For the Year January 1December 31, or Other Taxable Year Beginning Form

Understanding the Massachusetts 4868 Form

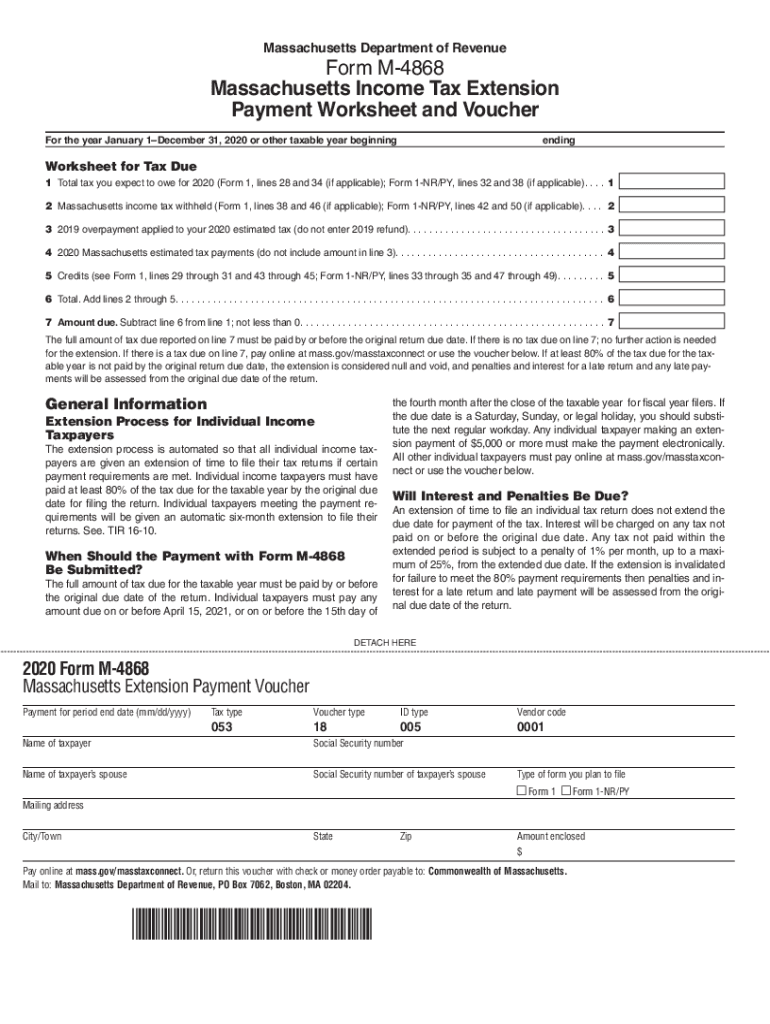

The Massachusetts 4868 form, also known as the MA M-4868, is a crucial document for taxpayers seeking an extension for filing their state income tax returns. This form allows individuals and businesses to request an automatic six-month extension to file their Massachusetts income tax returns, ensuring they have additional time to gather necessary documentation and complete their filings accurately.

Steps to Complete the Massachusetts 4868 Form

Completing the Massachusetts 4868 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the taxable year for which you are requesting an extension.

- Provide an estimate of your total tax liability for the year. This estimate helps the state determine if you need to make a payment with your extension request.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted electronically or via mail to the Massachusetts Department of Revenue.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Massachusetts 4868 form. Typically, the form must be submitted by the original due date of your tax return, which is usually April 15 for individual filers. If you miss this deadline, you may face penalties and interest on any unpaid taxes. The extension grants you until October 15 to file your completed tax return.

Required Documents for the Massachusetts 4868 Form

When filing the Massachusetts 4868 form, you may need to gather specific documents to support your extension request. These documents may include:

- Your previous year’s tax return for reference.

- Any relevant income documents, such as W-2s or 1099s.

- Documentation of any estimated payments made for the current tax year.

Having these documents ready can help ensure a smooth and efficient filing process.

Legal Use of the Massachusetts 4868 Form

The Massachusetts 4868 form is legally recognized as a valid request for an extension of time to file your state income tax return. When used appropriately, it provides taxpayers with the necessary time to prepare their returns without incurring late filing penalties. It is important to note that while the extension allows additional time to file, it does not extend the time to pay any taxes owed.

Digital vs. Paper Version of the Massachusetts 4868 Form

Taxpayers have the option to file the Massachusetts 4868 form either digitally or on paper. Filing electronically is often faster and more efficient, allowing for immediate confirmation of receipt. The digital version typically includes features that simplify the process, such as automatic calculations. However, some individuals may prefer the traditional paper method, which can be mailed to the Massachusetts Department of Revenue. Regardless of the method chosen, ensuring accuracy in the information provided is crucial.

Quick guide on how to complete for the year january 1december 31 2020 or other taxable year beginning

Manage For The Year January 1December 31, Or Other Taxable Year Beginning effortlessly on any platform

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Handle For The Year January 1December 31, Or Other Taxable Year Beginning on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign For The Year January 1December 31, Or Other Taxable Year Beginning with ease

- Find For The Year January 1December 31, Or Other Taxable Year Beginning and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign For The Year January 1December 31, Or Other Taxable Year Beginning and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the for the year january 1december 31 2020 or other taxable year beginning

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Massachusetts 4868 form and why do I need it?

The Massachusetts 4868 form is an application for an automatic extension of time to file your personal income tax return. This form allows taxpayers to request an extension of up to six months, giving them additional time to prepare their taxes. Using airSlate SignNow to eSign the Massachusetts 4868 form streamlines the process and ensures timely submission.

-

How can airSlate SignNow help me with the Massachusetts 4868 form?

airSlate SignNow simplifies the entire process for the Massachusetts 4868 form. With our platform, you can easily fill out, sign, and send the form electronically, eliminating postal delays and ensuring you meet submission deadlines. Our user-friendly interface makes it easy for anyone to navigate the required steps effortlessly.

-

Is there a cost associated with filing the Massachusetts 4868 form through airSlate SignNow?

Using airSlate SignNow to file your Massachusetts 4868 form involves subscription fees based on the plan you choose. Our pricing is competitive and designed to accommodate businesses of all sizes, ensuring you get value for your eSigning needs. Investing in a solution like ours can save you time and enhance your productivity during tax season.

-

What features does airSlate SignNow offer for the Massachusetts 4868 form?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and an intuitive signing process specifically designed for forms like the Massachusetts 4868 form. You can also track the status of your documents and set reminders to ensure timely completion and submission. Our platform ensures a seamless experience from start to finish.

-

Can I integrate airSlate SignNow with other software for the Massachusetts 4868 form?

Yes, airSlate SignNow offers integrations with various popular applications, allowing you to streamline your workflow when handling the Massachusetts 4868 form. Whether you use CRM systems, document management solutions, or accounting software, our platform can connect smoothly to enhance efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the Massachusetts 4868 form?

Using airSlate SignNow for the Massachusetts 4868 form provides numerous benefits, including increased speed in processing your application and reduced errors through guided filling. Moreover, signatures are legally binding, ensuring your form is accepted by the tax authorities. The convenience of eSigning means you can complete the process from anywhere, any time.

-

How secure is the submission of the Massachusetts 4868 form through airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform utilizes industry-leading encryption measures to protect your data while submitting the Massachusetts 4868 form. You can rest assured that your personal and financial information remains safe and secure as you eSign and send important tax documents.

Get more for For The Year January 1December 31, Or Other Taxable Year Beginning

Find out other For The Year January 1December 31, Or Other Taxable Year Beginning

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast