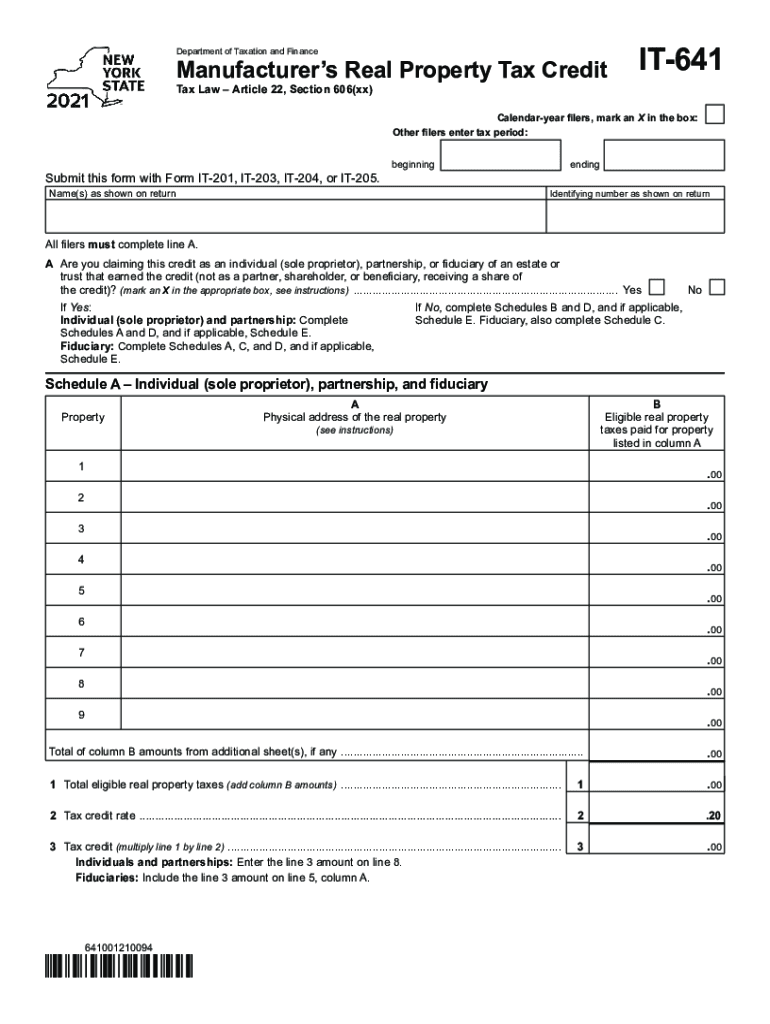

Form it 641Manufacturer's Real Property Tax Creditit641

What is the Form IT 641?

The Form IT 641 is a tax document used in New York State, specifically known as the Manufacturer's Real Property Tax Credit. This form allows eligible manufacturers to claim a credit against their real property taxes, thereby reducing their overall tax liability. The credit is designed to incentivize manufacturing activities within the state, supporting local businesses and economic growth. Understanding the purpose and function of this form is essential for manufacturers looking to benefit from available tax credits.

How to Use the Form IT 641

Using the Form IT 641 involves several steps to ensure proper completion and submission. First, gather all necessary documentation that supports your eligibility for the credit. This may include proof of manufacturing activities and property tax payments. Next, fill out the form accurately, ensuring all required fields are completed. After completing the form, review it for any errors before submission. The form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the New York State Department of Taxation and Finance.

Steps to Complete the Form IT 641

Completing the Form IT 641 requires attention to detail. Follow these steps for successful completion:

- Gather Documentation: Collect all relevant documents that demonstrate your eligibility for the credit.

- Fill Out the Form: Enter your business information, including name, address, and tax identification number.

- Detail Manufacturing Activities: Provide information about your manufacturing operations, including the types of products produced.

- Calculate the Credit: Determine the amount of credit you are eligible for based on your property tax payments.

- Review and Sign: Check for any mistakes and ensure all signatures are included before submission.

Eligibility Criteria for the Form IT 641

To qualify for the Manufacturer's Real Property Tax Credit using Form IT 641, certain eligibility criteria must be met. Primarily, the applicant must be a manufacturer operating within New York State. Additionally, the business must own or lease real property that is used for manufacturing purposes. It's also necessary to have paid property taxes on the eligible property. Familiarizing yourself with these criteria is crucial to ensure that you can successfully claim the credit.

Required Documents for the Form IT 641

When preparing to submit the Form IT 641, several documents are required to substantiate your claim. These may include:

- Proof of Property Ownership: Deeds or lease agreements that confirm your ownership or lease of the manufacturing property.

- Property Tax Bills: Copies of recent property tax bills that reflect the amounts paid.

- Manufacturing Activity Documentation: Records that detail the nature of your manufacturing operations, such as production reports or financial statements.

Filing Deadlines for the Form IT 641

Timely filing of the Form IT 641 is essential to ensure that you receive the tax credit. The form must typically be submitted by the deadline set by the New York State Department of Taxation and Finance, which usually aligns with the annual tax filing deadlines. It is important to stay informed about any changes in deadlines to avoid missing out on potential credits.

Quick guide on how to complete form it 6412020manufacturers real property tax creditit641

Complete Form IT 641Manufacturer's Real Property Tax Creditit641 effortlessly on any device

Digital document management has become favored among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Form IT 641Manufacturer's Real Property Tax Creditit641 on any platform through airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

The simplest way to alter and eSign Form IT 641Manufacturer's Real Property Tax Creditit641 without difficulty

- Obtain Form IT 641Manufacturer's Real Property Tax Creditit641 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which only takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow meets all your document administration needs in just a few clicks from any device you choose. Modify and eSign Form IT 641Manufacturer's Real Property Tax Creditit641 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 6412020manufacturers real property tax creditit641

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

How to make an e-signature for a PDF on Android devices

People also ask

-

What is ny it 641, and how does airSlate SignNow integrate it?

ny it 641 refers to a specific tax form requirement for New York businesses. airSlate SignNow simplifies the process by allowing users to securely sign and send this document electronically, ensuring compliance and saving time.

-

What are the pricing options for airSlate SignNow for ny it 641 usage?

airSlate SignNow offers various pricing plans starting from a free trial to premium options that cater to different business sizes. Each plan includes features tailored to manage documents like the ny it 641 efficiently, ensuring you get the best value.

-

Can I customize my documents for the ny it 641 with airSlate SignNow?

Yes, you can easily customize your ny it 641 documents using airSlate SignNow’s intuitive platform. This allows you to add your branding, adjust layouts, and include specific fields to meet your business needs.

-

What are the main benefits of using airSlate SignNow for ny it 641?

Using airSlate SignNow for the ny it 641 allows for fast, secure e-signatures and efficient document management. It streamlines your workflow, reduces paper usage, and ensures compliance with state requirements, helping your business run smoother.

-

Is airSlate SignNow safe for handling sensitive information on the ny it 641?

Absolutely! airSlate SignNow employs advanced security protocols to protect sensitive information related to the ny it 641. Your data is encrypted and securely stored, ensuring confidentiality and peace of mind.

-

How does airSlate SignNow improve collaboration for businesses dealing with ny it 641?

airSlate SignNow enhances collaboration by allowing multiple users to access and sign the ny it 641 document from anywhere. This real-time interaction speeds up the signing process and ensures everyone is on the same page.

-

What integrations does airSlate SignNow offer for managing ny it 641?

airSlate SignNow seamlessly integrates with various platforms, including CRM and accounting software, to help you manage your ny it 641 documents effortlessly. This integration helps streamline your overall workflow and enhances productivity.

Get more for Form IT 641Manufacturer's Real Property Tax Creditit641

Find out other Form IT 641Manufacturer's Real Property Tax Creditit641

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation