signed documents are valid and enforceable.

-

How easy is it to get started with airSlate SignNow in New York 634?

Getting started with airSlate SignNow in New York 634 is quick and easy. Simply sign up for an account, choose your preferred plan, and you can start sending and eSigning documents in minutes.

Get more for Form IT 634 Empire State Jobs Retention Program Credit Tax

- California ending form

- De facto parent pamphlet california form

- Notice hearing form

- Ca code form

- Request for prospective adoptive parent designation notice and order california form

- Prospective adoptive parent form

- Notice of intent to remove child and proof of notice objection to removal and order after hearing california form

- Emergency removal form

Find out other Form IT 634 Empire State Jobs Retention Program Credit Tax

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online