Form it 135 Sales and Use Tax Report for Purchases of Items and Services Costing $25,000 or More Tax Year 2024-2026

Understanding the Form IT 135 Sales And Use Tax Report

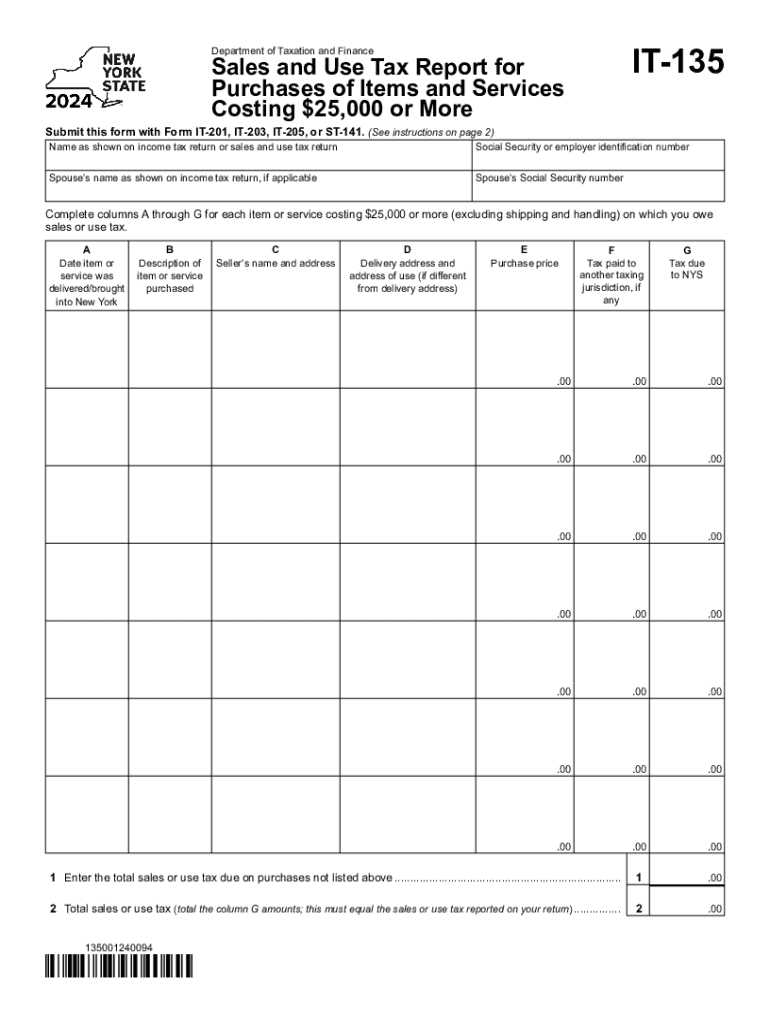

The Form IT 135 Sales And Use Tax Report is a crucial document for businesses in the United States that purchase items and services costing $25,000 or more within a tax year. This form allows businesses to report and remit sales and use tax obligations to the appropriate state tax authority. It is essential for ensuring compliance with state tax laws and regulations, as well as for maintaining accurate financial records.

How to Complete the Form IT 135

Completing the Form IT 135 involves several steps. First, gather all necessary financial documentation related to your purchases. This includes invoices, receipts, and any related contracts. Next, accurately fill out the form by entering details such as the total amount spent, the type of items or services purchased, and the applicable tax rate. It is important to double-check all entries for accuracy to avoid penalties or delays in processing.

Obtaining the Form IT 135

The Form IT 135 can be obtained directly from your state’s department of revenue website or through local tax offices. Many states provide downloadable versions of the form, which can be printed and filled out manually. Additionally, some states may offer an online submission option, allowing for a more streamlined process.

Key Elements of the Form IT 135

Several key elements must be included when filling out the Form IT 135. These include:

- Purchaser Information: Name, address, and tax identification number.

- Vendor Information: Name and address of the seller or service provider.

- Purchase Details: Description of items or services, purchase date, and total cost.

- Tax Calculation: Total sales and use tax due based on the applicable tax rate.

Filing Deadlines for the Form IT 135

Filing deadlines for the Form IT 135 vary by state but typically align with the end of the tax year. It is important to check with your state’s tax authority for specific dates to ensure timely submission. Late filings may result in penalties or interest charges, so adhering to deadlines is crucial for compliance.

Penalties for Non-Compliance

Failing to file the Form IT 135 or submitting inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. To avoid these consequences, businesses should ensure they understand their tax obligations and maintain accurate records of all purchases subject to sales and use tax.

Create this form in 5 minutes or less

Find and fill out the correct form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 135 sales and use tax report for purchases of items and services costing 25000 or more tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year?

The Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year is a tax document required for reporting signNow purchases. This form helps businesses comply with state tax regulations by detailing large transactions that may be subject to sales and use tax.

-

How can airSlate SignNow assist with the Form IT 135 Sales And Use Tax Report?

airSlate SignNow streamlines the process of completing and submitting the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year. Our platform allows users to easily fill out, sign, and send the form electronically, ensuring compliance and saving time.

-

What features does airSlate SignNow offer for managing tax forms like the Form IT 135?

airSlate SignNow offers features such as customizable templates, secure e-signatures, and document tracking. These tools simplify the management of tax forms, including the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year, making it easier for businesses to stay organized.

-

Is airSlate SignNow cost-effective for small businesses needing to file the Form IT 135?

Yes, airSlate SignNow provides a cost-effective solution for small businesses that need to file the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year. Our pricing plans are designed to accommodate various budgets while offering essential features for efficient document management.

-

Can I integrate airSlate SignNow with other software for filing the Form IT 135?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing users to file the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year directly from their preferred platforms. This integration enhances workflow efficiency and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the Form IT 135?

Using airSlate SignNow for the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year offers numerous benefits, including increased accuracy, faster processing times, and enhanced security. Our platform ensures that your sensitive information is protected while simplifying the filing process.

-

How does airSlate SignNow ensure the security of my Form IT 135 submissions?

airSlate SignNow prioritizes security by employing advanced encryption and secure cloud storage for all documents, including the Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year. This ensures that your data remains confidential and protected from unauthorized access.

Get more for Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year

Find out other Form IT 135 Sales And Use Tax Report For Purchases Of Items And Services Costing $25,000 Or More Tax Year

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe