Form it 135 Fill in Sales and Use Tax Report for Purchases 2022

Understanding the IT-135 Form for Sales and Use Tax Report

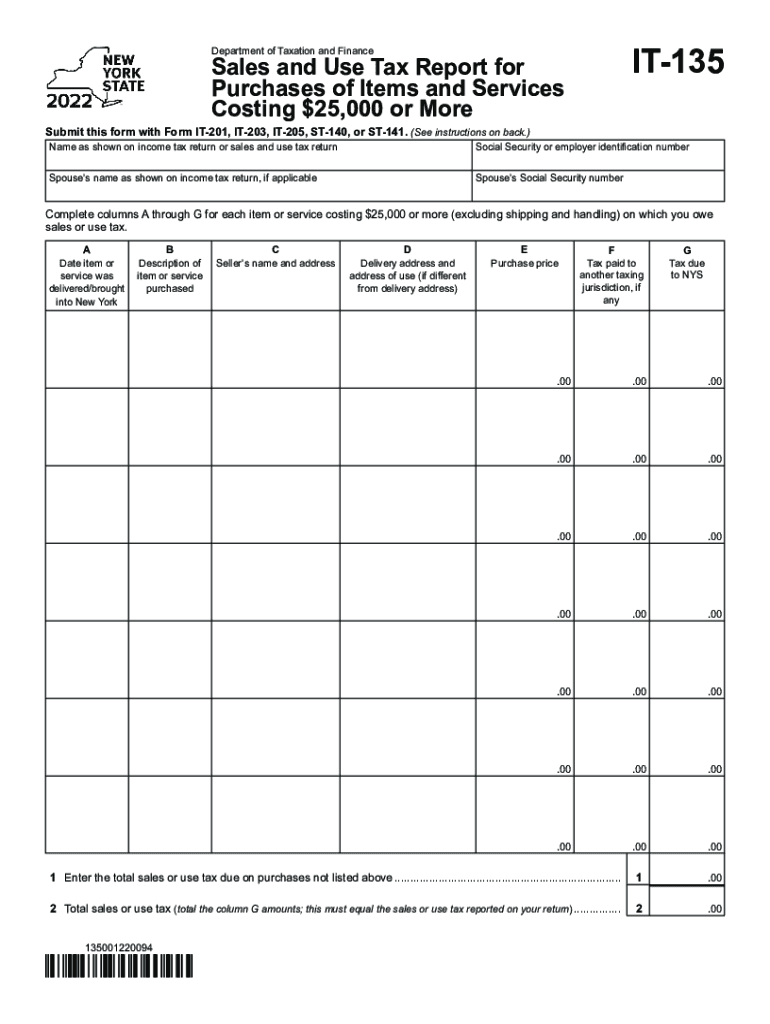

The IT-135 form is essential for reporting sales and use tax on purchases made in New York. This form is specifically designed for taxpayers who need to report tax on items that are not typically subject to sales tax at the point of purchase. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

Taxpayers must ensure they accurately report the total amount of purchases subject to tax, including any applicable exemptions. The form helps maintain compliance with New York tax laws, ensuring that all necessary taxes are paid on taxable purchases.

Steps to Complete the IT-135 Form

Completing the IT-135 form involves several key steps to ensure accuracy and compliance. First, gather all relevant purchase documentation, including receipts and invoices. This information will help in accurately reporting the total taxable purchases.

Next, fill out the form by entering your personal information, including your name and taxpayer identification number. Then, report the total amount of purchases that are subject to sales tax. Be sure to calculate the tax due based on the current tax rate. Finally, review the completed form for accuracy before submission.

Legal Use of the IT-135 Form

The IT-135 form serves as a legally binding document when filed correctly. It is important to understand that submitting this form indicates your compliance with New York sales tax laws. Failing to file or misreporting information can lead to penalties and interest charges from tax authorities.

To ensure the legal validity of the form, it must be signed and dated by the taxpayer. This signature affirms that the information provided is accurate and complete, thus protecting the taxpayer from potential legal issues related to tax compliance.

Filing Deadlines for the IT-135 Form

Timely filing of the IT-135 form is critical to avoid penalties. The form must be submitted by the designated deadline, which typically aligns with the end of the tax year or specific reporting periods set by the New York State Department of Taxation and Finance.

Taxpayers should be aware of any changes to deadlines that may occur due to new regulations or updates from tax authorities. Keeping track of these dates ensures that all tax obligations are met without incurring additional fees.

Form Submission Methods for the IT-135

Taxpayers have multiple options for submitting the IT-135 form, including online, by mail, or in-person. Submitting online through the New York State Department of Taxation and Finance website is often the most efficient method, allowing for quicker processing and confirmation of receipt.

For those who prefer to submit by mail, it is advisable to send the form via certified mail to ensure it is received by the deadline. In-person submissions can be made at local tax offices, providing an opportunity for immediate assistance if needed.

Key Elements of the IT-135 Form

Understanding the key elements of the IT-135 form is essential for accurate completion. The form includes sections for taxpayer information, total purchases, tax calculations, and exemptions. Each section must be filled out carefully to reflect the taxpayer's situation accurately.

Additionally, taxpayers should be aware of the specific instructions provided with the form, which outline how to report different types of purchases and any relevant exemptions that may apply. Familiarity with these elements ensures that the form is completed correctly and efficiently.

Quick guide on how to complete form it 135 fill in sales and use tax report for purchases

Effortlessly Prepare Form IT 135 Fill in Sales And Use Tax Report For Purchases on Any Device

Digital document management has become increasingly favored among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents promptly without any hold-ups. Manage Form IT 135 Fill in Sales And Use Tax Report For Purchases on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign Form IT 135 Fill in Sales And Use Tax Report For Purchases with Ease

- Locate Form IT 135 Fill in Sales And Use Tax Report For Purchases and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize essential sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 135 Fill in Sales And Use Tax Report For Purchases to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 135 fill in sales and use tax report for purchases

Create this form in 5 minutes!

How to create an eSignature for the form it 135 fill in sales and use tax report for purchases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 796 att feature in airSlate SignNow?

The it 796 att feature in airSlate SignNow allows users to streamline document signing processes efficiently. This functionality ensures that all parties can easily access and sign documents electronically, making the workflow faster and more organized.

-

How does airSlate SignNow compare in pricing for the it 796 att integration?

AirSlate SignNow offers competitive pricing for the it 796 att integration, making it a cost-effective solution for businesses of all sizes. With different pricing tiers, users can select a plan that best meets their needs without overspending.

-

What are the main benefits of using the it 796 att feature?

The it 796 att feature provides signNow benefits, including enhanced productivity and reduced paperwork. By digitizing the signing process, businesses can save time and resources while ensuring documents are securely signed and stored.

-

Can I integrate it 796 att with other applications?

Yes, airSlate SignNow supports integrations with various applications alongside the it 796 att feature. This ensures a seamless transition between different platforms, enhancing overall efficiency and data management for users.

-

Is it easy to use the it 796 att feature?

Absolutely! The it 796 att feature in airSlate SignNow is designed to be user-friendly, allowing even those with minimal technical skills to navigate and utilize the system effectively. This ease of use helps businesses adopt the tool quickly and maximize its benefits.

-

What types of documents can I eSign using it 796 att?

With the it 796 att feature, users can eSign a variety of document types, including contracts, agreements, and forms. This versatility makes airSlate SignNow the ideal choice for different industries and document requirements.

-

How secure is the it 796 att feature in airSlate SignNow?

The it 796 att feature is built with robust security measures to protect sensitive information. AirSlate SignNow employs encryption and secure electronic signatures to ensure that all documents remain confidential and tamper-proof.

Get more for Form IT 135 Fill in Sales And Use Tax Report For Purchases

- Tennessee prenuptial premarital agreement without financial statements tennessee form

- Amendment to prenuptial or premarital agreement tennessee form

- Financial statements only in connection with prenuptial premarital agreement tennessee form

- Revocation of premarital or prenuptial agreement tennessee form

- Tennessee parenting plan form

- Commercial real propety purchase and sale agreement tennessee form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497326607 form

- Tennessee corporation 497326608 form

Find out other Form IT 135 Fill in Sales And Use Tax Report For Purchases

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template