Installment Agreement Request PLEASE READDO NOT S 2021

Understanding the Installment Agreement Request

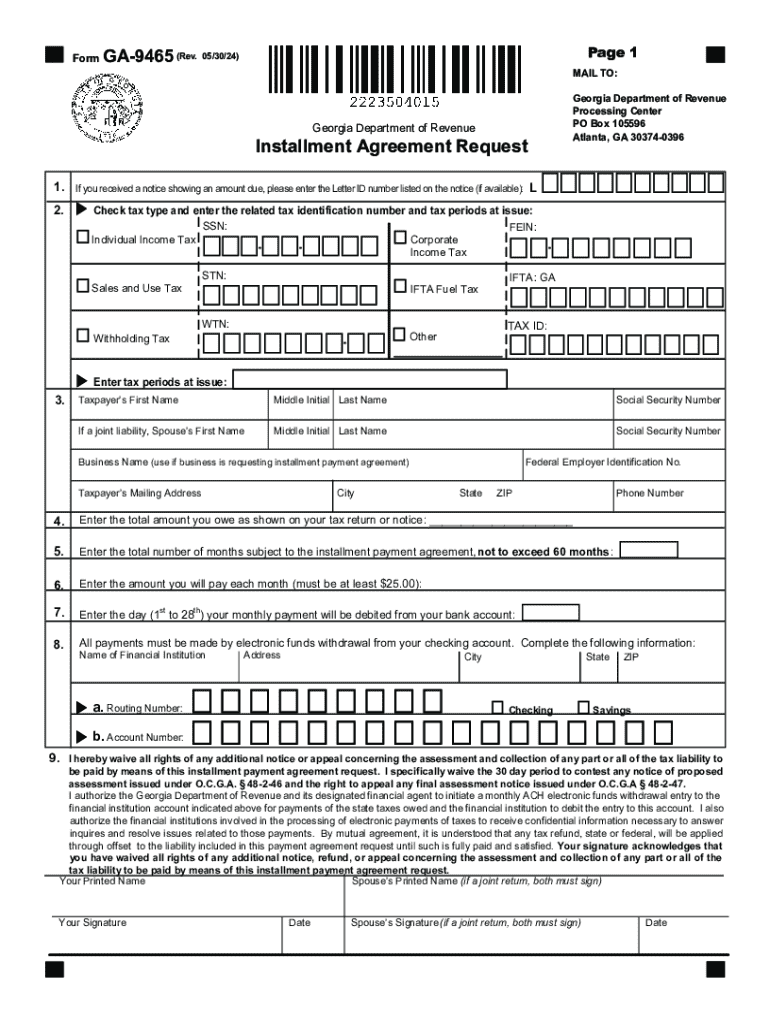

The Installment Agreement Request is a form used by individuals and businesses to request a payment plan with the Internal Revenue Service (IRS) for tax liabilities. This option is beneficial for taxpayers who cannot pay their owed taxes in full by the due date. By submitting this request, taxpayers can propose a structured payment schedule that allows them to pay off their tax debts over time, thus avoiding immediate financial strain.

Steps to Complete the Installment Agreement Request

Completing the Installment Agreement Request involves several key steps:

- Gather necessary financial information, including income, expenses, and any assets.

- Determine the amount owed to the IRS and the proposed monthly payment you can afford.

- Fill out the Installment Agreement Request form accurately, ensuring all information is complete.

- Review the form for accuracy before submission to avoid delays.

- Submit the form either online, by mail, or in person, depending on your preference and situation.

Eligibility Criteria for the Installment Agreement Request

To qualify for an installment agreement, taxpayers must meet specific eligibility criteria set by the IRS. Generally, the following conditions apply:

- The total tax owed must be below a certain threshold, which may vary depending on the type of agreement.

- Taxpayers must have filed all required tax returns.

- Taxpayers should not have any outstanding tax liabilities from previous years.

Meeting these criteria helps ensure that the request is processed smoothly and increases the likelihood of approval.

Key Elements of the Installment Agreement Request

When filling out the Installment Agreement Request, it is essential to include key elements that the IRS requires for processing:

- Taxpayer identification information, including Social Security number or Employer Identification Number.

- Details of the tax liabilities, including the tax year and the amount owed.

- Proposed monthly payment amount and the desired duration of the payment plan.

- Signature and date to validate the request.

Form Submission Methods

Taxpayers have several options for submitting the Installment Agreement Request:

- Online: If eligible, taxpayers can submit their request electronically through the IRS website.

- By Mail: Taxpayers can print the completed form and send it to the appropriate IRS address based on their location.

- In Person: Some taxpayers may choose to visit a local IRS office to submit their request directly.

IRS Guidelines for the Installment Agreement Request

The IRS provides specific guidelines to assist taxpayers in understanding the process and requirements for the Installment Agreement Request. These guidelines include:

- Information on the types of installment agreements available, including short-term and long-term options.

- Details on the potential fees associated with setting up an installment agreement.

- Clarification on the consequences of failing to adhere to the payment plan, which may include penalties or additional interest.

Create this form in 5 minutes or less

Find and fill out the correct installment agreement request please readdo not s

Create this form in 5 minutes!

How to create an eSignature for the installment agreement request please readdo not s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Installment Agreement Request PLEASE READDO NOT S?

An Installment Agreement Request PLEASE READDO NOT S is a formal request to set up a payment plan for outstanding debts. This process allows individuals to manage their financial obligations more effectively by breaking down payments into manageable installments.

-

How can airSlate SignNow help with my Installment Agreement Request PLEASE READDO NOT S?

airSlate SignNow streamlines the process of submitting your Installment Agreement Request PLEASE READDO NOT S by allowing you to create, send, and eSign documents quickly. Our platform ensures that all necessary paperwork is completed accurately and efficiently, saving you time and reducing stress.

-

What are the pricing options for using airSlate SignNow for my Installment Agreement Request PLEASE READDO NOT S?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can effectively manage your Installment Agreement Request PLEASE READDO NOT S.

-

What features does airSlate SignNow provide for managing Installment Agreement Requests?

With airSlate SignNow, you gain access to features such as customizable templates, real-time tracking, and secure eSigning. These tools enhance your ability to manage your Installment Agreement Request PLEASE READDO NOT S efficiently and ensure that all parties are kept informed throughout the process.

-

Are there any integrations available for airSlate SignNow to assist with my Installment Agreement Request PLEASE READDO NOT S?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and manage your Installment Agreement Request PLEASE READDO NOT S alongside other business processes.

-

What are the benefits of using airSlate SignNow for my Installment Agreement Request PLEASE READDO NOT S?

Using airSlate SignNow for your Installment Agreement Request PLEASE READDO NOT S provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally, giving you peace of mind.

-

Is airSlate SignNow secure for handling sensitive Installment Agreement Requests?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive information. You can confidently manage your Installment Agreement Request PLEASE READDO NOT S knowing that your data is safe.

Get more for Installment Agreement Request PLEASE READDO NOT S

Find out other Installment Agreement Request PLEASE READDO NOT S

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement