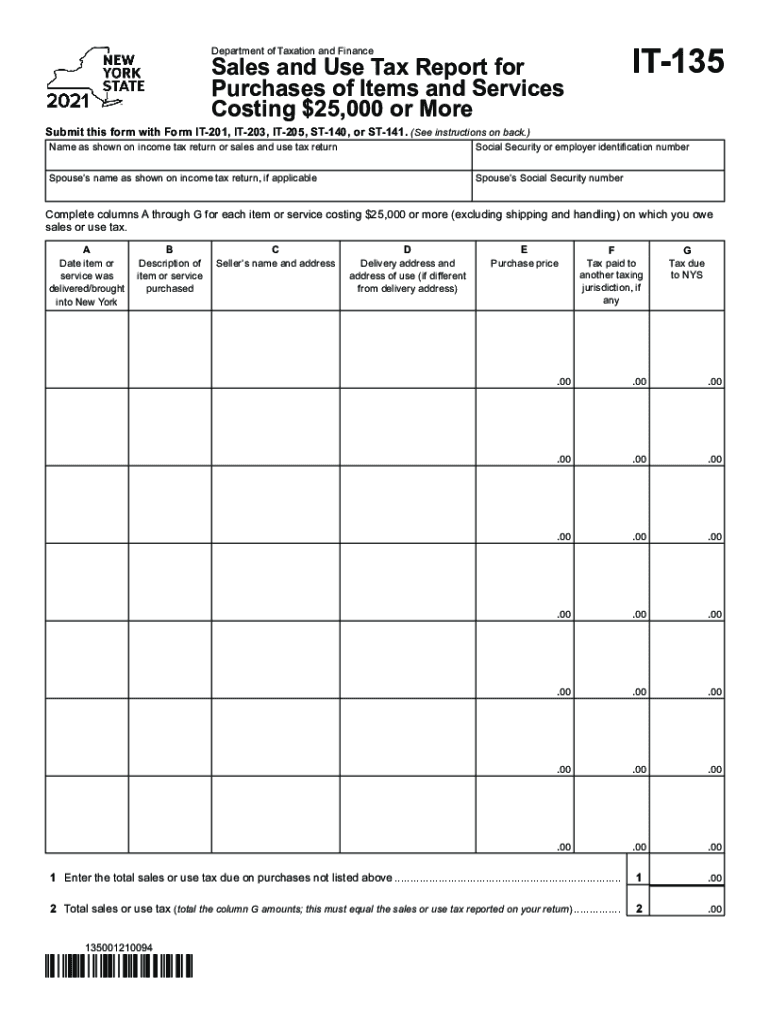

Form it 135 Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More Tax Year 2021

What is the Form IT 796 ATT?

The Form IT 796 ATT is a specific document used for reporting and claiming certain tax credits and exemptions in the United States. It is essential for businesses and individuals who engage in transactions subject to sales and use tax. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations and for maximizing potential tax benefits.

How to Use the Form IT 796 ATT

Using the Form IT 796 ATT involves several steps to ensure accurate reporting and compliance. First, gather all necessary information related to the transactions for which you are claiming credits or exemptions. This includes purchase details, tax identification numbers, and any supporting documentation. Next, fill out the form completely, ensuring that all required fields are addressed. Finally, submit the completed form to the appropriate state tax authority, either electronically or by mail, depending on the specific requirements.

Key Elements of the Form IT 796 ATT

The Form IT 796 ATT includes several key elements that are important for accurate completion. These elements typically consist of:

- Taxpayer Information: This section requires the name, address, and tax identification number of the taxpayer.

- Transaction Details: Information regarding the nature of the transactions and the amounts involved must be clearly stated.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the submission.

Steps to Complete the Form IT 796 ATT

Completing the Form IT 796 ATT involves a systematic approach:

- Collect all relevant transaction data.

- Access the form from the state tax authority's website or other official sources.

- Fill in the taxpayer information accurately.

- Detail the transactions, ensuring all amounts and descriptions are correct.

- Review the form for completeness and accuracy.

- Sign the form and submit it according to the state’s submission guidelines.

Filing Deadlines for the Form IT 796 ATT

Filing deadlines for the Form IT 796 ATT can vary by state and specific circumstances. It is essential to be aware of these deadlines to avoid penalties. Generally, forms must be submitted by the end of the tax period for which the credits or exemptions are being claimed. Checking the state tax authority's website for the most current deadlines is advisable.

Penalties for Non-Compliance with the Form IT 796 ATT

Failure to comply with the requirements associated with the Form IT 796 ATT can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state tax authorities. It is crucial for taxpayers to understand these consequences and ensure timely and accurate submissions to avoid any issues.

Quick guide on how to complete form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year 2021

Easily prepare Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year effortlessly

- Locate Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year 2021

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is it 796 att and how does it benefit my business?

The it 796 att is an advanced electronic signature solution that allows businesses to streamline their document signing processes. By using airSlate SignNow, companies can reduce turnaround times and enhance efficiency while ensuring legal compliance. This powerful tool can signNowly improve customer satisfaction and engagement.

-

How much does it 796 att cost?

The pricing for it 796 att depends on the specific plan you choose with airSlate SignNow. We offer various pricing tiers that cater to businesses of all sizes. Each plan is designed to meet diverse needs while providing cost-effective solutions for document signing and management.

-

What features are included with the it 796 att?

The it 796 att delivers a robust set of features, including template creation, real-time tracking, and automated reminders. Additionally, users have access to advanced security measures to protect sensitive information. These features collectively enhance the user experience and efficacy of document management.

-

Can the it 796 att integrate with other software?

Yes, the it 796 att is designed to integrate seamlessly with a variety of third-party applications, including CRM systems and cloud storage solutions. This flexibility allows businesses to incorporate eSigning into their existing workflows effortlessly. Enhanced integrations can lead to productivity gains across the organization.

-

Is it 796 att secure for sensitive documents?

Absolutely! The it 796 att utilizes advanced encryption technology and adheres to strict security standards. This ensures that all electronic documents and signatures remain confidential and tamper-proof, providing peace of mind to businesses handling sensitive information.

-

How does it 796 att improve efficiency for my business?

Implementing the it 796 att can substantially speed up the document signing process, eliminating the need for physical paperwork. With features like automated workflows and instant notifications, businesses can close deals faster and maintain operational agility. This leads to a more efficient organizational process overall.

-

What types of documents can I sign using it 796 att?

The it 796 att allows you to sign a wide array of documents, including contracts, agreements, and invoices. Its versatility makes it suitable for various industries, ensuring compliance and streamlining operations. This capability helps businesses manage their paperwork efficiently.

Get more for Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year

- Legal last will and testament form for divorced person not remarried with adult children california

- Legal last will and testament form for domestic partner with adult children from prior marriage california

- Legal last will and testament form for divorced person not remarried with no children california

- Legal last will and testament form for divorced person not remarried with minor children california

- Legal last will and testament form for domestic partner with adult children california

- Ca last form

- Ca legal partner form

- Legal last will and testament form for divorced person not remarried with adult and minor children california

Find out other Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free