Printable New York Form it 638 START UP NY Tax Elimination

What is the Printable New York Form IT-638 START-UP NY Tax Elimination

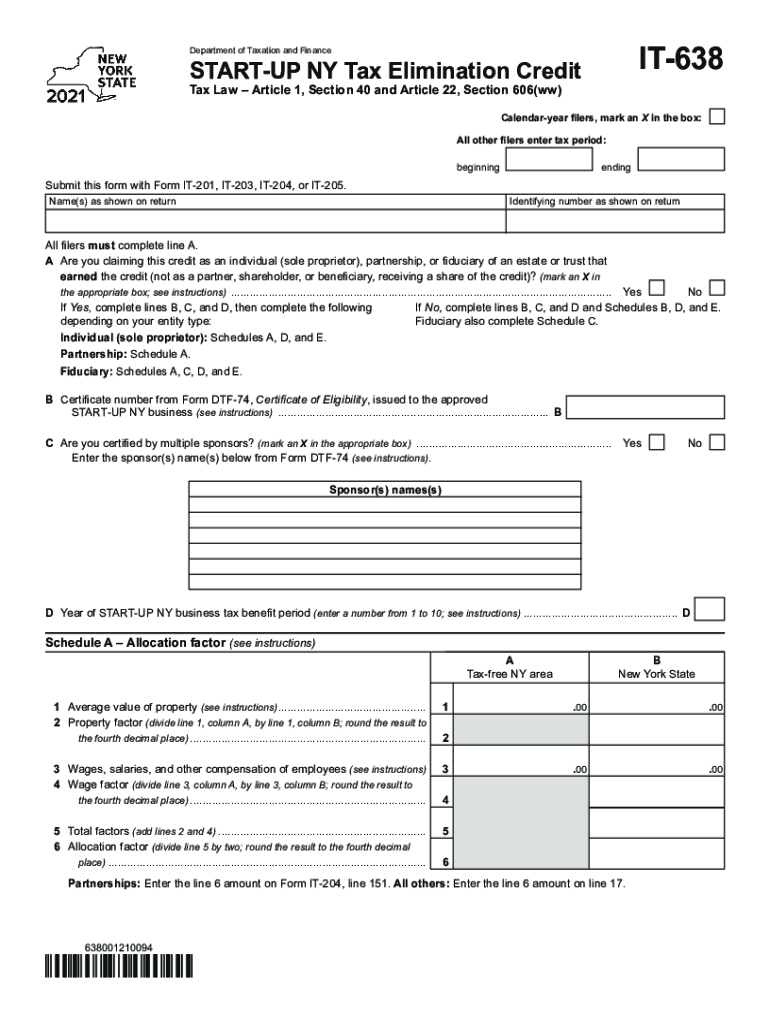

The Printable New York Form IT-638, also known as the START-UP NY Tax Elimination form, is a crucial document designed for businesses participating in the START-UP NY program. This program aims to attract new businesses and encourage the growth of existing ones by offering significant tax benefits. By completing and submitting this form, eligible businesses can apply for a tax exemption on income generated within designated tax-free zones in New York State. Understanding the purpose and implications of this form is essential for businesses looking to maximize their tax savings while contributing to the local economy.

Steps to Complete the Printable New York Form IT-638 START-UP NY Tax Elimination

Completing the Printable New York Form IT-638 involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary information: Collect all relevant business data, including your business name, address, and federal Employer Identification Number (EIN).

- Review eligibility criteria: Ensure your business meets the requirements for the START-UP NY program, such as being a qualified new business.

- Fill out the form: Carefully complete each section of the IT-638 form, providing accurate information regarding your business operations and tax details.

- Attach required documentation: Include any supporting documents that verify your eligibility and support your application.

- Review and sign: Double-check all entries for accuracy, then sign and date the form.

- Submit the form: Follow the designated submission methods to ensure your application is received by the appropriate tax authority.

Eligibility Criteria for the Printable New York Form IT-638 START-UP NY Tax Elimination

Eligibility for the Printable New York Form IT-638 is determined by specific criteria outlined by the New York State Department of Taxation and Finance. To qualify, businesses must:

- Be a new business or a business that is relocating to a START-UP NY tax-free zone.

- Engage in qualified activities, such as manufacturing, technology, or research and development.

- Meet the minimum investment and job creation requirements set forth by the program.

- Be in good standing with state tax obligations and not have any outstanding tax liabilities.

How to Obtain the Printable New York Form IT-638 START-UP NY Tax Elimination

The Printable New York Form IT-638 can be easily obtained through the New York State Department of Taxation and Finance website. The form is available in PDF format, allowing businesses to download, print, and complete it at their convenience. Additionally, physical copies may be available at local tax offices or business resource centers. It is essential to ensure that you are using the most current version of the form to comply with any updates to the tax laws or program requirements.

Legal Use of the Printable New York Form IT-638 START-UP NY Tax Elimination

The legal use of the Printable New York Form IT-638 is governed by state tax laws and regulations. To ensure compliance, businesses must accurately complete the form and provide truthful information regarding their operations and eligibility. Submitting false information or failing to meet the program's criteria can result in penalties, including the loss of tax benefits and potential legal action. Therefore, it is crucial for businesses to understand the legal implications of the form and to maintain accurate records to support their claims.

Quick guide on how to complete printable new york form it 638 start up ny tax elimination

Complete Printable New York Form IT 638 START UP NY Tax Elimination effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Printable New York Form IT 638 START UP NY Tax Elimination on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Printable New York Form IT 638 START UP NY Tax Elimination with ease

- Obtain Printable New York Form IT 638 START UP NY Tax Elimination and click Get Form to begin.

- Utilize the tools we provide to fill in your document.

- Highlight important sections of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Alter and eSign Printable New York Form IT 638 START UP NY Tax Elimination and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable new york form it 638 start up ny tax elimination

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an e-signature for a PDF file on Android

People also ask

-

What is the 2021 638 in relation to airSlate SignNow?

The 2021 638 refers to specific regulations and guidelines under which airSlate SignNow operates to ensure compliance in document management. This designation helps businesses understand the legal framework attached to electronic signatures and document processing, enhancing trust and security.

-

How does airSlate SignNow support compliance with 2021 638?

airSlate SignNow is designed to meet the requirements outlined in the 2021 638 compliance framework. Our platform utilizes advanced encryption and secure authentication methods to ensure that all electronic signatures and document transactions are legally binding and secure.

-

What are the pricing options available for the airSlate SignNow service related to 2021 638?

AirSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses, including options for those specifically looking for compliance with the 2021 638 guidelines. Customers can choose from monthly or annual subscriptions, making it a cost-effective choice for businesses of all sizes.

-

What are the key features of airSlate SignNow that align with the 2021 638 requirements?

Key features that support the 2021 638 compliance include robust electronic signature capabilities, secure document sharing, and comprehensive audit trails. These features ensure that all actions taken on documents are tracked and verifiable, greatly improving accountability and security.

-

Can airSlate SignNow integrate with other software to assist in 2021 638 processes?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications to streamline workflows related to the 2021 638 processes. By connecting with tools like CRM software and document management systems, businesses can enhance their efficiency and maintain compliance effectively.

-

What benefits does airSlate SignNow provide for businesses needing 2021 638 compliance?

Businesses utilizing airSlate SignNow for 2021 638 compliance enjoy increased efficiency, reduced paper usage, and improved turnaround times for document signing. Our user-friendly interface makes it easy to send, sign, and manage documents while ensuring all transactions adhere to legal standards.

-

How can I get started with airSlate SignNow to ensure compliance with 2021 638?

Getting started with airSlate SignNow is simple. First, sign up for a free trial on our website and explore the platform’s features related to the 2021 638 compliance. Our customer support team is available to guide you through the setup process and address any questions you may have.

Get more for Printable New York Form IT 638 START UP NY Tax Elimination

- Release mortgage form

- California premarital form

- Painting contractor package california form

- Framing contractor package california form

- Foundation contractor package california form

- Uniform statutory power of attorney property finances section 4401 california

- Plumbing contractor package california form

- California statutory form

Find out other Printable New York Form IT 638 START UP NY Tax Elimination

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed