Form it 601 Claim for EZ Wage Tax Credit Tax Year Fill

What is the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

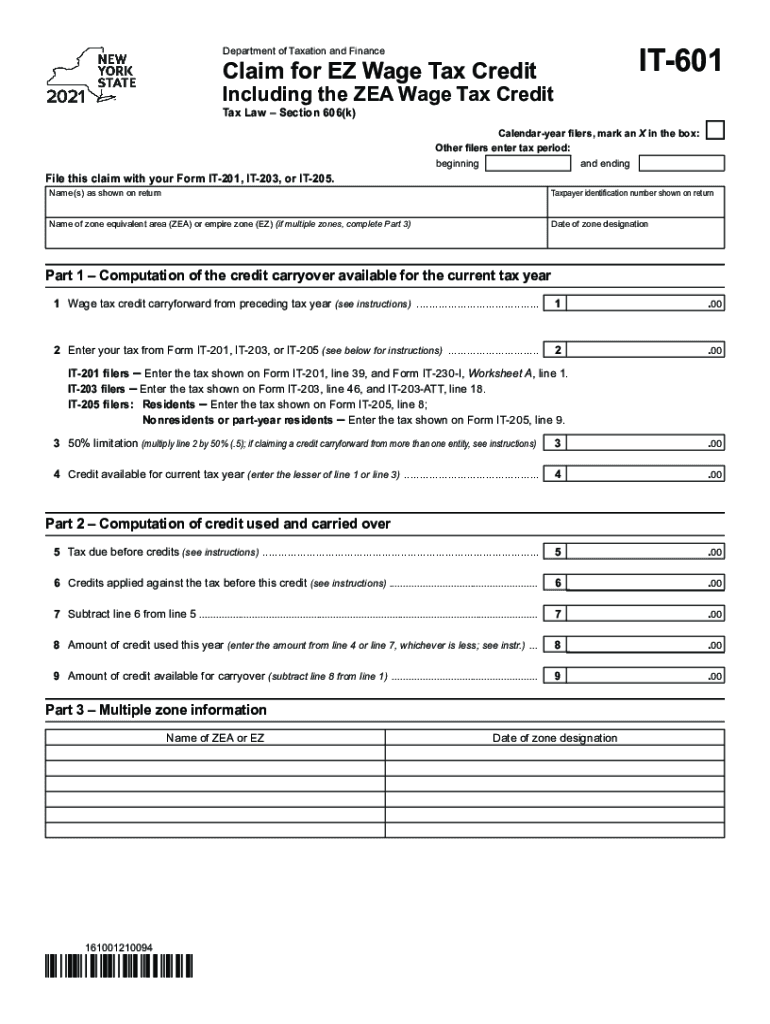

The Form IT 601 is a crucial document used to claim the EZ Wage Tax Credit for a specific tax year. This form is primarily designed for employers who wish to take advantage of tax credits available for hiring eligible employees. By completing the IT 601, businesses can reduce their overall tax liability, thereby encouraging job creation and economic growth. Understanding the purpose and implications of this form is essential for businesses aiming to maximize their tax benefits.

How to use the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

Using the Form IT 601 involves several steps to ensure accurate completion and submission. First, gather necessary information about the employees for whom the credit is being claimed, including their names, Social Security numbers, and employment dates. Next, fill out the form with this information, ensuring that all fields are completed correctly. After completing the form, it should be submitted according to the guidelines provided by the relevant tax authority. This process ensures that businesses can efficiently claim their entitled credits.

Steps to complete the Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

Completing the Form IT 601 requires careful attention to detail. Follow these steps:

- Gather employee information, including names and Social Security numbers.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for any errors or omissions.

- Submit the form to the appropriate tax authority by the specified deadline.

By following these steps, businesses can ensure that their claims for the EZ Wage Tax Credit are processed smoothly.

Eligibility Criteria

To qualify for the EZ Wage Tax Credit, certain eligibility criteria must be met. Generally, businesses must have hired employees who meet specific qualifications, such as being part of targeted groups defined by the tax authority. Additionally, the employees must have worked a minimum number of hours during the tax year. Understanding these criteria is vital for businesses to determine their eligibility and maximize their tax benefits.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 601 are critical for ensuring that businesses can claim their tax credits. Typically, the form must be submitted by the end of the tax year or within a specified period after hiring eligible employees. Keeping track of these important dates helps businesses avoid missing out on potential tax savings.

Required Documents

When completing the Form IT 601, certain documents are necessary to support the claim. These may include employee records, proof of eligibility for the EZ Wage Tax Credit, and any other documentation required by the tax authority. Having these documents ready can streamline the process and enhance the accuracy of the claim.

Quick guide on how to complete form it 601 claim for ez wage tax credit tax year fill

Effortlessly Prepare Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

Effortlessly Modify and Electronically Sign Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

- Find Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you'd like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 601 claim for ez wage tax credit tax year fill

How to generate an e-signature for your PDF in the online mode

How to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is it 601 and how does it relate to airSlate SignNow?

IT 601 is a term that often refers to electronic signature solutions and their integration into business processes. airSlate SignNow utilizes IT 601 principles to streamline document management, allowing businesses to send and eSign documents efficiently. This ensures compliance and signNowly reduces the time spent on paperwork.

-

What features does airSlate SignNow offer under the it 601 framework?

Under the IT 601 framework, airSlate SignNow provides features such as customizable templates, advanced security options, and audit trails for every signed document. These functionalities enhance document integrity and streamline business transactions. Users can easily create, send, and manage documents, all within a user-friendly interface.

-

How cost-effective is airSlate SignNow for businesses considering it 601?

AirSlate SignNow is designed to be a cost-effective solution for businesses looking to implement IT 601 compliant processes. Pricing plans are flexible and cater to various organization sizes, ensuring accessibility without compromising on features. This ensures that companies can optimize their workflows at a price point that suits their budget.

-

Can airSlate SignNow integrate with other services for it 601 compliance?

Yes, airSlate SignNow offers seamless integrations with various third-party applications to support IT 601 compliance. These integrations allow businesses to connect their existing tools, enhancing their workflows and data management. Popular integrations include CRM systems, cloud storage solutions, and productivity applications.

-

What are the benefits of using airSlate SignNow for it 601 based documentation?

Using airSlate SignNow for IT 601 documentation provides numerous benefits, including increased efficiency and improved accuracy in document handling. Businesses can automate signature collection and reduce errors associated with manual processes. This not only saves time but also ensures documents are processed swiftly and securely.

-

Is airSlate SignNow secure for handling it 601 related documents?

Absolutely, airSlate SignNow adheres to stringent security measures to protect documents related to IT 601. This includes encryption, multi-factor authentication, and secure cloud storage. These security features help preserve the integrity and confidentiality of sensitive information throughout the signing process.

-

How user-friendly is airSlate SignNow for new users interested in it 601?

AirSlate SignNow is designed with user-friendliness in mind, making it an excellent choice for new users wanting to adopt IT 601 practices. The intuitive interface and guided setup make it easy for anyone, regardless of their technical expertise, to start crafting and signing documents. Training materials and customer support further enhance the user experience.

Get more for Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

Find out other Form IT 601 Claim For EZ Wage Tax Credit Tax Year Fill

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple