Exemption Certificate Forms Ohio Department of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer 2021

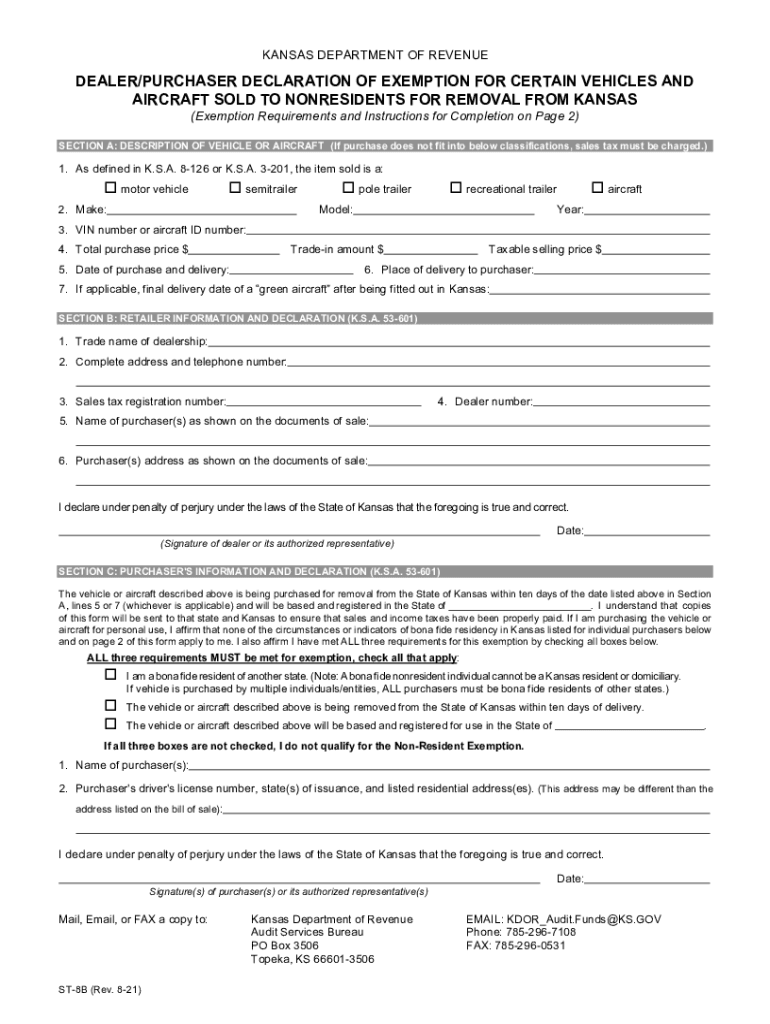

Understanding the Kansas Declaration Exemption

The Kansas declaration exemption, often referred to as the Kansas st 8b form, is essential for individuals and businesses seeking to claim tax exemptions on specific purchases. This form is particularly relevant for transactions involving vehicles and aircraft, allowing eligible parties to avoid sales tax under certain conditions. Understanding the nuances of this exemption can significantly impact financial decisions and compliance with state regulations.

Steps to Complete the Kansas Declaration Exemption

Filling out the Kansas declaration exemption form requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary documentation, including proof of eligibility for the exemption.

- Clearly identify the type of exemption being claimed, such as for vehicles or aircraft.

- Complete all required fields on the form, ensuring accuracy in personal and business information.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the appropriate channels, whether online or via mail.

Key Elements of the Kansas Declaration Exemption

Understanding the key elements of the Kansas declaration exemption is crucial for successful application. Essential components include:

- Eligibility Criteria: Specific qualifications must be met to qualify for the exemption, such as the type of vehicle or aircraft.

- Required Documentation: Supporting documents may include proof of business status, previous tax filings, or other relevant information.

- Submission Methods: The form can typically be submitted online, by mail, or in-person at designated locations.

Legal Use of the Kansas Declaration Exemption

The legal use of the Kansas declaration exemption is governed by state tax laws. It is important to understand the implications of misuse, as improper claims can lead to penalties. Compliance with all regulations surrounding the form is necessary to maintain legal standing and avoid complications with tax authorities.

Examples of Using the Kansas Declaration Exemption

Practical examples can illustrate how the Kansas declaration exemption is applied in real-world scenarios. For instance:

- A business purchasing a fleet of vehicles for commercial use may utilize the exemption to save on sales tax.

- An individual acquiring an aircraft for personal use may also qualify, provided they meet the necessary criteria.

Filing Deadlines and Important Dates

Being aware of filing deadlines is essential for those utilizing the Kansas declaration exemption. Specific dates may vary based on the type of exemption claimed and the fiscal calendar. Staying informed about these timelines ensures timely submission and compliance with state regulations.

Quick guide on how to complete exemption certificate forms ohio department of taxationexemptions ampamp exclusions vehicles vessels californiaexemption

Effortlessly Prepare Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer on Any Device

Digital document management has gained increased traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Manage Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer on any system using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer Seamlessly

- Find Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and select the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer while ensuring excellent communication at every step of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exemption certificate forms ohio department of taxationexemptions ampamp exclusions vehicles vessels californiaexemption

Create this form in 5 minutes!

How to create an eSignature for the exemption certificate forms ohio department of taxationexemptions ampamp exclusions vehicles vessels californiaexemption

The best way to generate an e-signature for your PDF file online

The best way to generate an e-signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF document on Android devices

People also ask

-

What is a Kansas declaration exemption?

A Kansas declaration exemption is a legal document that allows certain property to be exempt from taxation under specific conditions in Kansas. Understanding this exemption can help businesses and individuals protect their assets while minimizing tax liabilities.

-

How does airSlate SignNow support Kansas declaration exemption processes?

airSlate SignNow simplifies the signing and sending of Kansas declaration exemption forms through its easy-to-use platform. Users can quickly draft, send, and eSign these documents, ensuring compliance with local regulations without the hassle of physical paperwork.

-

What features does airSlate SignNow offer for managing Kansas declaration exemptions?

With airSlate SignNow, you can track the status of your Kansas declaration exemption documents in real-time, set up reminders for deadlines, and collaborate with multiple parties seamlessly. These features enhance your efficiency and ensure that your exemption applications are submitted on time.

-

Is airSlate SignNow affordable for businesses processing Kansas declaration exemptions?

Yes, airSlate SignNow offers competitive pricing to help businesses of all sizes manage their Kansas declaration exemption needs without breaking the bank. With various plans available, you can choose one that fits your budget while still accessing all necessary features.

-

Can airSlate SignNow integrate with other software for Kansas declaration exemptions?

Absolutely, airSlate SignNow provides integration options with popular business software, allowing you to streamline your Kansas declaration exemption processes. This interoperability ensures that your data flows smoothly between platforms, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Kansas declaration exemption submissions?

Using airSlate SignNow for your Kansas declaration exemption submissions brings numerous advantages, including reduced turnaround time, increased accuracy, and greater security. This efficient solution can help you focus on your core business activities while confidently managing exemptions.

-

How can I get started with airSlate SignNow for Kansas declaration exemptions?

Getting started with airSlate SignNow is simple. Visit our website, sign up for a free trial, and explore the features designed specifically for managing Kansas declaration exemptions. Our user-friendly interface ensures a smooth onboarding experience.

Get more for Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer

- Co landlord notice 497299878 form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services colorado form

- Temporary lease agreement to prospective buyer of residence prior to closing colorado form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497299881 form

- Letter from landlord to tenant returning security deposit less deductions colorado form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return colorado form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return colorado form

- Letter from tenant to landlord containing request for permission to sublease colorado form

Find out other Exemption Certificate Forms Ohio Department Of TaxationExemptions & Exclusions Vehicles, Vessels CaliforniaExemption Cer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself