Fillable Form Ga 9465 Installment Agreement Request 2021-2026

What is the Fillable Form GA-9465 Installment Agreement Request

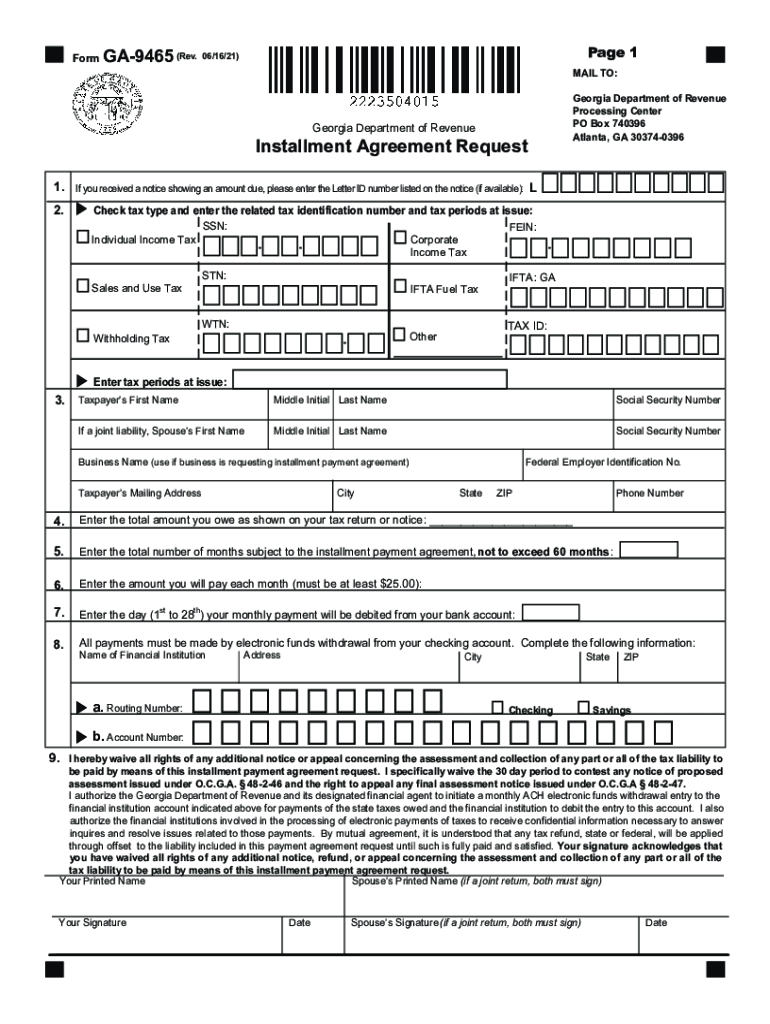

The GA-9465 form is an official document used by taxpayers in Georgia to request an installment agreement with the Georgia Department of Revenue. This form is specifically designed for individuals who are unable to pay their tax liabilities in full and wish to set up a payment plan. By submitting the GA-9465, taxpayers can propose a manageable payment schedule that allows them to pay their outstanding taxes over time. This form is essential for ensuring compliance with state tax obligations while providing flexibility for those facing financial difficulties.

Steps to Complete the Fillable Form GA-9465 Installment Agreement Request

Completing the GA-9465 form involves several straightforward steps:

- Gather necessary information, including your Social Security number, tax year, and the total amount owed.

- Fill out personal details, including your name, address, and contact information.

- Specify the proposed monthly payment amount and the desired duration of the payment plan.

- Provide any additional information required, such as financial details that support your request.

- Review the completed form for accuracy and sign it to certify the information provided.

Once completed, the form can be submitted to the Georgia Department of Revenue for processing.

Eligibility Criteria for the GA-9465 Installment Agreement Request

To qualify for an installment agreement using the GA-9465 form, taxpayers must meet specific eligibility criteria:

- The total tax liability must be within a certain limit set by the Georgia Department of Revenue.

- Taxpayers must be current with their tax filings and not have any outstanding returns.

- The proposed payment plan must be reasonable based on the taxpayer's financial situation.

Meeting these criteria is crucial for the approval of the installment agreement request.

Form Submission Methods for the GA-9465

The GA-9465 form can be submitted to the Georgia Department of Revenue through various methods:

- Online: Taxpayers can fill out and submit the form electronically through the Georgia Department of Revenue's website.

- Mail: The completed form can be printed and mailed to the appropriate address specified on the form.

- In-Person: Taxpayers may also choose to deliver the form in person at designated Georgia Department of Revenue offices.

Choosing the right submission method can help ensure timely processing of the request.

Key Elements of the Fillable Form GA-9465 Installment Agreement Request

Understanding the key elements of the GA-9465 form is essential for effective completion:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Tax Information: Taxpayers must provide details about their tax liability, including the tax year and total amount owed.

- Payment Proposal: This section allows taxpayers to specify their proposed monthly payment amount and the duration of the agreement.

- Signature: The form must be signed by the taxpayer to validate the information provided.

Each of these elements plays a crucial role in the processing of the installment agreement request.

Legal Use of the Fillable Form GA-9465 Installment Agreement Request

The GA-9465 form is legally binding once submitted and accepted by the Georgia Department of Revenue. It establishes an official agreement between the taxpayer and the state regarding the payment of taxes owed. This legal framework ensures that both parties adhere to the terms outlined in the form, including the payment schedule and any associated penalties for non-compliance. Understanding the legal implications of submitting this form is important for taxpayers seeking to manage their tax obligations responsibly.

Quick guide on how to complete fillable form ga 9465 installment agreement request

Prepare Fillable Form Ga 9465 Installment Agreement Request effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and physically signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly and without delays. Manage Fillable Form Ga 9465 Installment Agreement Request on any device using the airSlate SignNow Android or iOS applications and enhance your document workflow today.

How to modify and eSign Fillable Form Ga 9465 Installment Agreement Request without hassle

- Locate Fillable Form Ga 9465 Installment Agreement Request and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the tedious search for forms, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Fillable Form Ga 9465 Installment Agreement Request and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable form ga 9465 installment agreement request

Create this form in 5 minutes!

How to create an eSignature for the fillable form ga 9465 installment agreement request

The best way to make an e-signature for your PDF file online

The best way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the gtc dor ga gov payment plan?

The gtc dor ga gov payment plan is a structured payment option provided by the Georgia Department of Revenue for taxpayers. This plan allows individuals to make their tax payments in installments, offering flexibility and support for managing their financial obligations. It’s a useful arrangement to consider if you’re looking to ease the burden of lump-sum payments.

-

How can I enroll in the gtc dor ga gov payment plan?

To enroll in the gtc dor ga gov payment plan, you typically need to visit the Georgia Department of Revenue's official website. There, you will find detailed instructions on how to apply for the payment plan, including any documentation requirements. Make sure to complete the necessary forms accurately to ensure a smooth enrollment process.

-

What are the benefits of the gtc dor ga gov payment plan?

The primary benefit of the gtc dor ga gov payment plan is that it allows taxpayers to manage their financial responsibilities more effectively. By breaking down your tax payment into smaller, more manageable installments, you can alleviate potential financial stress. Additionally, this payment plan helps avoid penalties and late fees associated with unpaid taxes.

-

Are there any fees associated with the gtc dor ga gov payment plan?

Yes, there may be fees associated with the gtc dor ga gov payment plan, depending on your specific situation. It’s essential to review the terms and conditions outlined by the Georgia Department of Revenue to understand any applicable fees. Being aware of these fees can help you budget accordingly.

-

How does the gtc dor ga gov payment plan affect my credit score?

Participating in the gtc dor ga gov payment plan itself shouldn’t negatively impact your credit score. However, consistent and timely payments can potentially benefit your financial standing. Always ensure that you meet your payment obligations to maintain a positive financial history.

-

Can I modify my gtc dor ga gov payment plan after enrollment?

Yes, you can modify your gtc dor ga gov payment plan after initially enrolling, but you will need to contact the Georgia Department of Revenue for specific instructions. Modifications might be necessary due to changes in your financial situation or ability to pay. It's essential to stay proactive and communicate any changes as early as possible.

-

What documents do I need for the gtc dor ga gov payment plan application?

When applying for the gtc dor ga gov payment plan, you typically need documentation that supports your financial situation. This may include income statements, tax returns, and any relevant expenses that demonstrate your need for a payment plan. Having these documents ready can streamline the application process.

Get more for Fillable Form Ga 9465 Installment Agreement Request

- Company policies procedures 481376052 form

- New york sale of a business package form

- New york contract for deed package form

- Ny employment form

- New york mortgage form

- New york satisfaction cancellation or release of mortgage package form

- New york prenuptial form

- New york roofing contractor package form

Find out other Fillable Form Ga 9465 Installment Agreement Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors