St8b 2017

What is the Kansas St8b?

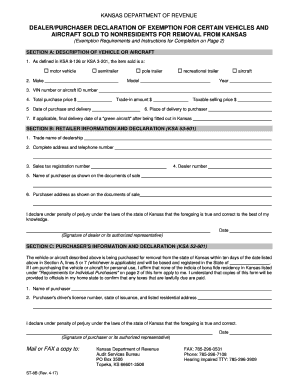

The Kansas St8b form, also known as the Kansas purchaser declaration exemption, is a crucial document used by dealers in the state of Kansas. This form allows eligible purchasers to claim an exemption from sales tax on certain transactions, primarily involving vehicles and aircraft. The St8b form is essential for those who qualify under specific criteria set by the Kansas Department of Revenue. Understanding the purpose and requirements of this form is vital for both dealers and purchasers to ensure compliance with state regulations.

Steps to Complete the Kansas St8b

Completing the Kansas St8b form requires careful attention to detail to ensure all necessary information is provided accurately. Here are the steps to follow:

- Obtain the Kansas St8b form from the Kansas Department of Revenue website or through your dealer.

- Fill in the purchaser's information, including name, address, and contact details.

- Provide the vehicle or aircraft details, such as make, model, year, and identification number.

- Indicate the reason for the exemption, referring to the specific criteria outlined by the state.

- Sign and date the form to certify the information is correct.

- Submit the completed form to the dealer or the appropriate authority as required.

Legal Use of the Kansas St8b

The Kansas St8b form must be used in accordance with state laws to ensure its validity. It is legally binding when completed correctly and submitted as part of a transaction involving exempt purchases. The form should only be used for eligible items, such as certain vehicles and aircraft, as specified by Kansas tax regulations. Misuse or incorrect completion of the St8b can lead to penalties or disqualification from the exemption.

Required Documents for the Kansas St8b

When completing the Kansas St8b form, certain documents may be required to support the exemption claim. These documents can include:

- Proof of eligibility for the exemption, such as a business license or tax-exempt certificate.

- Identification documents for the purchaser, such as a driver's license or tax ID number.

- Documentation related to the vehicle or aircraft being purchased, including the title or bill of sale.

Having these documents ready can streamline the process and ensure compliance with state requirements.

Eligibility Criteria for the Kansas St8b

To qualify for the Kansas St8b exemption, purchasers must meet specific eligibility criteria set forth by the Kansas Department of Revenue. Generally, these criteria include:

- The purchaser must be a registered business or individual eligible for tax exemptions.

- The item being purchased must qualify under the categories specified for exemption, such as certain vehicles or aircraft.

- The purchaser must provide valid documentation supporting their claim for exemption.

Understanding these criteria is essential for ensuring that the exemption is applied correctly and legally.

Examples of Using the Kansas St8b

Practical examples of using the Kansas St8b form can help clarify its application in real-world scenarios. Here are a few instances:

- A car dealership sells a vehicle to a business that qualifies for a sales tax exemption. The business completes the St8b form to claim the exemption.

- An individual purchases an aircraft for commercial use and submits the St8b form to avoid paying sales tax on the transaction.

- A non-profit organization acquires a vehicle for its operations and uses the St8b form to document its tax-exempt status.

These examples illustrate how the St8b form facilitates tax exemptions in various purchasing situations.

Quick guide on how to complete st8b

Complete St8b effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, adjust, and eSign your documents promptly without delays. Handle St8b on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to adjust and eSign St8b without hassle

- Obtain St8b and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Adjust and eSign St8b while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st8b

Create this form in 5 minutes!

How to create an eSignature for the st8b

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the Kansas dealer exemption and how does it apply to my business?

The Kansas dealer exemption allows certain dealers to purchase vehicles without paying sales tax, provided they meet specific criteria. This exemption is relevant for businesses involved in buying and selling vehicles in Kansas. Understanding this exemption can save your company money and streamline the purchasing process.

-

How can I ensure my dealership qualifies for the Kansas dealer exemption?

To qualify for the Kansas dealer exemption, your dealership must be registered with the state and comply with all necessary regulations. Additionally, maintaining accurate records and understanding the specific criteria set forth by the Kansas Department of Revenue is crucial. Consulting with a tax professional can also provide clarity on this exemption.

-

What are the benefits of using airSlate SignNow for signing documents related to the Kansas dealer exemption?

AirSlate SignNow simplifies the signing process for documents related to the Kansas dealer exemption by enabling electronic signatures on contracts and forms. This means faster transactions and enhanced efficiency for your dealership. Moreover, it's a cost-effective solution that integrates seamlessly with your existing processes.

-

Are there any additional costs associated with using airSlate SignNow for Kansas dealer exemption documentation?

AirSlate SignNow offers transparent pricing plans, so you can choose an option that suits your dealership's needs without hidden fees. The platform is designed to be cost-effective, especially for handling the paperwork associated with the Kansas dealer exemption. Check our pricing page for detailed information.

-

Can I integrate airSlate SignNow with other software I use for my dealership?

Yes, airSlate SignNow provides easy integration with various popular software applications used in the automotive industry. This compatibility can enhance the effectiveness of managing documents related to the Kansas dealer exemption and streamline overall operations. Explore our integration options to see how we can fit into your workflow.

-

How does airSlate SignNow ensure the security of documents related to the Kansas dealer exemption?

AirSlate SignNow employs advanced encryption and security measures to protect your documents and sensitive information. This is especially important when dealing with materials related to the Kansas dealer exemption, which can include confidential business and personal data. You can trust that your documents remain secure throughout the signing process.

-

Is there a mobile app available for managing Kansas dealer exemption documents with airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly mobile app that lets you manage Kansas dealer exemption documents on the go. This feature provides flexibility and convenience, allowing dealers to send and sign documents anytime, anywhere, ensuring that important transactions are not delayed.

Get more for St8b

Find out other St8b

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship