Ksrevenue Govpdfst8bST 8B Exemption for Certain Vehicles and Aircraft Sold to 2021-2026

Understanding the Kansas aircraft sales tax exemption

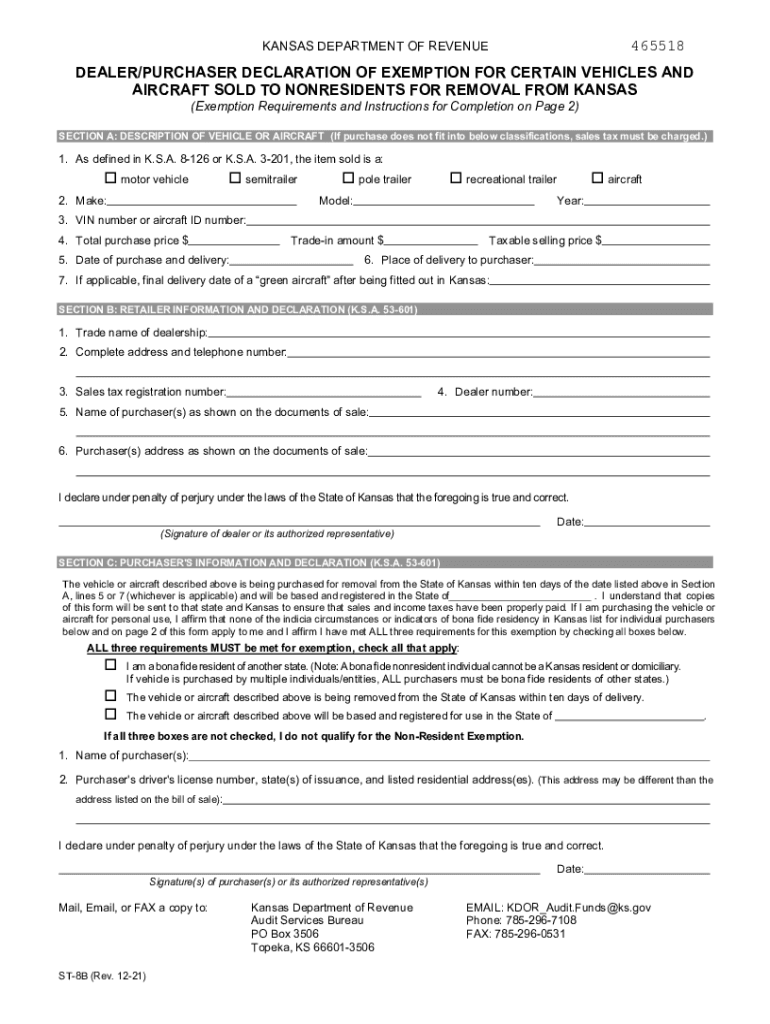

The Kansas aircraft sales tax exemption, often referred to as the ST-8B exemption, applies to certain vehicles and aircraft sold within the state. This exemption allows eligible purchasers to avoid paying sales tax on qualifying transactions. The primary purpose of this exemption is to promote economic growth and support industries that rely on aircraft and vehicle sales. To qualify, buyers must meet specific criteria set forth by the Kansas Department of Revenue.

Steps to complete the ST-8B form

Completing the ST-8B form involves several key steps to ensure compliance and eligibility for the aircraft sales tax exemption. Begin by gathering necessary information, including the seller's details, the aircraft's identification number, and the purchase price. Next, accurately fill out each section of the form, paying close attention to the eligibility criteria. After completing the form, review it for accuracy before submitting it to the appropriate authority. This process helps to prevent delays or issues with your exemption request.

Eligibility criteria for the ST-8B exemption

To qualify for the Kansas aircraft sales tax exemption, purchasers must meet specific eligibility criteria. Generally, the exemption is available for aircraft that are used primarily for business purposes or for certain non-profit organizations. Additionally, the buyer must provide proof of the intended use of the aircraft, which may include documentation or a declaration statement. It is essential to understand these criteria to ensure that your application for the ST-8B exemption is successful.

Required documents for the ST-8B exemption

When applying for the Kansas aircraft sales tax exemption, certain documents are required to support your application. These may include proof of the aircraft's identification number, a bill of sale, and any relevant business documentation that demonstrates the intended use of the aircraft. Additionally, you may need to provide a completed ST-8B form with all required signatures. Ensuring that you have all necessary documents prepared can streamline the application process and enhance your chances of approval.

Legal use of the ST-8B exemption

The legal use of the ST-8B exemption is crucial for both buyers and sellers in Kansas. Understanding the legal framework surrounding the exemption helps to ensure compliance with state laws. The exemption is designed to facilitate legitimate transactions while preventing misuse. Buyers must use the aircraft in accordance with the stated purpose on the form, and sellers should verify that the buyer qualifies for the exemption before completing the sale. Adhering to these legal guidelines protects all parties involved in the transaction.

Form submission methods for the ST-8B exemption

There are various methods available for submitting the ST-8B exemption form in Kansas. Purchasers can choose to submit the form online, by mail, or in person at designated state offices. Each method has its own advantages, such as convenience or direct interaction with state officials. It is important to select the submission method that best aligns with your needs and to ensure that all required documents accompany the form to avoid processing delays.

Quick guide on how to complete ksrevenuegovpdfst8bst 8b exemption for certain vehicles and aircraft sold to

Prepare Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the appropriate form and store it securely on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To with ease

- Obtain Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ksrevenuegovpdfst8bst 8b exemption for certain vehicles and aircraft sold to

Create this form in 5 minutes!

People also ask

-

What is the Kansas ST8B form and why is it important?

The Kansas ST8B form is a crucial document used for reporting and remitting sales tax in the state of Kansas. It ensures that businesses comply with local tax regulations, helping them avoid penalties. Understanding how to accurately fill out the Kansas ST8B form is essential for any business operating in Kansas.

-

How does airSlate SignNow simplify the process of completing the Kansas ST8B form?

airSlate SignNow streamlines the completion of the Kansas ST8B form by providing an intuitive interface for easy editing and signing. Users can conveniently fill in the required fields electronically, eliminating the need for cumbersome paper forms. The platform enhances efficiency and accuracy in the submission process.

-

What features does airSlate SignNow offer for managing the Kansas ST8B form?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and automated workflows that specifically cater to the Kansas ST8B form. Users can easily create, share, and track the document changes, ensuring everyone is on the same page. These features help save time and reduce errors in tax reporting.

-

Is there a cost associated with using airSlate SignNow for the Kansas ST8B form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs for managing the Kansas ST8B form. Pricing typically depends on the number of users and features selected. Investing in airSlate SignNow ensures valuable time and cost savings by streamlining the document signing and submission process.

-

Can I integrate airSlate SignNow with other tools for the Kansas ST8B form?

Absolutely! airSlate SignNow supports numerous integrations with popular business tools and applications that can help you manage the Kansas ST8B form more efficiently. Integrations with CRMs, accounting software, and storage services can automate data flow and enhance overall productivity in document management.

-

What are the benefits of using airSlate SignNow for the Kansas ST8B form?

Using airSlate SignNow for the Kansas ST8B form yields multiple benefits, including time savings, improved compliance, and enhanced collaboration among team members. The platform allows for quick document processing and simplifies access to the form whenever needed. Overall, it supports businesses in maintaining accurate tax records effortlessly.

-

Is the Kansas ST8B form customizable within airSlate SignNow?

Yes, the Kansas ST8B form can be customized within the airSlate SignNow platform to meet your specific business needs. Users can add their branding, modify sections, and tailor the form to gather necessary information efficiently. Customization ensures that the form aligns with your reporting requirements and enhances the overall user experience.

Get more for Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To

Find out other Ksrevenue govpdfst8bST 8B Exemption For Certain Vehicles And Aircraft Sold To

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed