Form it 611 1 Claim for Brownfield Redevelopment Tax Credit Tax Year

What is the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

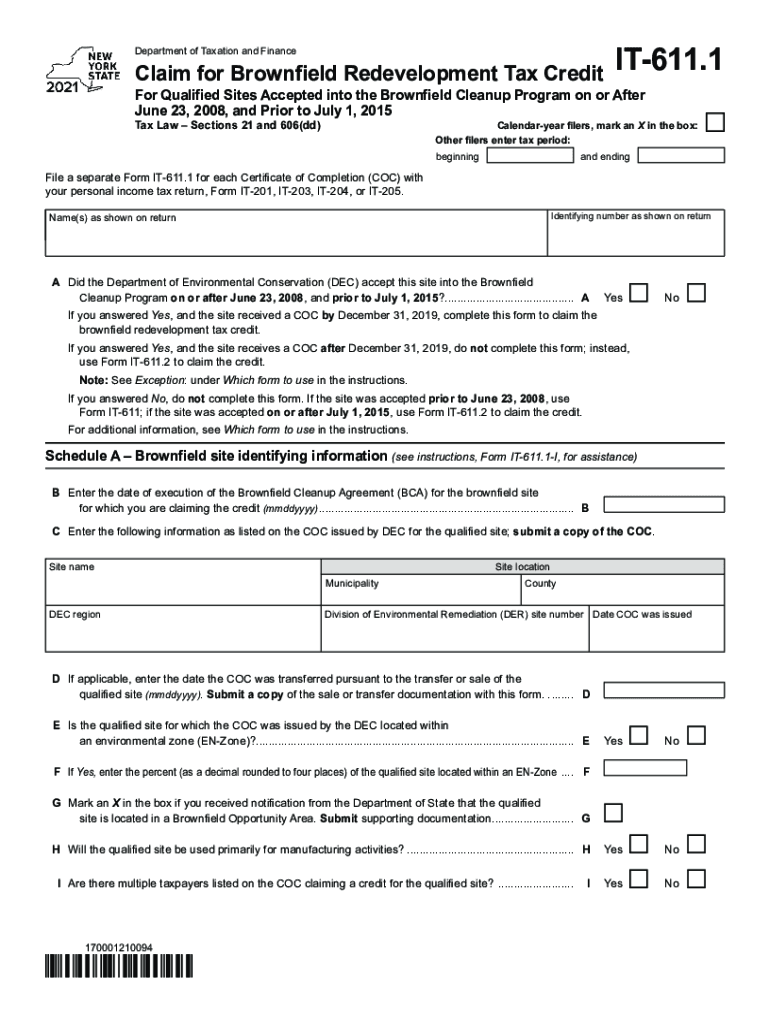

The Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year is a tax document used by businesses and property owners in the United States to claim tax credits for the redevelopment of brownfield sites. Brownfield sites are properties that may be complicated by the presence of hazardous substances, pollutants, or contaminants. This form is essential for those looking to receive financial incentives for cleaning up and redeveloping these areas, ultimately contributing to environmental restoration and community revitalization.

How to use the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

Using the Form IT 611 1 involves several steps to ensure proper completion and submission. First, gather all necessary documentation related to the brownfield site, including proof of cleanup efforts and associated costs. Next, fill out the form accurately, providing detailed information about the property, the nature of the redevelopment, and the expenses incurred. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. It is advisable to keep copies of all submitted documents for your records.

Steps to complete the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

Completing the Form IT 611 1 requires attention to detail. Follow these steps:

- Gather all relevant documents, including cleanup costs and property details.

- Fill in the property information section, including the address and description of the site.

- Detail the cleanup activities undertaken and provide associated costs.

- Calculate the tax credit amount based on the eligible expenses.

- Sign and date the form, ensuring all information is accurate.

Eligibility Criteria

To be eligible for the brownfield redevelopment tax credit, certain criteria must be met. The property must be classified as a brownfield site, and the applicant must have incurred eligible costs related to the cleanup and redevelopment. Additionally, the redevelopment must comply with local, state, and federal regulations. It is important to review the specific eligibility requirements outlined by the relevant tax authority to ensure compliance.

Required Documents

When submitting the Form IT 611 1, several documents are typically required to support the claim. These may include:

- Proof of ownership or lease of the brownfield site.

- Documentation of cleanup activities, such as contracts and invoices.

- Environmental assessments or reports detailing the contamination.

- Receipts for expenses incurred during the redevelopment process.

Form Submission Methods

The Form IT 611 1 can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing a hard copy of the form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form it 6111 claim for brownfield redevelopment tax credit tax year 2021

Effortlessly prepare Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year on any device

Digital document management has surged in popularity among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary forms and safely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year with ease

- Find Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form retrieval, or mistakes necessitating new printed document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 6111 claim for brownfield redevelopment tax credit tax year 2021

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year is a tax form used by businesses to claim a tax credit for costs associated with the redevelopment of brownfield sites. This form requires detailed documentation of eligible expenses, allowing businesses to potentially reduce their tax liabilities. Understanding this form is crucial for maximizing tax benefits in redevelopment projects.

-

How can airSlate SignNow help with Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year?

airSlate SignNow streamlines the process of completing Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year by providing easy document management and eSigning capabilities. Users can create, send, and sign documents digitally, ensuring accuracy and compliance in submissions. This efficient solution reduces the administrative burden while keeping your proposals organized.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including individual and team packages. Plans are designed to be budget-friendly while providing advanced features for managing documents effectively. You can start with a free trial to assess how airSlate SignNow can aid in completing the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year.

-

What features does airSlate SignNow provide for managing tax-related documents?

airSlate SignNow provides essential features such as customizable templates, secure eSignature capabilities, and document tracking. These tools help users efficiently prepare, send, and store documents like the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year. By leveraging these features, businesses can ensure timely submissions and compliance with tax regulations.

-

Is airSlate SignNow compliant with tax regulations for Form IT 611 1?

Yes, airSlate SignNow is designed to be compliant with various tax regulations, including those related to the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year. The platform ensures that all documentation is handled securely and follows best practices. This compliance helps businesses confidently submit their claims without risking rejection due to documentation errors.

-

Can airSlate SignNow integrate with other tools for tax management?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax management platforms, enhancing your workflow. Integration allows for easy importation of data required for completing Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year while minimizing manual data entry errors. This efficiency can save your business valuable time and resources.

-

What are the benefits of using airSlate SignNow for tax credit claims?

Using airSlate SignNow for tax credit claims, including the Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year, offers numerous benefits such as increased efficiency, reduced turnaround time, and improved accuracy. The electronic signing process speeds up approvals, allowing businesses to focus on their core activities. Moreover, centralized document management keeps everything organized for easy access during audits.

Get more for Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Receipt acknowledgment form

- Blocked account form

- Blocked account 497299324 form

- Accommodations disabilities form

- Media request to photograph record or broadcast california form

- Order on media request to permit coverage california form

- California clerks office form

- Attorney name state bar number and addressfor court use only form

Find out other Form IT 611 1 Claim For Brownfield Redevelopment Tax Credit Tax Year

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe